BHP quotes outdated figures as efforts to prop up carbon capture for steel start to get desperate

Key Findings

BHP continues to promote carbon capture, utilisation and storage (CCUS) as a means to decarbonise steel production, but its justifications are based on outdated figures from the International Energy Agency (IEA).

More recent figures from the IEA point to a significantly reduced role for CCUS, which continues to underperform and is rapidly being overtaken by direct reduced iron (DRI) technology as a more promising route to steel decarbonisation.

While BHP is also working on other steel decarbonisation solutions that have more potential than CCUS, the company is running out of excuses for not having a measurable Scope 3 target.

As pressure mounts on big miners to set and meet responsible Scope 3 emissions targets, BHP has taken to quoting outdated International Energy Agency (IEA) figures to help justify its support for underperforming carbon capture, utilisation and storage (CCUS) technology.

BHP supplies huge quantities of iron ore to the global steel industry, a sector that is now beginning to decarbonise by switching from blast furnaces to direct reduced iron (DRI) technology that can run on green hydrogen.

However, BHP insists that CCUS will play a role by decarbonising blast furnaces that consume coal. This is hardly surprising – BHP is the world’s largest shipper of metallurgical coal.

In a November 2023 sponsored article in The Australian Financial Review, (AFR) highlighting its steel decarbonisation efforts, BHP stated: “CCUS has the potential to be a key technology for reducing emissions from existing global blast furnaces, which are anticipated to remain a significant portion of steel production over coming decades.”

To back this up, BHP further states: “The International Energy Agency estimates CCUS technology needs to apply to more than 53 per cent of primary steel production by 2050 under its Net Zero Emissions [NZE] scenario.”

BHP seems to have forgotten that the IEA published an updated version in 2023, which has a rather different figure.

The IEA’s updated 2023 NZE scenario reduces CCUS’s role to 37% of steel production by 2050, down from 53% just two years ago. Meanwhile, hydrogen-based steelmaking’s role increases from 29% in 2021 to 44%.

IEEFA expects that that the IEA will continue to reduce emphasis on CCUS for steelmaking as the technology’s underperformance continues.

BHP does at least admit, “At present, there are no full-scale operational CCUS facilities in blast furnace steelmaking operations, with only a limited number of small capacity carbon capture or utilisation pilots underway or in the planning phases globally.”

Not only are there no full-scale CCUS facilities for blast furnaces in operation, there’s virtually nothing on the horizon.

The German think tank Agora Industry highlights that, since 2020, commercial-scale project announcements for DRI and CCUS for blast furnace-based steelmaking have developed very differently. To date, virtually all steel companies that plan to build low-carbon steelmaking capacity at commercial scale have opted for hydrogen-based or hydrogen-ready DRI plants, not CCUS.

The 2030 project pipeline of DRI plants has grown to 94 million tonnes a year (Mtpa), while the pipeline for commercial-scale CCUS on blast furnace-based operations amounts to just 1Mtpa, according to Agora.

The Global CCS Institute (GCCSI) released its 2023 Global Status of CCS report the same month as BHP’s sponsored article was published. The GCCSI is tracking only four commercial-scale CCUS projects in the steel sector globally. At least three of these are for DRI-based steelmaking, not blast furnaces, with two only in the early stages of development.

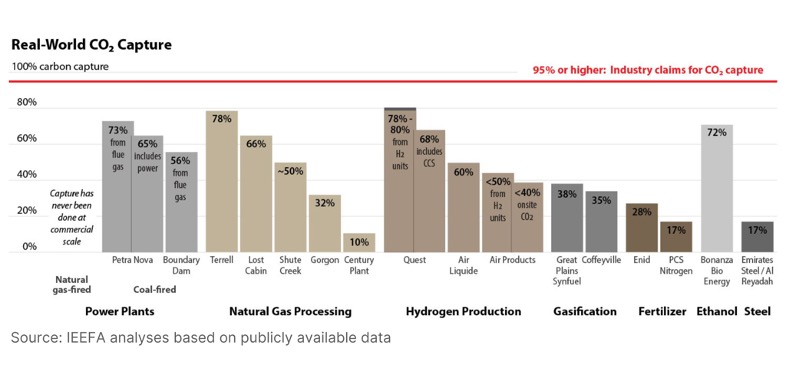

BHP also neglects to mention the low capture rates of CCUS projects. Few operational CCUS plants around the world provide data that would allow independent analysis of their performance (a major red flag). Those that do demonstrate that carbon capture rates of ~20% to ~50% are commonplace (Figure 1). Any fossil fuel-based installation that captures carbon at that kind of rate cannot be considered decarbonised.

