IEEFA U.S.: Surge of coal-fired generation retirements looking like a reverse S-curve

There is an inverse S-curve developing in the U.S. coal generation sector, with announced plant retirements expanding rapidly as utilities and independent power producers adjust to the influx of cleaner and cheaper wind, solar and battery storage resources disrupting the electric system.

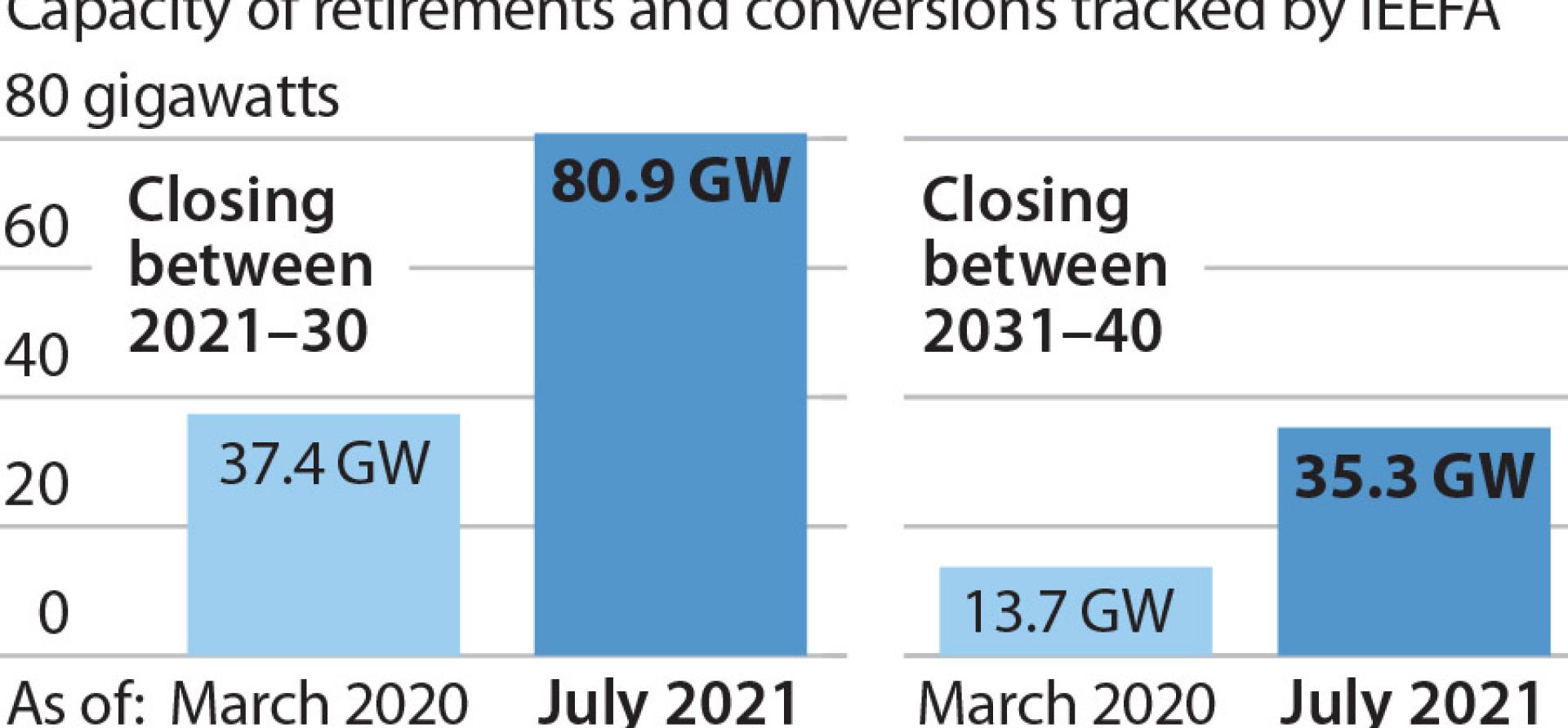

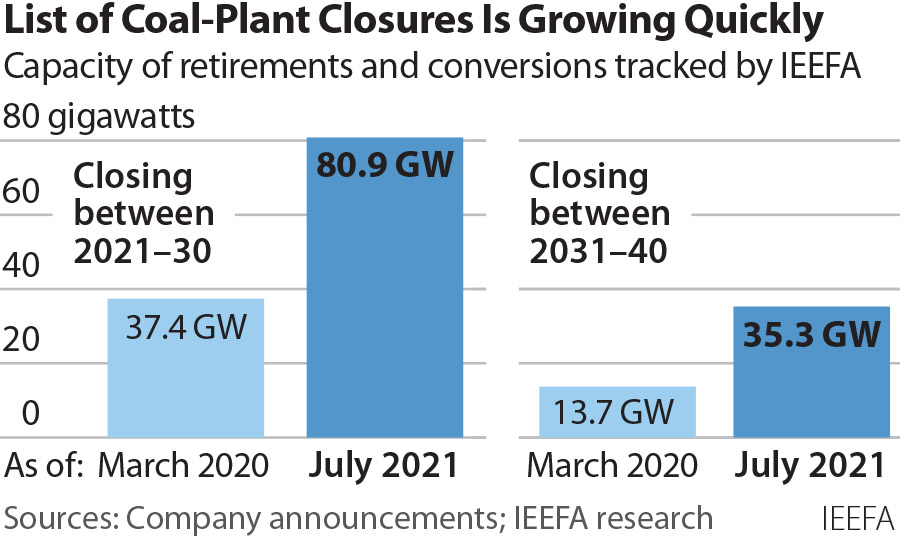

IEEFA data shows that just since March, the generating capacity of coal plants slated to retire or convert to gas from 2021-2030 has risen by 10 gigawatts (GW), to a total of 80.9GW—a 116% increase from a year ago in March 2020, when utilities had only 37.4GW of coal capacity scheduled to close through 2030.

