IEEFA Argentina: Early performance suggests shortfall in 2019 oil and gas production

In September 2017, Argentina launched a multi-year Energy Plan. The plan was ambitious. Oil production was expected to double in five years. Natural gas production was expected to double by 2023. Aggressive development of northern Patagonia’s Vaca Muerta oil and gas resources was expected to drive this growth.

Based on current government reports, however, through the first four months of 2019, the Argentine plan is off to a slow start.

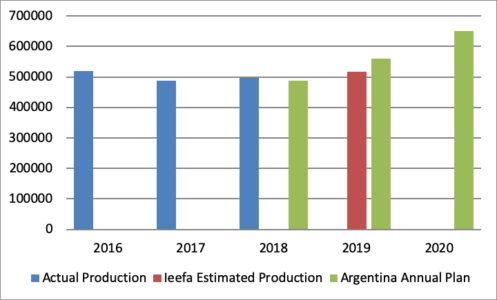

- IEEFA’s annualized projection for 2019 shows that production will fall short of planned goals by 7.5%. The plan calls for 560,000 barrels per day (bpd) and Argentine producers are likely to pump 518,000 bpd.

- In 2018, the first year of the plan, oil production exceeded the plan by 2%.

- Overall production for 2019 will increase year over year by approximately four percent, not the 15% annual leap anticipated under the plan.

Argentina oil production: Actual and estimated production versus Argentina Energy Plan (2016-2020)

(Annual average barrels per day)

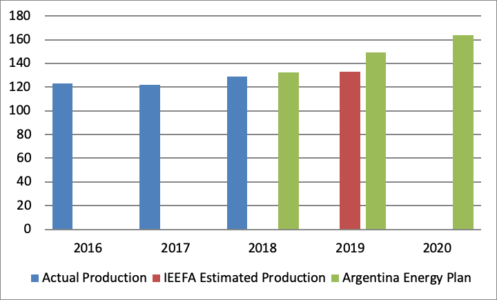

- IEEFA’s annualized projection for 2019 shows that natural gas production will fall short of planned goals by 11%. The plan calls for 149 million cubic feet and Argentina’s producers are likely to pump 132.8 million cubic feet.

- Argentine producers fell below plan in 2018 by 2.6%.

- Actual gas production is expected to increase by 4% in 2019 while the plan called for a 14% increase.

Argentina gas production: Actual and estimated production versus Argentina Energy Plan (2016-2020)

Million cubic feet (MMm3)/day

IEEFA’s 2019 oil and gas estimates are derived from the first four months of oil and gas production data published by the Argentine government. The annualized projection from the first four months of 2019 is adjusted based on production data for the first four months of 2016, 2017 and 2018.

THE FAILURE TO MEET PLANNED GOALS IN 2019 EILL REQUIRE ARGENTINE OIL AND GAS PRODUCERS TO REDOUBLE their efforts in 2020 to avoid further erosion of the plan. For example, if Argentina is to catch up to its goals in 2020, gas production would need to increase by 23% from 2019 levels.

Argentina is shifting from conventional oil and gas extraction to unconventional fracking

The uptick in oil and gas production comes as the country is also shifting its emphasis from reliance on conventional oil and gas extraction to unconventional fracking. The policy shift was undertaken in recognition of the significant resources in northern Patagonia and by a desire to reverse a substantial decline in oil and gas production over most of the last decade.

In a tacit acknowledgement of Argentina’s weak performance, President Mauricio Macri recently expressed concern that the world was moving away from fossil fuels and that many of the oil and gas companies doing business in Argentina were “laid back” about progress in Argentina.

Kathy Hipple ([email protected]) is an IEEFA financial analyst.

Tom Sanzillo ([email protected]) is IEEFA’s director of finance.

RELATED ITEMS

IEEFA Argentina: Vaca Muerta development stalled?

Financial Risks Cloud Development of Argentina’s Vaca Muerta Oil and Gas Reserves