IEEFA: ExxonMobil investors need to drill deeper to find the truth

Late last month, ExxonMobil’s investors issued a stunning rebuke to the company’s management. At the annual meeting, shareholders elected three new board members over management’s objections. Much has been said about what upheaval means for cutting carbon emissions, but shareholders not only passed resolutions calling for greater climate responsiveness, they also demanded transparency.

The shareholder backlash was a long time coming for a company that had suffered through more than a decade of high-profile misfires. ExxonMobil’s former chief executive admitted he paid too much for its $41 billion acquisition of XTO Energy, a U.S. natural gas driller. Exxon’s Canadian oil sands projects have struggled financially. And the company fumbled an exploration deal with Russia’s Rosneft.

These missteps culminated in a disastrous 2020, in which the company slashed estimates of its oil reserves by one-third, and wrote off $16.8 billion in oil and gas assets in the U.S. alone. Investors should not lose sight of these underlying problems as the global economy recovers in 2021 and oil prices surge.

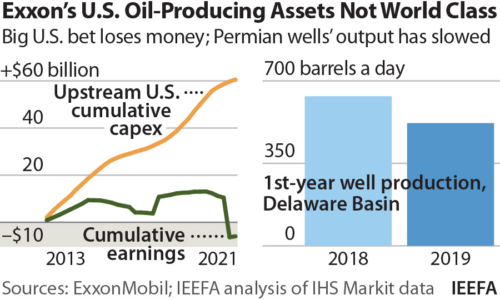

ITEM ONE ON THE NEW BOARD’S AGENDA SHOULD BE A THOROUGH REVIEW of the company’s upstream assets, starting with the Permian Basin in Texas and New Mexico. ExxonMobil has spent lavishly to improve its position in the basin, telling investors that oil and gas drilling was the path back to financial success, and that the Permian was one of its crown jewels. In 2020 and 2021, the company repeatedly held up the productivity of its Delaware Basin wells as the best way to compare Exxon’s allegedly world-class Permian portfolio with its peers.

But can the company really count on the Permian as the home run that it needs to make up for a series of strikeouts?

ExxonMobil’s drilling results raise questions about its ability to deliver on Permian ambitions

Early signs aren’t promising. A close evaluation of ExxonMobil’s drilling results raises troubling questions not only about the company’s ability to deliver on its Permian ambitions, but more importantly, about the quality of its disclosures to investors.

Even in their own presentations touting performance, the company admitted to investors that its Delaware wells had lost ground, in comparison both with the prior year and with its Delaware Basin rivals.

Our analysis of ExxonMobil’s Delaware Basin portfolio confirmed this performance decline, finding that the company’s wells have continued to fall behind those of its Permian Basin rivals. Its newer wells are on track to produce less than the basin average, while key rivals in the region have held steady.

MEANWHILE, EXXONMOBIL SAYS LITTLE TO INVESTORS ABOUT ITS WELLS in the Midland Basin, another portion of the Permian. The company has drilled far more wells in the Midland than in the Permian over the last five years, and its Midland wells are of middling productivity, at best.

In the Delaware Basin, the falloff in ExxonMobil’s well productivity may stem from its unusual practice of fracking multiple layers of rock — including some layers that are less productive. ExxonMobil credits this strategy with reducing costs and boosting efficiency. They may be correct.

These questions wouldn’t matter so much if the stakes weren’t so high

But if so, why haven’t they leveled with investors? Why did their recent investor presentations seem to imply that their wells were getting more productive, when they weren’t? Why invite skeptical investors to scrutinize their operations on a metric on which they’re underperforming?

If ExxonMobil is blowing smoke, doesn’t that suggest there’s a fire?

These questions wouldn’t matter so much if the stakes weren’t so high. In 2013, ExxonMobil was the most valuable company in the world. Today, it ranks 31st. Over the same period, ExxonMobil poured $61 billion of capital spending into U.S. oil and gas production. So far, even with recent rising oil prices and a small profit in the last quarter, those investments have yielded cumulative losses of $6 billion.

ExxonMobil has gone from one of the world’s premiere enterprises — a blue-chip stock market standout — to a dismal underperformer. Its stock price has rebounded sharply since the worst days of 2020, but today is roughly where it was in 2006. The company was kicked out of the Dow Jones Industrial Average last year. All the while, the company has talked about its bright prospects, while resorting to taking on debt to sustain its dividend payments.

To regain investors’ trust and its leadership within the oil and gas industry, ExxonMobil needs both standout performance and world-class transparency. As its Permian results show, the company has delivered neither.

Clark Williams-Derry ([email protected]) is an IEEFA energy finance analyst.

This op ed appeared originally in the Houston Chronicle on June 17, 2021 – Opinion: ExxonMobil investors need to drill deeper to find truth

Related items:

IEEFA U.S.: ExxonMobil touts Permian Basin success but achieves mixed results

IEEFA: ExxonMobil: Permian Leader or Just Another Fracker?

IEEFA: Oil supermajors made $20.5 billion in 2020 but spent $49.9 billion to please investors