IEEFA Update: A Brave New World Is Taking Hold in the Grid Integration of Renewables

Important regional electricity markets and whole countries are blowing past old record levels of wind and solar power by taking a variety of simple, practical steps to improve grid flexibility.

Current trends make a mockery of doubts peddled by system incumbents who keep promoting new subsidies (like capacity payments) for old-school gas and nuclear power as the best way to assure electricity supply security.

As we outlined in a report published this week—“Power Industry Transition, Here and Now”—there is nothing hypothetical about the global rise of renewable energy grid integration.

The report’s nine case studies show how markets from Texas to Tamil Nadu, India, to California to Denmark are making use of tools and policies that grid experts and academics have long argued are needed to achieve a larger presence of variable renewables.

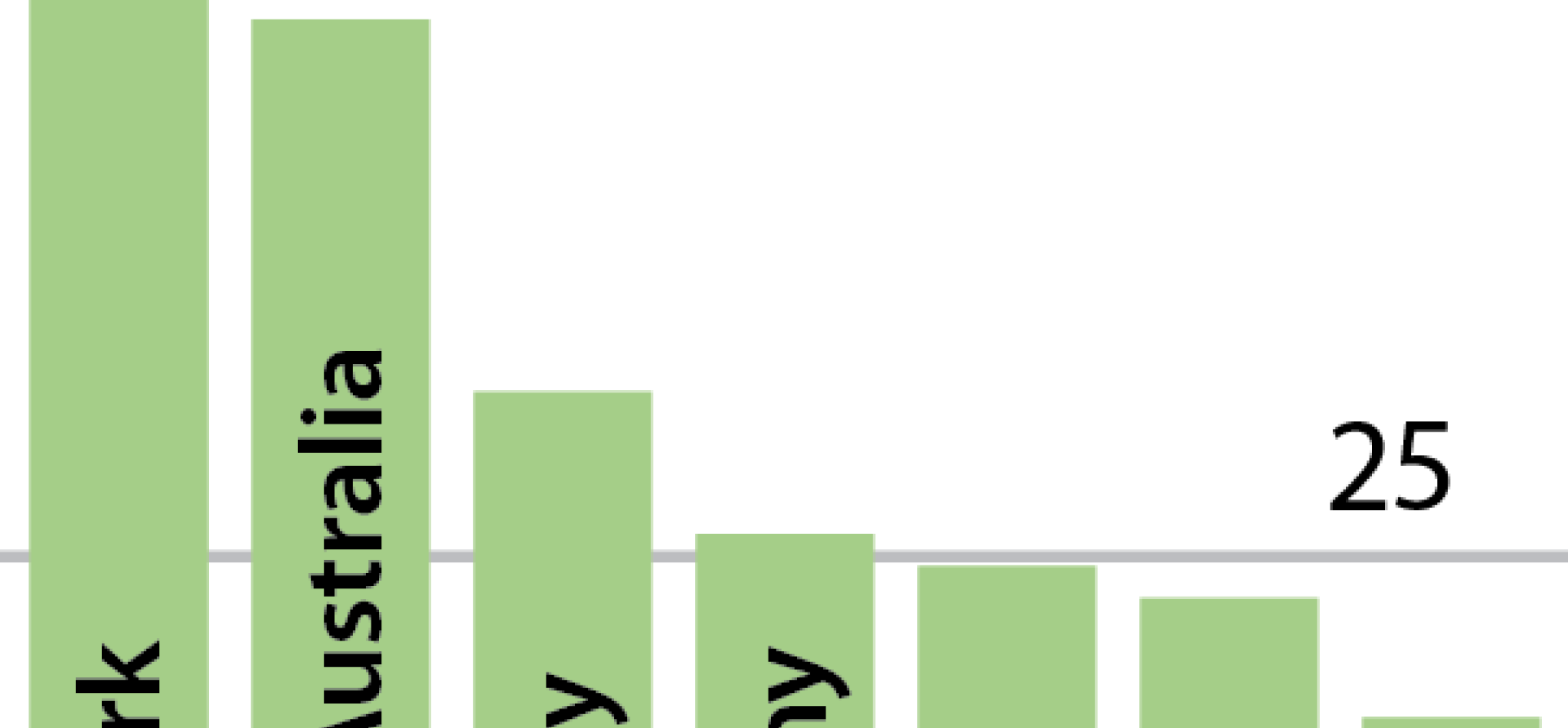

Our research shows how the market share for wind and/or solar made up from 14 to 53 percent of generation in various markets, up to 10 times the global average of 5 percent as estimated by the International Energy Agency.

These case studies prove that renewables can be (and are being) safely integrated into the grid, can assure ongoing security of supply, and can promote system flexibility—all through an assortment of mechanisms that vary by specific national circumstances.

URUGUAY, FOR EXAMPLE, HAS BECOME THE WORLD’S FASTEST-GROWING WIND MARKET by integration with its strong domestic hydropower resources—a highly flexible power source that the country can tune up and down according to the availability of wind power. Uruguay last year got 33 percent of its electricity from wind, up from 1 percent in 2013.

Other countries have achieved similar flexibility. Denmark stands out as the world’s No. 1 market by share of wind and solar power, achieving 53 percent of net generation from wind and solar last year. Denmark has done this by successfully balancing the variability of wind generation with cross-border, sub-sea cables whose capacity is equivalent to more than half the country’s domestic generation. In this way, Denmark exploits the diversity of generation of its bigger neighbors, especially by tapping into hydropower from Scandinavia and renewables and thermal generation in Germany. Such interconnection allows Denmark to import and export power according to the status of its domestic wind generation, a mechanism that allows it to balance its grid.

