IEEFA update: Exxon’s Q2 report marks another signpost on the long road downwards

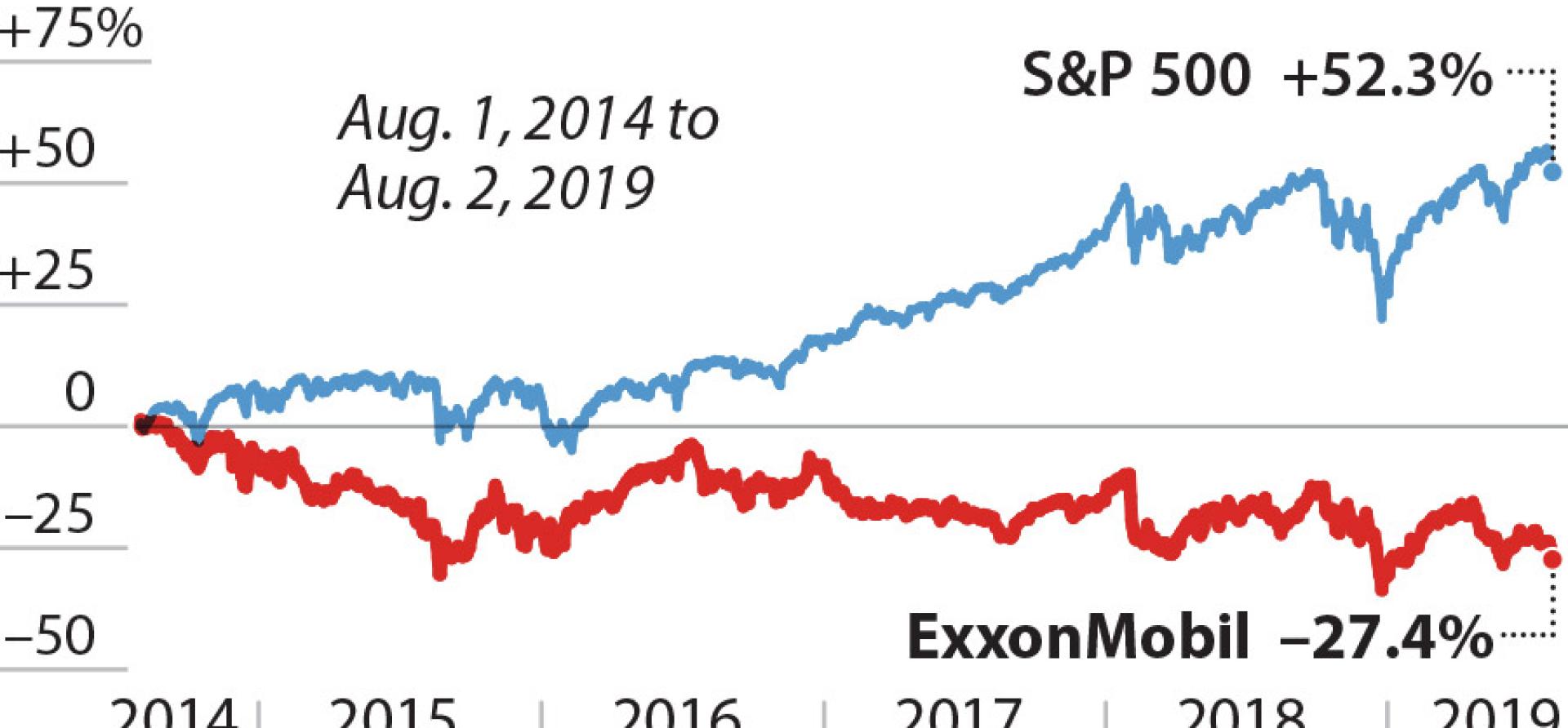

ExxonMobil released its 2019 second quarter earnings on August 2nd and the market was not impressed. After another dismal quarter, Exxon’s stock continues its downward slide.

