UK can save £100 billion by cutting dependence on fossil gas, study finds

An accelerated shift away from fossil gas will avoid huge economic outflows and reduce vulnerability to future energy supply and price fluctuations

Key Takeaways:

Sustaining gas demand at levels suggested by the Climate Change Committee’s “Balanced Net Zero Pathway” will cost the UK economy £473 billion in gas purchases by 2050

The UK can avoid £100 billion in imported gas supplies by switching to the National Grid ESO’s “Future Energy Scenarios – Leading the Way” pathway

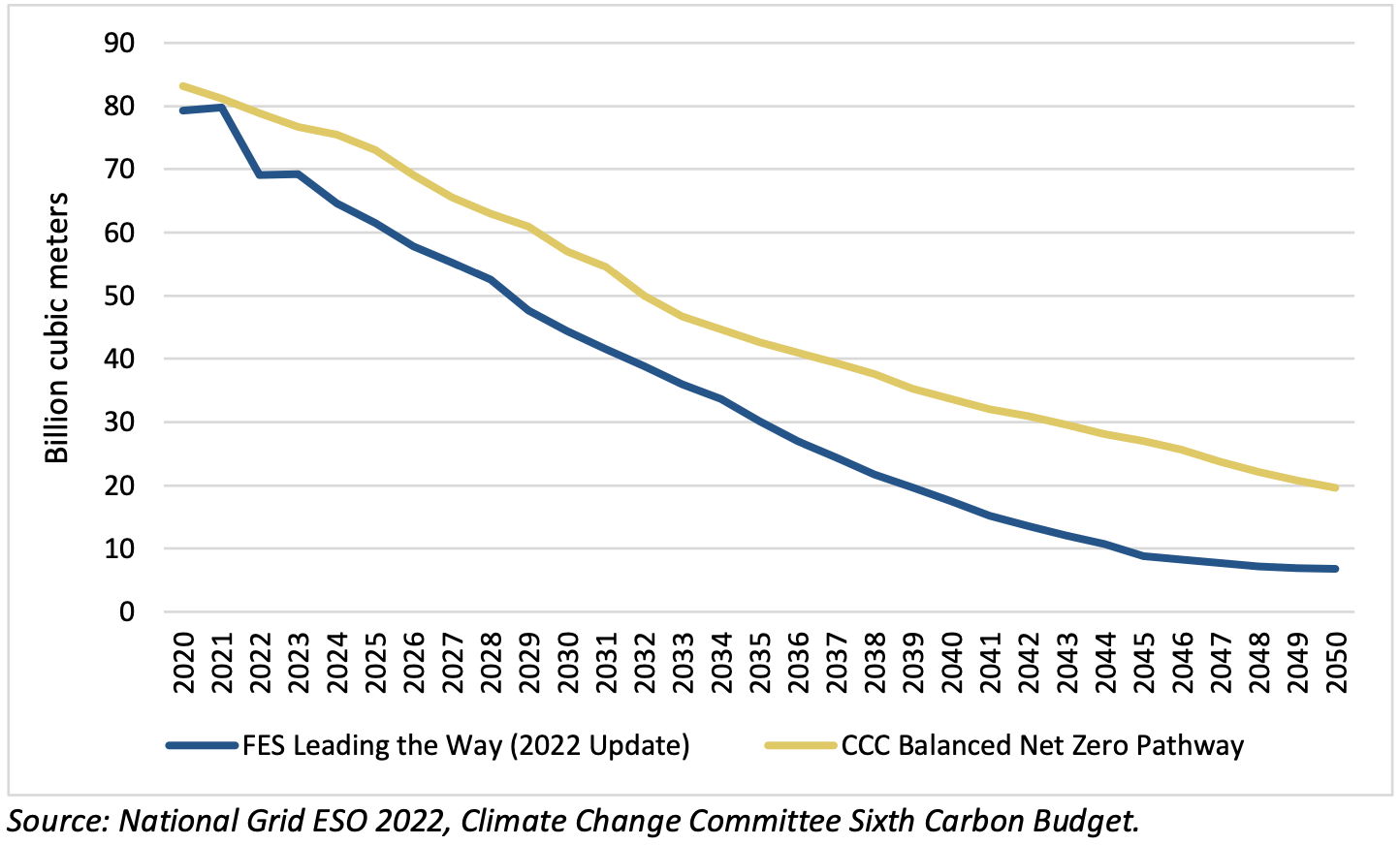

The additional 400 billion cubic meters (bcm) set out under the Climate Change Committee’s scenario is equivalent to 12 years of gas imports based on 2020 levels, which could be avoided by deploying lower-cost, zero-emission alternatives and efficiency measures

Continued reliance on fossil gas will cause huge economic outflows from the economy and is a missed opportunity for the UK to invest in renewable power generation, which would protect consumers from future energy supply and price fluctuations

The cost of gas in the UK is expected to remain above pre-pandemic levels for most of the decade and will face increased carbon taxes in the decades to come

London, 27 September 2022 | The UK is on track to spend £473 billion by 2050 to feed its reliance on fossil gas, despite the availability of lower-cost, zero-emission solutions. A new report by IEEFA highlights an alternative decarbonisation pathway that can avoid £100 billion in international payments for gas supplies.

Sustaining gas demand to 2050 at levels suggested by the Climate Change Committee (CCC), a UK government advisor, will leak hundreds of billions of pounds from the UK economy while accentuating energy security risks through continued exposure to supply threats and pricing volatility.

Switching pathways to one focused on increased renewable power generation, electrification of heating and efficiency measures can help the UK meet its 2050 net-zero obligations while improving its energy security, stimulating long-term employment and productivity, fostering local and export supply chains, and reducing the country’s trade deficit.

