IEEFA Update: Peabody’s Recovery Plan Overstates the Market for Coal

Last week’s bankruptcy court approval of Peabody Energy’s reorganization plan should be cause for investor alarm.

Last week’s bankruptcy court approval of Peabody Energy’s reorganization plan should be cause for investor alarm.

The flaws in the plan are fundamental:

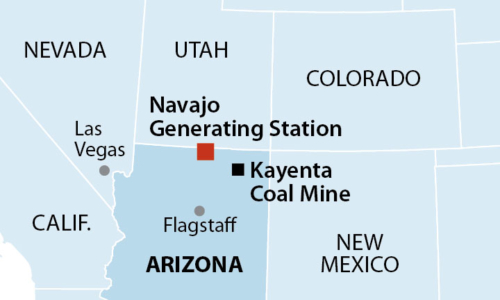

- First, the company is claiming an increase in coal sales at a time of a declining market. The company in fact faces the likely loss of five to seven million tons per year just from the likely closure of the Navajo Generating Station in Arizona and its impact on its Kayenta mine. Other coal plants under contract with Peabody have a shaky future.

- Second, we see three Peabody mines in the western U.S.—El Segundo and Lee Ranch in New Mexico, and Twentymile in Colorado—as particularly vulnerable to market forces. None of them were considered marketable in a deal to sell them to Bowie Resources that fell apart last year.

- Third, the Energy Information Agency projects that production in the Powder River Basin, the largest regional reserve of U.S. coal, is in decline. Between publication of its annual 2016 and 2017 projections, the EIA reduced the aggregate volume of coal produced in the Powder River Basin from 2017-2021—the same timeframe covered in Peabody Plan recovery plan—by 245 million tons. Peabody’s bankruptcy filing, by contrast, shows a net gain in production of 15 million tons. Combined, the EIA and Peabody projections strongly suggest mine consolidations in the region are likely and that company consolidations and new coal-industry bankruptcy may occur as well.

Here, in an excerpt from a commentary we posted in November, is the big picture for U.S. coal:

“The bottom line is that coal-fired power plants are continuing to close in the U.S., causing the markets to shrink further. Recent IEEFA reports include one that shows how Texas, which historically has been the largest consumer of coal in the nation, is likely to close more coal-fired power plants in the coming years. The coal industry has argued that coal plant capacity factors would increase as some plants close, but this hasn’t been true in Texas. Increased competition from wind, solar and natural gas is altering the electricity landscape. This will have a profound effect on mines in the Powder River Basin, as we explained in a separate report a few weeks ago, where Texas coal plants have been the biggest customers of mines owned by Peabody and other major coal companies.”

PEABODY’S RECOVERY MODEL DOES NOT WORK, ITS COAL-RESERVE CALCULATIONS ARE SUSPECT, AND ITS FUNDAMENTAL SALES PROJECTIONS are overstated. Core weaknesses in the company remain, even with the company’s recent achievements in production efficiency and its shedding of $5 billion in debt.

Indicators to watch include what if any adjustments Peabody makes to its proven and probable reserve calculations. In its 2015 statement, Peabody carried 4.3 billion tons of what its executives said was economically extractable coal. Given the current market climate and the long-term EIA downgrade of Powder River Basin production, what the company tells its investors will be quite revealing. This stands, too, for proven and probable reserves in the company’s Western coal producing segment.

We think the company probably has a substantially smaller amount of proven and probable reserves than it has presented in its SEC filing, and we’ll be watching closely as Peabody revises it reserve calculation in not just the Powder River Basin and the Western U.S. but in the Illinois Basin as well.

On the controversial self-bonding front, where Peabody has historically avoided paying third party insurers to cover its reclamation liabilities, the company has made much of its new policy of now paying actual premiums for actual reclamation insurance. This is an important victory for environmental protection. The willingness of any insurance company to offer such coverage avoids what would have been a highly public and contentious review of the company’s eligibility for self-bonding.

ASIDE FROM THE WEAKNESSES DESCRIBED ABOVE, WE THINK THE COMPANY’S RELIANCE ON HEDGE FUNDS AS AN IMPORTANT SOURCE OF LIQUIDITY DEMONSTRATES NOT FUNDAMENTAL STRENGTH but fundamental weakness.

U.S. coal companies—Peabody included—that survive will probably remain slow and steady revenue producers with modest margins. Hedge funds, by contrast, typically seek high-risk situations and then pressure a company’s balance sheet for short-term double-digit returns, as noted by the St. Louis Post-Dispatch, Peabody’s hometown paper. It is not a recipe that suggests long-term stability.

Peabody’s bankruptcy plan puts the company back into the black, but probably only temporarily, and the company and its many stakeholders—investors, partners, and workers—are likely ultimately to see red again.

Long term, the company will underperform on its production and revenue forecast.

Tom Sanzillo is IEEFA’s director of finance.

RELATED POSTS:

IEEFA U.S. Coal Outlook 2017: Short-Term Gains Muted by Prevailing Weaknesses in Fundamentals

IEEFA Update: Elections Have Consequences, but Perhaps Few That Can Save Coal

IEEFA Op-Ed: Market Forces Are What’s Killing the Navajo Generating Station