High stakes for Asian Development Bank’s ambitious coal power retirement plan

24 September 2021 (IEEFA Asia): In the lead up to the United Nations Climate Change Conference COP26, the Asian Development Bank (ADB) announced a plan to speed up the retirement of high emissions coal-fired power plants in Southeast Asia. This announcement sets the stage for a transformation of the Asian multilateral development bank’s (MDB) role in guiding power infrastructure development in the region, finds a new report by the Institute for Energy Economics and Financial Analysis (IEEFA).

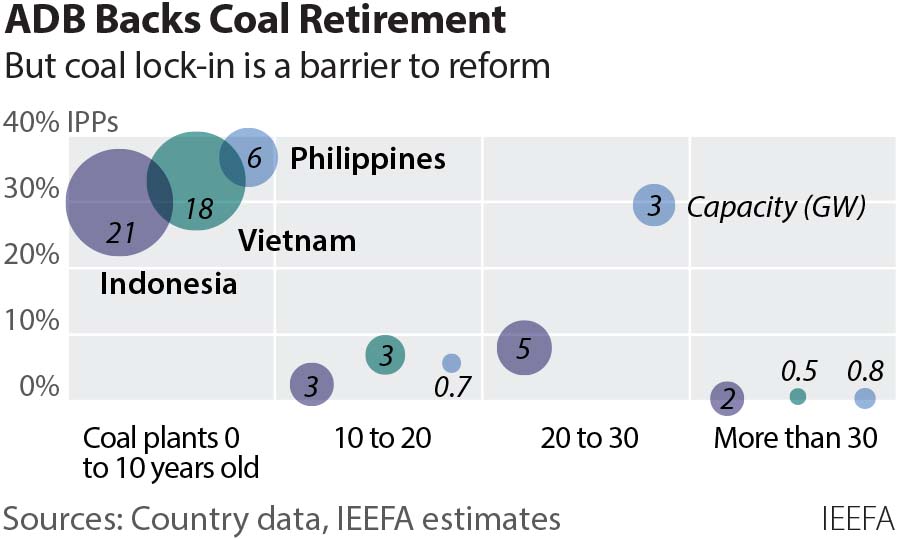

With British insurer Prudential and other financial firms, ADB’s ambitious plan is to build public-private funding vehicles to buy coal-fired power plants and retire them within 15 years to allow countries time to switch to renewable energy.

“COP26 is driving a new round of policy work by the MDB’s, and ADB is working hard to have a compelling solution on the table for donor nations to support,” says report co-author Melissa Brown.

“The ADB has an important role to play because donor nations have struggled to find fundable transition initiatives in Southeast Asia’s strategically important energy growth markets, including the Philippines, Vietnam, Indonesia, and in South Asia, Bangladesh.”

ADB’s ambitious plan is to buy high emissions coal-fired power plants in Southeast Asia and retire them within 15 years

The ADB proposes an energy transition mechanism (ETM) focused on coal retirement. The ETM has the potential to be an innovative effort to match new sources of blended finance with high priority steps that Southeast Asian countries could take to decarbonize.

“ADB’s ETM program will inevitably be assessed based on its ability to build on new financial market trends and accelerate the reduction and elimination of climate risks for the stakeholders they serve,” says Brown.

“To meet these expectations and have a catalytic impact, the projects undertaken should also meet the highest standards of market governance and align with credible international coal phase-out goals.

“The stakes are high for all concerned, because implementation challenges could rob the ADB of credibility and block funding for other equally important high impact clean energy funding strategies.”

In April, ADB launched a USD4.05 million technical assistance program (TA) to accelerate the clean energy transition in Southeast Asia. The TA signaled a new pathway for ADB by candidly addressing the complexity of the region’s dependence on fossil fuels and the barriers to scaling up renewables.

“The element of the program that has captured the market’s attention is a proposal to develop a public-private funding vehicle that would finance early decommissioning for some of Southeast Asia’s most carbon-intensive fossil fuel power plants to kick-start transition and create more space for the scale-up of renewables,” says Brown.