IEEFA data shows that just since March, the generating capacity of coal plants slated to retire or convert to gas from 2021-2030 has risen by 10 gigawatts (GW), to a total of 80.9GW—a 116% increase from a year ago in March 2020, when utilities had only 37.4GW of coal capacity scheduled to close through 2030.

The change is equally pronounced for retirements from 2031-40. IEEFA data shows 35.3GW of coal capacity slated to retire this decade, up sharply from the scheduled 19.4GW of retirements in March 2021 and almost triple the 13.7GW tracked in March 2020.

The broad acceleration of utilities’ plans for coal retirements is exemplified by the new Clean Energy Plan announced recently by Michigan’s Consumers Energy, in which it now proposes to be coal-free by 2025. That’s 15 years sooner than what the company proposed just three years ago in its 2018 integrated resource plan. In that plan, Consumers said it would close Dan Karn Units 1 and 2 in 2023, Units 1 and 2 at the Campbell plant in 2031, and its final coal generating unit, Campbell 3, in 2040. Consumers would have still relied on coal-fired generation for almost 30% of its electric output through 2030 and more than 15% through 2040.

The Consumers proposal is potentially trend-setting

That all changed in June, when Consumers filed its 2021 IRP, which now calls for the closure of all three coal units at the 1,462MW Campbell plant in 2025. Importantly, the new, faster phaseout is also cheaper. According to Consumers’ filing, retiring its coal units in 2025 and ramping up its renewable capacity will save consumers $650 million through 2040, compared to the earlier plan.

The Consumers proposal is potentially trend-setting in another manner as well. Instead of planning—as, for example, Duke Energy is in the Carolinas—to build a series of new gas units, either combined-cycle or combustion turbines, the utility has proposed buying four existing units. The biggest, the 1,164MW Covert combined-cycle gas facility currently owned by ArcLight Capital Holdings, began commercial operations in 2004. It will be at or near the end of its normal lifespan by 2040 or so. That fits in with Consumers’ new plan, which calls for a steady decline in the utility’s gas-fired electric output coupled with a rapid increase in clean generation. By 2040, the utility projects more than 60% of its generation will come from renewable wind and solar. Coupled with new storage resources and a strong energy efficiency program, 90% of its customer needs will come from non-emitting resources.

Another significant shift was announced this spring by the Tennessee Valley Authority, the wholesale power provider that serves 10 million people in Tennessee and six surrounding states. In April, Jeff Lyash, the utility’s CEO, said that TVA would retire its remaining coal-fired generation, which has a total capacity of 6,915MW, by 2035. Since then, the utility has released more detailed environmental impact statements (EIS) for two of the plants—Kingston (1,420MW) and Cumberland (2,470MW)—that call for them to start closing as early as 2026, and be completely closed by 2031 and 2033, respectively. Three of TVA’s plants—Shawnee, Kingston and Gallatin, which have a combined capacity of 3,580MW—are already more than 60 years old. The youngest of the 22 units at these three plants entered commercial operation in 1959. The analyses of Shawnee and Gallatin could be released soon, and may recommend similar accelerated retirements.

Another significant shift was announced this spring by the Tennessee Valley Authority, the wholesale power provider that serves 10 million people in Tennessee and six surrounding states. In April, Jeff Lyash, the utility’s CEO, said that TVA would retire its remaining coal-fired generation, which has a total capacity of 6,915MW, by 2035. Since then, the utility has released more detailed environmental impact statements (EIS) for two of the plants—Kingston (1,420MW) and Cumberland (2,470MW)—that call for them to start closing as early as 2026, and be completely closed by 2031 and 2033, respectively. Three of TVA’s plants—Shawnee, Kingston and Gallatin, which have a combined capacity of 3,580MW—are already more than 60 years old. The youngest of the 22 units at these three plants entered commercial operation in 1959. The analyses of Shawnee and Gallatin could be released soon, and may recommend similar accelerated retirements.

In the official announcements for these EIS actions, TVA noted the obvious: “TVA’s recent evaluation confirms that the aging coal fleet is among the oldest in the nation and is experiencing deterioration of material condition and performance challenges. The performance challenges are projected to increase because of the coal fleet’s advancing age and the difficulty of adapting the fleet’s generation within the changing generation profile; and, in general, because the coal fleet is contributing to environmental, economic, and reliability risks.”

So, while not moving nearly as quickly as Consumers, TVA is pushing forward, and there is little question about the final outcome. The question is not if the coal plants will close, but rather when they will close.

IEEFA expects it to be sooner, not later. Further, we expect the recent upswing in retirement announcements to continue as utilities and independent power producers across the country acknowledge the clear reality that coal can no longer compete—either economically or environmentally —with renewable energy resources, battery storage and energy efficiency.

Dennis Wamsted ([email protected]) is an IEEFA analyst/editor.

Seth Feaster ([email protected]) is an IEEFA energy data analyst.

Related Items:

IEEFA U.S.: The coal-to-renewables transition takes off

IEEFA: Birchwood coal facility closure/redevelopment highlights transition from coal to renewables