Executive Summary

Sustaining gas demand to 2050 at levels suggested by the Climate Change Committee “Balanced Net Zero Pathway” (BNZP) will create huge economic outflows from the UK economy, while accentuating energy security risks through continued exposure to supply threats and pricing volatility.

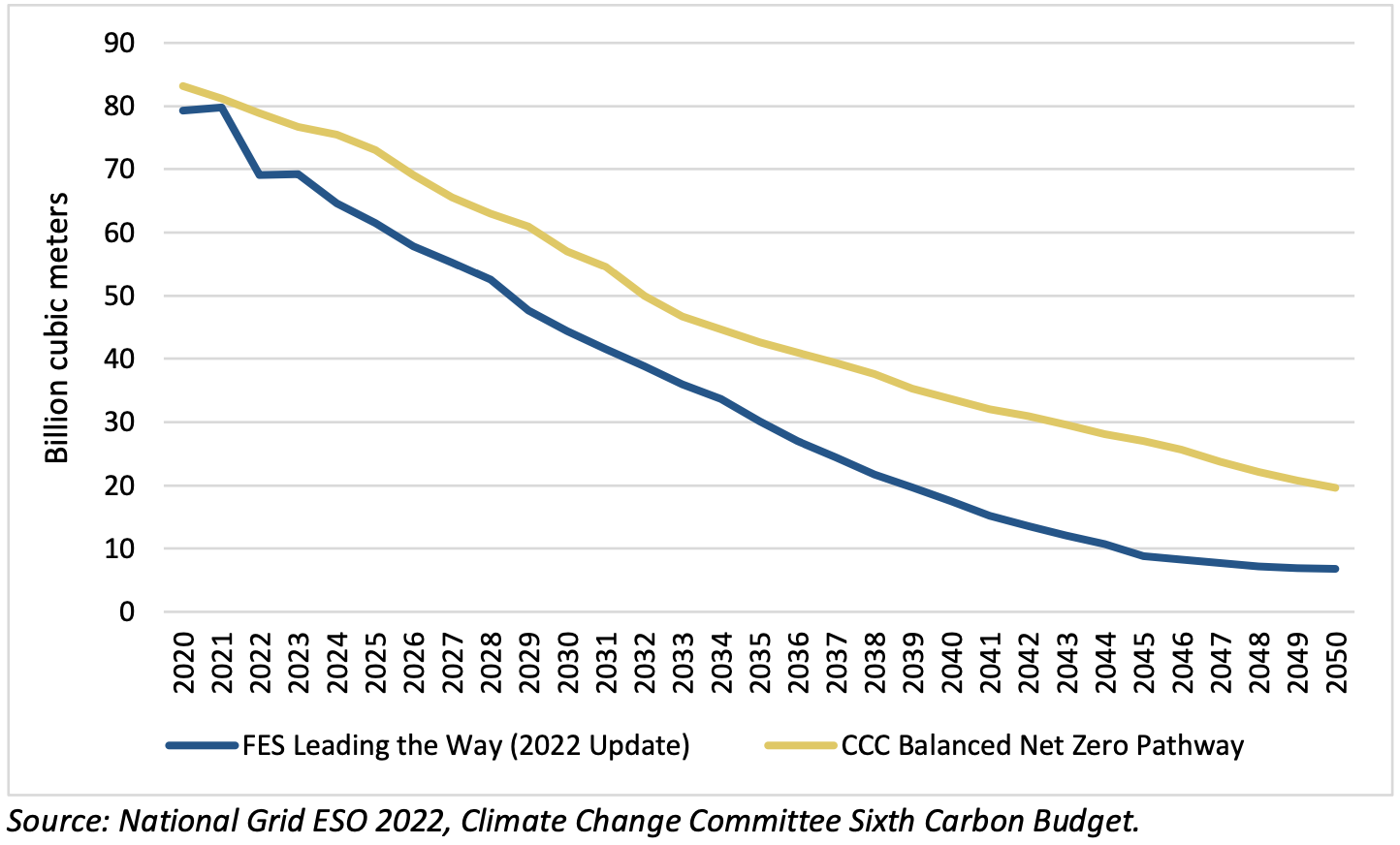

The National Grid’s Future Energy Scenarios “Leading the Way” (FES-LTW) illustrates an alternative pathway that encourages increased renewable energy and efficiency and would result in 65 percent lower gas demand than the BNZP case in 2050.

Under BNZP, the UK is set to face more than £470 billion in fuel costs for the purchase of gas, of which more than £100 billion could be avoided by switching to FES-LTW.

The UK will also have to spend an additional £21 billion on emissions allowances under the BNZP scenario vs. the FES-LTW, as legislation evolves to expand the existing UK emissions trading scheme with a cross-border adjustment mechanism that we assume comes into effect from 2035.

Continued support of gas as a material part of the UK’s future energy mix is difficult to justify in the face of lower cost, zero-emission renewable technologies that can support progress towards the UK’s 2050 net-zero obligations.

Using gas for power generation with carbon capture and storage (CCS) is at least 50 percent more expensive than offshore wind, and relies on unproven CCS technology. Gas use for blue hydrogen production carries the same burden: Higher cost, higher implementation risk, and higher GHG emissions relative to expected green hydrogen production.

A pathway that de-emphasizes gas investments and encourages renewables would not only offer a more technically sound net-zero strategy, it would also improve energy security, stimulate long-term employment and productivity, foster local supply chains and reduce the UK trade deficit.