ADB proposes an energy transition mechanism (ETM) focused on coal retirement

The TA, along with the ETM, are signs of a potential sea change for the ADB. However, for this plan to attract meaningful donor and private sector funding, the market will have to be convinced that the ETM is a cost-effective catalyst that can rewire Southeast Asian power markets for clean energy – and do so within a meaningfully short timeframe.

To further analyse the prospects for this proposal, the ADB and regional stakeholders will need to think carefully about the details of the program and its ability to catalyse new funding flows that meet local needs. The following issues deserve careful attention:

- Is the ADB well-positioned to provide the right technical inputs and stewardship for the ETM?

- Can Southeast Asian markets meet the pre-conditions for success of an ETM: competitive pressure from stranding risk, transparent price discovery, and strong governance mechanism?

- How will the ETM address the challenge of coal lock-in in Southeast Asia and the reliance on opaque power purchase agreements that have been a barrier to rapid transition?

- Are there other market-based strategies that would more efficiently unlock blended capital?

- Investors could be exposed to complex reputational risks via the ETM. Has the proposed program been stress-tested to address the challenges?

How will the ETM address the challenge of coal lock-in in Southeast Asia?

Based on IEEFA’s analysis of the goals of the ETM and the market realities, stakeholders should have a big role in guiding the ADB to a better understanding of what role an ETM might play in creating durable incentives for change.

“Power market decision-making typically sits with energy, power, or industry ministries that often have more loyalty to domestic energy interests and power companies than price-sensitive power consumers,” says Brown.

“Without a credible commitment to stakeholder governance, it could prove difficult to attract the support of donor countries and international asset owners who have every reason to be sensitive to reputational risks.”

Finding the right way to calibrate design decisions will be critical because the three Southeast Asian power markets that are the focus of the ETM are ill-suited to a one-size-fits-all funding solution. Local stakeholders may also prefer programs focused on new grid and storage innovations that can unlock more investment in renewables.

One critical issue will be how much money would be needed to position an ETM program for success.

Senior ADB officials have already signaled their intention to press partners at the upcoming COP26 meetings for commitments to the ETM facility.

“The funding needed to support the scale-up of this program is dramatically higher than existing ADB clean energy financing programs,” says report co-author Grant Hauber.

One critical issue will be how much money would be needed to position an ETM program for success

“Simply funding the buyout of the book value of one large coal-fired facility in the 1-gigawatt (GW) range would cost approximately USD1.0 billion if the backer’s generous assumption of USD1.0 to 1.8 million per megawatt were used.”

According to IEEFA’s analysis, if the goal was to use the ETM facility to support the early retirement of half of the coal fleet in Indonesia, the Philippines, and Vietnam, the total facility size could balloon to as much as USD30.0 to 55.0 billion.

This is significantly more than the ADB’s USD20.0 billion COVID-19 assistance package, or the USD1.7 billion of co-financing pledged for the ASEAN Catalytic Green Finance Facility.

“Considering the gap between current funding levels for the energy transition in Southeast Asia and the commitments needed to turn an ETM into a viable catalyst for decommissioning, stakeholders would be right to stress test any statements regarding the timing or funding levels for the ETM,” says Hauber.

“This is a market that needs credible market catalysts to accelerate the transition. Matching the expansive goals in the ADB’s USD4.05 million technical assistance (TA) program with efforts to mobilize tens of billions of dollars from a mix of donor nations and financial investors would be ambitious under any circumstances.

“It will naturally raise questions about how this process can be managed to ensure that other, potentially more cost-effective proposals are not crowded out.”

Read the report: ADB Backs Coal Power Retirement in Southeast Asia

Media contact: Paige Nguyen ([email protected]) Ph: +61 433 048 877

Author contacts: Melissa Brown, Director of Energy Finance Studies, Asia ([email protected])

Grant Hauber, Energy Finance Analyst ([email protected])

*Authors are available for media interviews and background briefings*

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)