Figure 1: CCUS capture rates don’t measure up

Despite the poor track record of CCUS across all sectors, BHP has carbon capture development projects with steelmakers HBIS and ArcelorMittal.

In its sponsored AFR article, BHP highlights ArcelorMittal’s Steelanol carbon capture and usage (CCU) project at its steelmaking operations in Ghent, Belgium, “a scale demonstration plant that will capture carbon-rich process gases from the blast furnace and convert them into ethanol”.

What BHP didn’t mention is that this project will capture less than 2% of the Ghent plant’s carbon emissions.

Despite all this, BHP’s then-chief commercial officer Vandita Pant stated that “CCUS is one of the key abatement technologies” that can support net zero emissions steelmaking. Since the sponsored article was published, Pant has been promoted to chief financial officer.

Pressure on BHP’s Scope 3 emissions will grow

There was a major push for ineffective CCUS technology at the recent COP28 climate summit, with hundreds of carbon capture lobbyists attending the conference amid growing focus on Scope 3 emissions.

While Scope 1 and 2 emissions occur as companies carry out their operations, Scope 3 emissions result from customers using a company’s products, or from suppliers making products that a company uses. BHP’s emissions are dominated by Scope 3, which makes up 97% of the total.

In the run-up to the conference, Sultan Al Jaber – president of COP28 and chief executive of the Abu Dhabi National Oil Company (ADNOC) – stated that companies must act to reduce all greenhouse gas (GHG) emissions, including Scopes 1, 2 and 3.

Just before the start of COP28, the Climate Leaders Coalition (CLC) – of which BHP is a member along with other fossil fuel producers including Santos and Woodside – highlighted that only 29% of its members have a science-based Scope 3 target.

The CLC report stated, “Regulators have cemented scope 3 as a key pillar of organisations' credible net zero transition plans. Activity is heating up and will come to a boil over the next 2 years.”

BHP does not have a measurable Scope 3 emissions reduction target. It has a “goal” to reach net zero Scope 3 emissions by 2050 but, as the company itself makes clear, a goal is not the same as a target.

Despite the increasing likelihood that CCUS for steel won’t play much of a role in reducing BHP’s Scope 3 emissions, the company is running out of excuses for not setting a measurable Scope 3 target. As its sponsored AFR column highlights, BHP is also working on steel decarbonisation solutions that look likely to make an impact.

BHP points to its project with Hatch to combine electric smelting furnace technology with DRI. This would allow the use of BHP’s blast furnace-grade Pilbara iron ore in lower-carbon steelmaking. The company has previously noted that this type of technology combination has already been identified as a likely decarbonisation option by major international steelmakers.

At its November 2023 ESG Roundtable, BHP stated that it had already successfully produced DRI in test work from its Pilbara iron ores, using both gas and hydrogen. Importantly, BHP has made clear that it has been able to pelletise its Pilbara iron ores – a necessary step for use in DRI furnaces – at pilot scale. It has been widely held until now that Pilbara ores are unsuitable for pelletisation, and hence use in DRI.

In December 2023, BHP announced a new agreement with Chinese steelmaker HBIS under which BHP’s iron ore will be trialled in commercial-scale DRI production at HBIS’s new DRI plant.

IEEFA believes that new technology combinations that allow the use of lower-grade Pilbara iron ores in DRI-based steelmaking look like a genuine solution to steel decarbonisation. This is in significant contrast to the role CCUS is likely to play.

Other major iron ore miners are increasingly focused on a future where they supply more iron ore to DRI-based steelmaking operations that do not use coal. BHP – and its new CFO – need to accept that CCUS will not save coal-based steelmaking in the long run.

The company should instead focus more on technology developments that allow the use of its ores without coal. It has already made progress with such projects and, as they produce more results, BHP will have even less excuse not to have a measurable Scope 3 target.