IEEFA update: The terrible, horrible, no good, very bad year for oil and gas

2019 was an especially difficult year for the oil and gas industry.

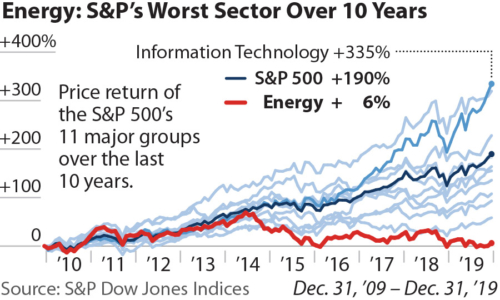

The energy sector (which does not include renewable energy) finished dead last in the S&P 500, the second year in a row it has held that distinction. In a year of improving oil prices, the energy sector still finished firmly in last place, with a 7 percent gain compared to a 29 percent gain overall for the S&P 500. The next worst-performing sector was health care, which posted a 19 percent gain.

The industry continued to collapse in value, relative to the broader stock market. The oil and gas sector now comprises 4.3% of the S&P 500 index, compared to 28% in the 1980s.

The industry continued to collapse in value, relative to the broader stock market. The oil and gas sector now comprises 4.3% of the S&P 500 index, compared to 28% in the 1980s.

Throughout the year, oil and gas markets remained over-supplied. Oil prices began the year at $55 per barrel and ended the year 24 percent higher, at $68 per barrel. Natural gas prices remained below $3 mmbtu all year long. The oil price increases were not enough to lift investor interest and persistent low prices for natural gas continued as rising supply outpaced rising demand.

The market response to the industry’s current predicament and largely negative outlook was punctuated each month by significant financial events.

January

- ExxonMobil CEO Darren Woods delivers financial results to analysts during an earnings call ‒ the first head of the company to do so in 15 years. His participation followed investor and analyst criticism and disappointing earnings results throughout 2017 and 2018, Woods’ first two years as CEO.

February

- The Wall Street Journal reports “harsh reality,” for frackers facing difficulty as “Wall Street backs away,” confirming IEEFA’S view that E&P companies had lost access to the cheap capital that had long funded the sector.

March

- ExxonMobil rebooks 3.2 billion barrels of Canadian oil sands reserves, which it had debooked in 2016, a questionable financial accounting move. (Imperial Oil, ExxonMobil’s Canadian subsidiary, posted a flat stock price, while the market rose by 29 percent).

- Norway surprises the market by announcing it would exclude E&P companies from its pension fund, the world’s second largest, as a “means to reduce the aggregate oil price risk in the Norwegian economy.”

April

- In Vaca Muerta, Argentina’s vast oil and gas reserves in Patagonia, critically-needed foreign investment remains muted as financial risks mount. The country’s ambitious energy plan, which called for unconventional production (fracking) to double oil and gas production in five years, will likely fail, predicts IEEFA.

May

- Occidental trumps $33 billion Chevron’s bid for Anadarko, with a $38 billion bid. Chevron fails to match, accepting a $1 billion in break-up fee. Occidental funds transaction with expensive funding from Warren Buffett. Occidental’s stock is in free-fall after “winning” the bid, dropping from its May 6 price of $58.77, when Anadarko accepted the bid, to close out the year at $40.70

June

- Steve Schlotterbeck, former CEO of EQT, the largest natural gas producer in the U.S., suggests that “The shale gas revolution has frankly been an unmitigated disaster for the buy/hold investor.”

- Norway’s “oil fund,” begins to divest from its exploration and production (E&P) holdings.

- Negative cash flows reported for 29 fracking-focused companies in the U.S. through Q2 2019 as sector bleeds red ink.

July

- BP confirms that some of its oil reserves will be stranded, confirming that “some of those resources won’t come out the ground.”

August

- Koch Industries, no longer bullish on Canadian oil sands, sells its remaining holdings, capping a list of foreign investors that have fled the sector.

- ExxonMobil’s Q2 earnings were “embarrassingly” disappointing, and revealed the company’s need to borrow funds to pay its dividend.

- U.S. fracking sector reports meager positive cash flows in Q2, the first positive ones after a decade of negative cash flows, as frackers reduce capital expenditures. The small gain will not suffice to pay more than $100 billion in long-term debt they owe.

September

- Greta Thunberg addresses U.N. General Assembly, continues to spark youth climate activism around the world.

- Attacks on Saudi Arabia facilities fails to lift price of oil, illustrates current markets are oversupplied and likely to remain so for the foreseeable future.

- IHS Markit predicts natural gas prices will remain lower for longer.

- University of California announces divestment from fossil fuels.

- Equity research firm Redburn publishes a long-term outlook for nine integrated oil and gas major companies, “Lost in Transition,” and concludes: “When industries face existential risk, historical multiples provide no floor for share prices.”

October

- ExxonMobil announces Q3 earnings. It had spent more than $3 billion on U.S. upstream capex while earning a meager $37 million.

- GE announces $8.7 billion write-down in connection with its failed acquisition of Baker Hughes, reflecting dim forecast for oil field services sector.

- Oil field services giant Schlumberger announces $12.7 billion write-down, due to “a macro environment of slowing production growth rate in North America as operators maintained capital discipline, reducing drilling and frack activity,” according to its CEO.

- BP announced a $2-3 billion impairment charge on sales of many of its U.S. holdings that were on its books for more than the sale prices.

November

- Moody’s revises ExxonMobil’s credit outlook to negative on cash flow worries.

- Appalachian frackers face uphill battle as negative cash flows mount. Shares of the publicly traded E&P companies in Appalachia have plummeted through 2019.

- Staale Gjervik, head of XTO, an ExxonMobil subsidiary, acknowledges that the company’s plan to achieve “quick cash” from the Permian Basin had failed.

December

- Chevron writes off $5-6 billion, after-tax, in shale assets in Appalachia. Begins sales effort for its Appalachian holdings, initially purchased for $4.1 billion, with significant additional investments. Rystad Energy believes these assets are only worth $500 million, given the low gas prices.

- The world’s largest oil reserves in Saudi Arabia were offered to investors in an IPO. Major investors took a pass.

- ExxonMobil has taken only limited write-offs related to its $35 billion acquisition of XTO, leading analysts to wonder whether Exxon would announce significant 2019 write-off.

- Journalists caution the industry with a new golden rule: “Never buy a shale-gas business.”

- Shell announces $2.3 billion write-off on weaker economic outlook.

- Energy consultant, Rystad, ends the year with its December newsletter title, “2019 ends on a low note, offering a gloomy start to 2020.”

- The Wall Street Journal closes its year-end reporting with analysts predicting that recent OPEC producer reductions would not improve the industry’s problem with “sliding” oil prices. This article caps at least 14 articles written by the Journal over the year chronicling industry problems with fracking, oil and natural gas oversupply, persistent low oil prices, declining profits for oil majors and climate change.

Kathy Hipple ([email protected]) is an IEEFA financial analyst.

Related items

IEEFA report: Oil majors live beyond their means ‒ can’t pay for dividends, buybacks

IEEFA update: Appalachia fracking industry faces uphill battle for earnings

IEEFA update: Oil and gas stocks place dead last in 2019, again, despite 30% price rise