IEEFA primer: Cleanup costs supersede most other liabilities in oil and gas bankruptcies

December 5, 2019 (IEEFA U.S.) – The Institute for Energy Economics and Financial Analysis (IEEFA) published a “primer” today – a background guide explaining what the cleanup obligations are in cases of bankruptcy by oil and gas companies.

Called Cleaned Out by Bankruptcy: A Primer on Environmental Cleanup Duties, the brief notes the increasing numbers of bankruptcies in the fossil fuel sector as companies face growing economic, climate and stranded-asset risks as well as declining market prices and competition from renewables. Since 2015, nearly 200 North American oil and gas producers have filed for bankruptcy, restructuring over $100 billion in debt.

Called Cleaned Out by Bankruptcy: A Primer on Environmental Cleanup Duties, the brief notes the increasing numbers of bankruptcies in the fossil fuel sector as companies face growing economic, climate and stranded-asset risks as well as declining market prices and competition from renewables. Since 2015, nearly 200 North American oil and gas producers have filed for bankruptcy, restructuring over $100 billion in debt.

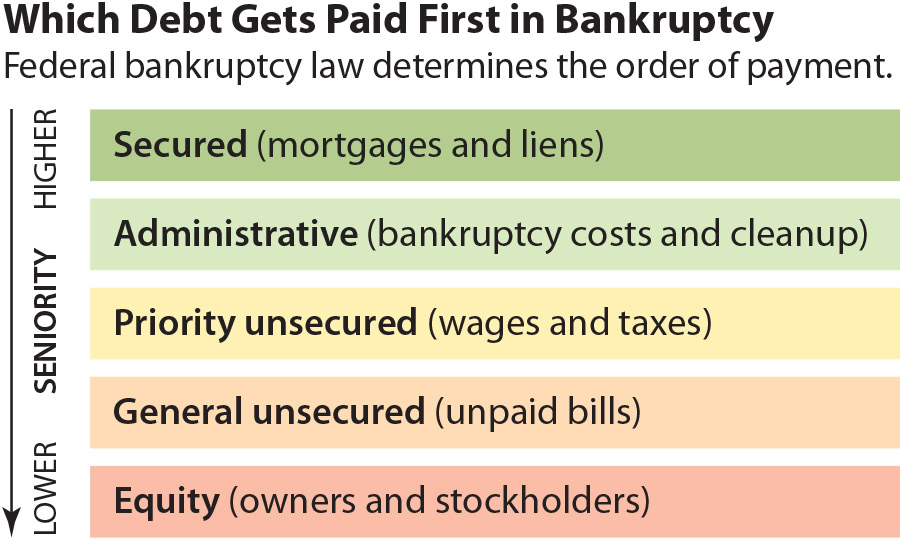

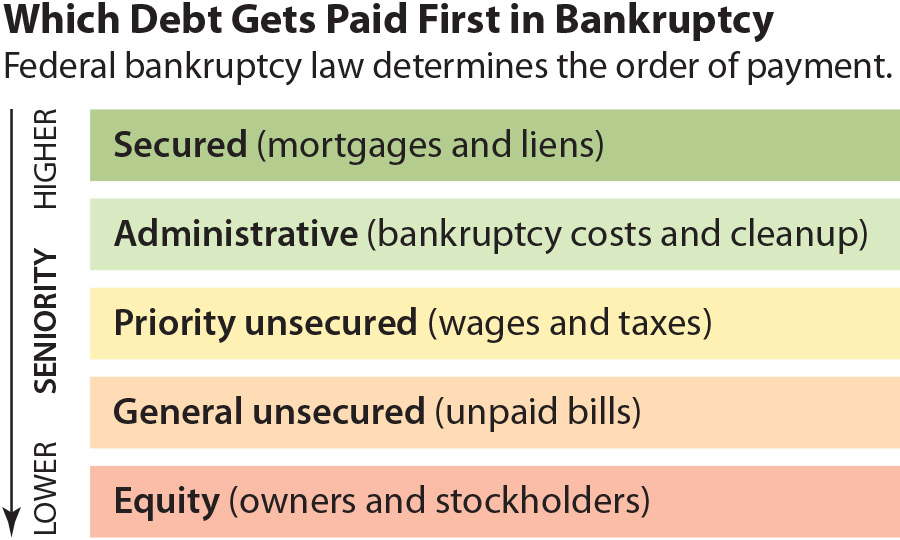

“Companies cannot walk away from their remediation obligations. In fact, after secured creditors, cleanup costs are next in line for payment during the bankruptcy process,” said IEEFA energy finance analyst Clark Williams-Derry, author of the primer.

Comparing payoff obligations to a falling cascade of “pools” – or categories of creditors and investors, Williams-Derry notes cleanup costs are placed high up on the list of liabilities that must be addressed by faltering companies.

Cleanup duties are given “super-priority” status and may include remediating contaminated sites, disposing of hazardous waste, or decommissioning oil and gas wells.

Federal law does not let oil companies off the hook for cleanup and remediation “Federal bankruptcy law does not let oil companies dodge responsibility for plugging old wells, rehabilitating drilling sites, or cleaning up contamination. These are considered absolute,” said Williams-Derry.

Even “secured investors” at the top of the obligations list, need to be concerned if a company’s assets have depreciated in value. As an example, the primer cites a company that has $1 billion in debt that is secured by a set of oil and gas wells. If the bankruptcy court determines that the assets actually are worth only $600 million, then the creditor’s recovery may be limited to $600 million, rather than the full $1 billion.

“Asset retirement obligations represent a profound but underappreciated risk to the solvency and profitability of the oil and gas sector. Investors would be wise to consider the financial risks stemming from cleanup when deciding whether to pour additional money into fossil fuel companies,” the primer concludes.

Author

Clark Williams-Derry ([email protected]) is an IEEFA energy finance analyst.

IEEFA Primer: Cleaned Out by Bankruptcy: A Primer on Environmental Cleanup Duties

Media contact

Vivienne Heston ([email protected]) +1 (914) 439-8921

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) conducts research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.