Meanwhile in South Australia, the world’s No. 2 market by share of wind and power (48 percent), grid operators are ramping up tech-driven flexibility through demand response and battery storage.

South Australia is a global leader in major grid-scale and residential battery deployments, with at least five of such installations completed or announced at the time of writing. Tesla’s 100-megawatt lithium-ion battery (the world’s biggest) was completed in late 2017 alongside a 315- megawatt wind farm to help balance the grid. An additional 30 megawatts of battery capacity is being built on the Yorke Peninsula of South Australia next to the Wattle Point Wind Farm. Planning is underway for three more major grid-scale, residential projects.

South Australia has also contracted for nearly 1 gigawatt of demand response this year, which allows users to be paid to reduce consumption in the event of demand surges.

OTHER WAYS OF INCREASING ELECTRICITY-SYSTEM FLEXIBILITY include new grid controls that force renewables themselves to respond to changes in electricity supply and demand (in Germany) and market reforms (Texas) to pay generators more for responding to near-term peaks and troughs in demand and supply.

Our case studies show that flexibility is key to the expansion of wind and solar power. Having focused this research on options already proven at scale, we know that such initiatives are achievable.

Only one of our nine case studies (Spain) was of a market that has capacity payments, where power plants—often conventional coal, gas, nuclear and hydropower—are subsidized simply to be available as back-up. Spain’s electricity system has excess capacity, and therefore no need for such subsidies.

We see no evidence that capacity markets are needed in the global transition to renewables, notwithstanding keen lobbying by fossil fuel utilities such as Germany’s RWE (and many others) to sustain the status quo.

The cost-effective solutions we outline in our report offer a proven and more sensible way forward.

Gerard Wynn is a London-based IEEFA energy finance consultant.

RELATED ITEMS:

IEEFA Report: ‘Here and Now’ — Nine Electricity Markets Leading the Transition to Wind and Solar

IEEFA India: Tamil Nadu, Population 72 Million, Emerges as a National Transition Model

IEEFA Update: In U.S. Utility NextEra, a Template for Electricity-Generation Transition