IEEFA India: Renewable energy sector could attract a flood of global capital to meet climate targets

India is the world’s fourth largest energy consumer and among the fastest growing large economies. With strong economic growth and electricity demand, the country will need additional sources of energy to fuel its economy – the International Energy Agency (IEA) projects that India’s energy demand will increase by 35% from 2019 to 2030.

The nation’s electricity needs historically have been met through thermal power – primarily state-owned – but the trend has changed. Over the past 15 years, private ownership of generation assets has increased consistently, with a rising share of non-hydro renewable energy (RE) sources.

In both generation and financing, the private sector is playing a big role in renewable energy deployment

In both generation and financing, the private sector is playing a big role in renewable energy deployment. Similar trends have emerged globally with private capital leading renewable energy financing.

Over the past decade, the financing landscape in RE has transformed. As the sector went mainstream, incumbent players have tapped into a variety of financing avenues. This has been partly led by a global thrust towards sustainable finance and the rise of environmental social and governance (ESG) investing.

Sustainable finance bonds totalled US$552 billion in the first half of 2021, an all-time first half record, while sustainable lending totalled US$321 billion in the same period, more than tripling on a year-on-year basis, according to Refinitiv’s The Green Bond Guide. According to Bloomberg, ESG assets may hit US$53 trillion by 2025, a third of global assets under management (AUM).

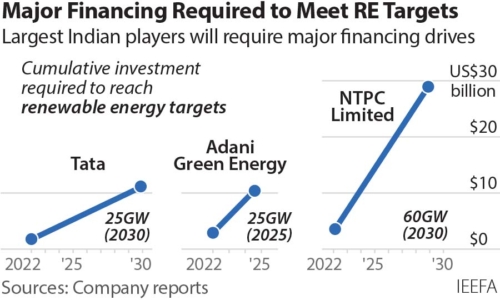

That said, industry players will need to embark on a major financing drive for India to reach its renewable energy goals. For example, Tata Power, Adani Green Energy Ltd and NTPC Limited require billions of dollars in investment to achieve their renewable targets over the next two to eight years.

Given that 70-80% of financing for renewables is done using debt, it is imperative to secure debt funding in a timely manner on favourable terms. Moreover, traditional financing structures and sources used to fund capacity expansion in the sector need to be augmented.

Domestic sources of lending remain limited for funding RE assets, primarily due to a lack of non-bank debt sources, a shallow corporate bond market and a lack of domestic institutional financing. Offshore investments, debt and equity alike, can play an important role in helping Indian companies secure low-cost and tenured financing.

Funding avenues for renewable energy players

On the debt side, bond instruments are well suited to funding RE projects, as they provide long-term capital at competitive rates, raised from a diverse set of investors. Further, with multi-decade low rates in the developed world and growing inclination towards ESG factors, global investor appetite for Indian RE assets is growing.

Green bonds are the most widely used bond instrument to fund RE assets, with global issuances of US$406 billion in 2021 (until October). Another set of bond instruments, sustainability-linked bonds, have been used extensively by global utilities such as Enel and Total Energies to raise capital for their green energy initiatives. Sustainability-linked bonds have also started to make inroads into the Indian markets with Adani Electricity Mumbai recently raising US$300 million in sustainability-linked bonds in July 2021.

A viable alternative to raising term loans domestically is to tap foreign lenders willing to take exposure to renewable energy

Bonds may be more suited to RE projects but the majority of debt used during construction is raised through term loans from banks and financial institutions domestically. Refinancing occurs through either another loan facility with more favourable terms or bond issuances. The term loans are usually raised at higher rates, given the execution risk involved. A viable alternative to raising term loans domestically is to tap foreign lenders willing to take exposure to the RE sector.

Bank of America (BoA), JBIC of Japan, HSBC, Barclays and Deutsche Bank are some examples of global financial institutions expanding their sustainable books to achieve their net-zero pledges or being persuaded to lend to climate-aligned sectors by growing shareholder activism.

On the equity front, while an initial public offering (IPO) or private placement helps raise fresh capital and provides an exit for investors, asset level monetisation is imperative for RE companies to keep recycling capital from operational projects to under-construction projects.

Pooled investment vehicles such as infrastructure investment trusts (InvITs) allow companies to monetise operational cash generating assets by pooling multiple assets under a single entity.

Indigrid, sponsored by KKR, is India’s first power sector InvIT. It has recently acquired an operational solar asset while another KKR-sponsored company, Virescent, set up India’s first renewable-focused InvIT in September 2021.

Further strategic partnerships with oil and gas majors, such as in Adani Green Energy’s deal with Total SE, also help recycle capital from operational projects. Global oil and gas companies such as Total, BP and Shell have made sizeable commitments to green investments and can be potential partners in India’s renewable energy finance quest.

Multilateral development banks have committed capital to Indian renewable energy projects

Capital from Multilateral Development Banks (MDBs) is another source of both debt and equity for Indian companies. MBDs differ from global and local commercial banks in that they do not seek to maximise investment returns, which allows them to invest in high-risk countries and sectors. Such banks provided a total of US$66 billion towards green funding in 2020.

MDBs such as the World Bank, the International Finance Corporation (IFC), the Asian Development Bank (ADB), Germany’s KfW and Japan International Cooperation Agency (JICA) have committed capital to Indian RE projects.

Globally, a flood of capital is vying for opportunities to invest in zero-emissions renewable energy infrastructure assets, led by the advent of ESG investing. India presents attractive prospects for these investors to deploy capital and gain exposure to the country’s growing RE sector while also helping developers to secure low-cost capital from optimum sources.

To leverage and attract this global capital, Indian companies have numerous financing avenues, ranging from green bonds and loans to InvITs. Into the future, the ability to secure this capital will be critical for these companies to reach their RE goals.

Shantanu Srivastava is an Energy Finance Analyst at the Institute for Energy Economics and Financial Analysis (IEEFA).

This article first appeared in RenewableWatch.

Related articles

IEEFA: Innovative financing can help India achieve its renewable energy goals