The National Grid Electricity System Operator’s “Future Energy Scenarios - Leading the Way” highlights a roadmap to cut natural gas demand by 400 billion cubic meters (bcm) through 2050, a 27% reduction compared to the CCC’s Balanced Net Zero Pathway—the equivalent of 12 years of net UK gas imports, based on 2020 levels.

“There is no economic case for sustaining gas demand at levels suggested by the CCC’s Balanced Net Zero Pathway, which will leave the country vulnerable to price fluctuations,” said Andrew Reid, IEEFA guest contributor and author of the report. “The UK is in a strong position to speed up the deployment of indigenous renewable generation capacity and support investment in local infrastructure, while avoiding huge economic outflows through the purchase of international gas supplies.

“Adopting a pathway to 2050 that minimises the UK’s reliance on fossil gas will shield the economy from the risk of high-emission, high-cost energy imports, and it could avoid some of the impacts we are seeing now, with millions of people facing fuel poverty and potential shortages in the UK this winter.”

In the wake of the Russian invasion of Ukraine and disruptions in energy supplies, the cost of gas in the UK is expected to remain above pre-pandemic levels for most of the decade and will face increased carbon taxes in the decades to come.

The CCC’s Balanced Net Zero Pathway anticipates that gas will continue to play a significant role in the UK’s energy mix in 2050, mainly for electricity generation with carbon capture and storage (CCS), and as feedstock in the production of “blue hydrogen,” which will also rely on CCS—despite the fact that gas-fired generation is at least 50% more expensive than offshore wind for each unit of energy produced.

“The UK government must avoid repeating past policy mistakes by urgently deploying existing solutions to displace gas from the UK economy as quickly as possible, especially from the power and heating sectors,” said Arjun Flora, director of IEEFA Europe energy finance studies. “We urge the CCC to stop promoting pathways that forecast significant volumes of ‘blue hydrogen,’ which is simply a more expensive, dangerous and risky form of gas reliance.”

Read the report: https://ieefa.org/resources/continued-reliance-gas-will-weaken-uk-economy

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. www.ieefa.org

Press Contact

Sofia Russi | [email protected] | +39 349 3229 728