IEEFA: ExxonMobil reserve portfolio posts small quarterly return despite price increases

April 30, 2021 (IEEFA) — Despite an extraordinary rise in the price of oil for ExxonMobil’s U.S. operations, the company’s U.S. reserve portfolio managed a meagre $363 million in earnings, according to an IEEFA analysis of its first-quarter earnings report.

Oil prices rose to an average of $56.20 during the first quarter of 2021, a 44 percent increase from the $39.06 posted during the last quarter of 2020.

“ExxonMobil has been pouring billions into the Permian Basin since 2013,” said Tom Sanzillo, IEEFA director of financial analysis. “The earnings report of $363 million this quarter—when oil prices took off—represents more an accounting gimmick than an actual return for investors.”

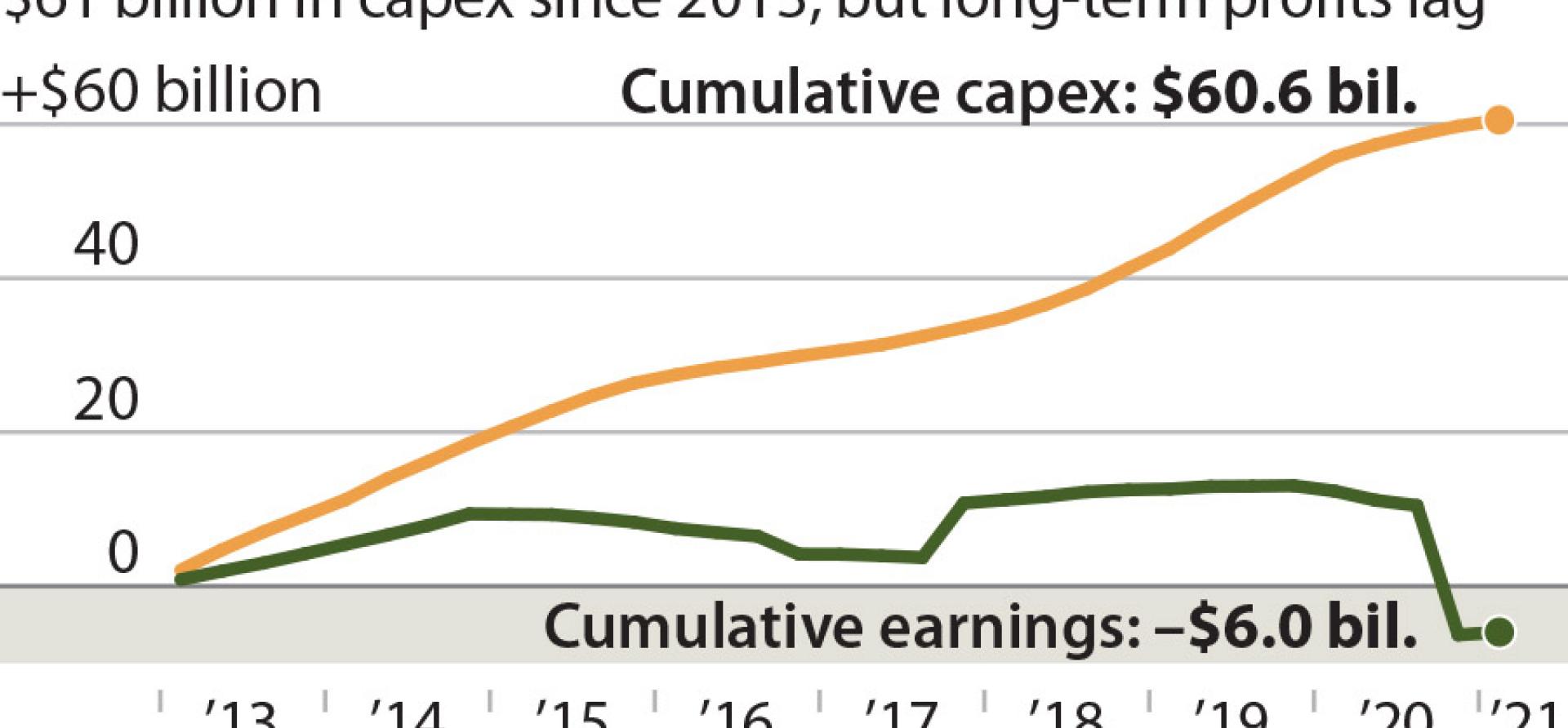

The Irving, Texas-based supermajor reported spending $3.1 billion on capital expenditures during the first quarter, including $800 million on its U.S. upstream operations. Weak earnings in ExxonMobil’s upstream portfolio have become common. Since 2013, it has invested more than $60 billion in U.S. upstream operations while posting $6 billion in cumulative losses.

“Do the math,” said Clark Williams-Derry, an IEEFA energy finance analyst. “ExxonMobil’s U.S. upstream segment bled cash for the quarter, after factoring in capital expenditures. The company’s U.S. oil and gas portfolio continues to underperform.”

Tom Sanzillo ([email protected]) is IEEFA’s director of financial analysis.

Clark Williams-Derry ([email protected]) is an IEEFA energy finance analyst.

Related items:

IEEFA: Oil supermajors made $20.5 billion in 2020 but spent $49.9 billion to please investors

IEEFA U.S.: Appalachian frackers report $504M in negative free cash flow despite capex slashing

IEEFA update: ExxonMobil’s financials indicate slide under CEO Darren Woods’s leadership