At least as far back as 1980, ExxonMobil was part of an elite group of companies in the top ten of Standard and Poor’s 500 index. Now, its current market capitalization, at $303 billion, has fallen behind Visa’s $397 billion. One real-time S&P 500 monitor positions Exxon in 11th place as of August 2. By month’s end, if conditions persist, the company is likely to be formally removed from the S&P top ten list.

ExxonMobil’s diminished market position caps a 39-year decline of oil and gas dominance of the markets. In 1980, seven of the top ten companies in the S&P 500 were oil and gas companies. As of August 2nd this year, there are none. In 1980, energy stocks commanded 28% of the S&P index. Today, they comprise only 5%. Last week, the energy sector once again claimed last place in the S&P 500 ratings by sector.

After borrowing $4.2 billion during the quarter, its free cash flow was negative $0.9 billion.

IN Q2, EXXONMOBIL HAD TO BORROW JUST TO PAY ITS DIVIDEND. ExxonMobil’s second quarter earnings contained the following disclosures: Its enterprise-wide earnings were $3.1 billion. The company spent $6.9 billion in capital expenditures and another $3.7 billion in dividends to shareholders. After borrowing $4.2 billion during the quarter, its free cash flow was negative $0.9 billion.

Revenue covered operational costs and ExxonMobil’s aggressive capital expenditure program. Asset sales were disappointing. Revenue from operations could not cover dividends to shareholders. The money to pay dividends was borrowed, increasing the company’s long-term indebtedness by 10%.

During the quarter, the company increased production by 7% worldwide. And so it goes with the energy sector. Oil and gas companies increase production even as they lose money. Put simply, the more oil and gas they produce, the more money they lose.

IN THE PERMIAN BASIN, EXXON IS SPENDING MONEY TO EARN EVEN LESS MONEY. Exxon is throwing the “total Exxon Mobil capability” behind its drilling in the Permian Basin. Over the first half of 2019, Exxon Mobil put one-third of its projected $30 billion capex budget into its U.S. upstream operations, which contributed only 8% of the quarter’s earnings. This imbalance between aggressive capex spending and far-smaller returns from its U.S. upstream portfolio has been a consistent theme, going back as far as 2014. One Exxon representative on this quarter’s earnings call professed: “We are making money in the Permian right now.” He did not elaborate, however, on how much the company was making, whether this was a recent phenomenon nor whether it would continue. Investors would benefit from a clearer understanding of the Permian Basin’s profitability as it continues to be the workhorse for Exxon’s upstream U.S. portfolio.

Due to its financial heft, ExxonMobil is taking a “different approach” to fracking in the Permian Basin

The company, in tacit recognition of the financial quagmire of most companies in the unconventional space, a.k.a. fracking, is also claiming that its strategy for the Permian is different from other companies’ approach. “We are taking a different approach to the Permian. I mean we are taking an approach which is leveraging the scale of this corporation. It’s a manufacturing approach. We are doing it at scale, which obviously a lot of the small players wouldn’t have the capacity to do that. We believe we have a significant capital advantage by doing it that way.”

Vicki Hollub, CEO of Occidental Petroleum, disagrees. She says integrated oil majors who hope to succeed in the Permian where the smaller players have struggled financially will face the same logistical challenges. She is not bullish on their success.

MEANWHILE, EXXONMOBIL’S LOSING STREAK CONTINUES. As demonstrated in ExxonMobil’s failed tar sands investments in Canada, write-offs on its XTO acquisition, and wasted money on an unsuccessful Russian deal, the company’s capex bets have been coming up short for at least a decade. The only difference between ExxonMobil and the dozens of companies that are failing under the fracking sector’s inability to prove financially sustainable, is that the once-mighty oil giant has more assets to burn through before it hits bottom.

The markets have signaled that ExxonMobil’s business strategy is a bad bet. Remaining investors would do well to pay attention.

Tom Sanzillo (tsanzill[email protected]) is IEEFA’s director of finance.

Kathy Hipple ([email protected]) is an IEEFA financial analyst.

RELATED ITEMS:

IEEFA update: ExxonMobil’s drill, drill, drill strategy earns a “D-“

IEEFA U.S.: ExxonMobil goes back large into risky Canadian oil sands