IEEFA Update: Across a Bedeviled Industry, Too Much Coal Is Being Mined Still for Too Few Customers

Arch Coal and Cloud Peak Energy will report earnings tomorrow, the first out of the gate among the major U.S. coal producers. Whatever emerges in the details won’t alter the fundamental problems bedeviling the industry.

Arch Coal and Cloud Peak Energy will report earnings tomorrow, the first out of the gate among the major U.S. coal producers. Whatever emerges in the details won’t alter the fundamental problems bedeviling the industry.

A few notes on what we see:

- SNL, the energy-industry data repository, has overall coal production for Q2 declining from Q1, and while 2017 appears to be showing better numbers on production and consumption than 2016, how significant those numbers are remains to be seen.

- Arch has cut production in Wyoming at its Black Thunder mine, one of its powerhouse producers. We’ll be looking to see the effects on Arch revenues, cost controls and margins here. That said, improvements in metallurgical coal prices may offset some of the company’s weakness in its Powder River Basin holdings.

- Production is down at two Cloud Peak mines that typically serve domestic electricity-generation plants: Antelope and Cordero mines, both in Wyoming. Production is up at the company’s Spring Creek mine, which is on the Montana side of the Powder River Basin and typically ships to Asia. CEO Colin Marshall stated in Q1 that global coal prices at $80 would allow the company to make a go of export coal sales. We’ll be waiting to see if the fundamentals allow Cloud Peak to go from negative margins on its export sales to positive. We expect erosion in revenues at the company’s other mines.

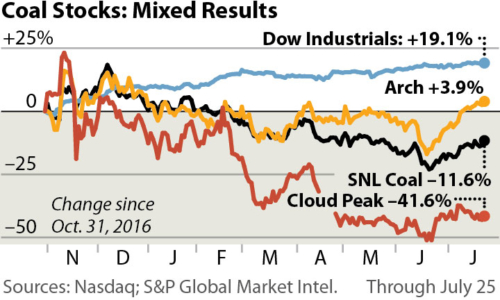

Year-to-date stock prices for both companies are mixed. Arch has been able to keep its head above water vis-à-vis the rest of the coal industry. Cloud Peak continues to struggle as the company grapples with declining demand and a marginal export presence.

Year to date, the coal industry continues to lag the Dow Jones industrial Average. The SNL Coal Index is down 12 percent since November while the Dow is up 19 percent. This tendency by the industry to lag the major stock indexes is going strong now into its sixth year even with the slight uptick reported in late 2016.

One analyst commenting recently on the short-term possibilities for the industry suggested it might make sense for coal producers to keep it in the ground. The overcapacity picture isn’t likely to change much in the earnings reports that are emerging. Too many companies are still producing too much coal for a declining base of consumers.

We remain wedded to the proposition that there will be more consolidation across the U.S. coal industry and most probably more bankruptcies.

The problem for the coal industry is that money makes this all happen and right now it is hard to see the combination or combinations that make a significant investable proposition that can help really provide a lift. We are more likely to continue to see smaller deals, many counterproductive attempts to add more capacity to an oversupplied market.

Tom Sanzillo is IEEFA’s director of finance.

RELATED POSTS:

IEEFA Update: A Texas Coal Domino Teeters

IEEFA Europe: The Carbon-Capture Dream Is Dying

IEEFA Update: Two Sets of Data Tell the Same Tale: U.S. Coal Industry Continues to Shed Jobs

IEEFA U.S. Coal Outlook 2017: Short-Term Gains Muted by Prevailing Weaknesses in Fundamentals