Latest Energy Markets Research

See more >

Australian government has questions to answer over Future Gas Strategy

May 09, 2024

Josh Runciman

Analysis

Australian gas companies need a new strategy as they enter a declining market

April 09, 2024

Amandine Denis-Ryan

Briefing Note

Fixing India’s power market to help add more renewables

January 02, 2024

Saloni Sachdeva Michael

Insights

The wasted years on governance arrangements for DER technical standards

October 10, 2023

Gabrielle Kuiper

Analysis

Fact Sheet | San Miguel Global Power: Fossil-fuel oriented growth strategy raises financial red flags

September 18, 2023

Sam Reynolds, Hazel Ilango

Fact Sheet

Virtual Power Plants (VPPs) in Australia

September 14, 2023

Gabrielle Kuiper

Slides

How the sharing economy could play a major role in helping Eraring close on time

September 13, 2023

Gabrielle Kuiper

Analysis

Draft natural gas rules in the Philippines ignore high costs and economic consequences

September 04, 2023

Sam Reynolds

Analysis

Crucial contours for operationalising the Indian carbon market need clarity

July 28, 2023

Saloni Sachdeva Michael

Analysis

Electricity price rises hitting consumers – key to focus on renewables, storage and system efficiency

June 09, 2023

Johanna Bowyer

Analysis

Unlocking sustainable investments: The Reserve Bank of India's crucial role in energy transition

June 08, 2023

Shantanu Srivastava, Saurabh Trivedi

Analysis

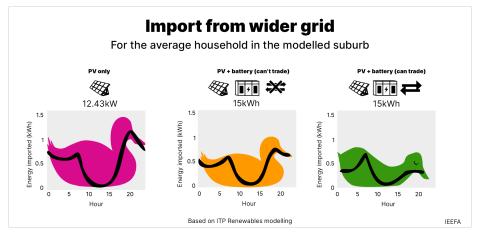

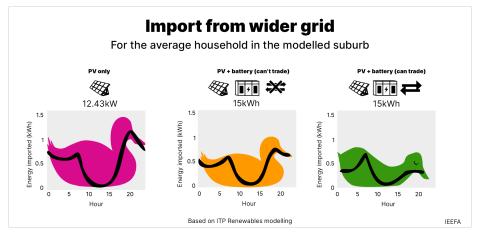

Saturation DER modelling shows distributed energy and storage could lower costs for all consumers if we get the regulation right

April 27, 2023

Gabrielle Kuiper

Analysis

Latest Energy Markets Reports

See more >

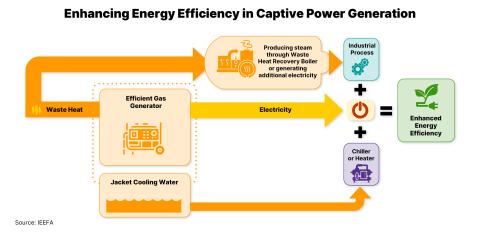

Industrial energy efficiency to curb Bangladesh's short-term LNG demand growth

May 13, 2024

Shafiqul Alam

Report

San Miguel Global Power: Fossil fuel-oriented growth strategy raises financial red flags

September 18, 2023

Sam Reynolds, Hazel Ilango

Report

Business model innovations drive the Philippines' energy transition

August 22, 2023

Ramnath Iyer

Report

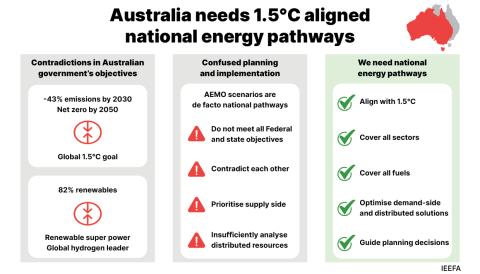

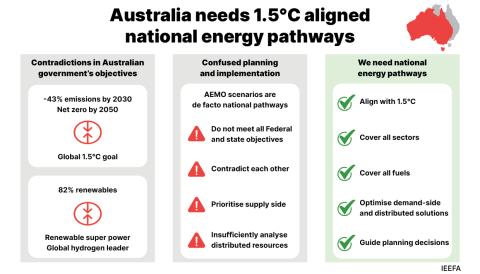

Australia needs 1.5°C aligned national energy pathways

June 29, 2023

Amandine Denis-Ryan, Jay Gordon

Report

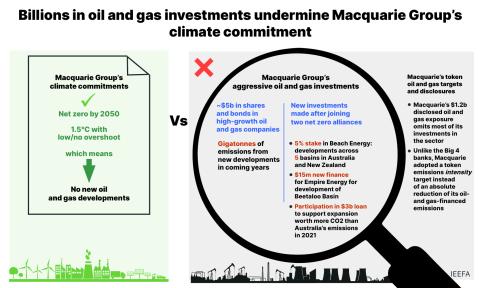

Billions in oil and gas investments undermine Macquarie Group's climate commitment

June 08, 2023

Amandine Denis-Ryan, Saurabh Trivedi

Report

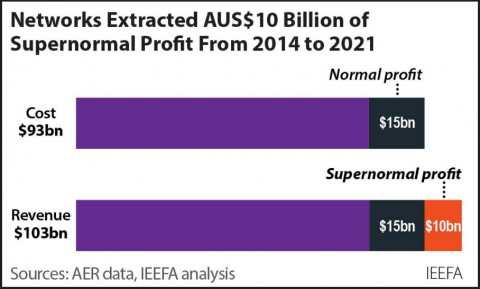

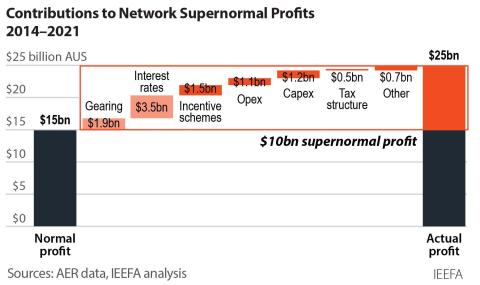

No relief from electricity network supernormal profits

March 30, 2023

Simon Orme

Report

Carmichael coal is not reducing poverty in South Asia

December 14, 2022

Simon Nicholas

Report

Regulated electricity network prices are higher than necessary

October 04, 2022

Simon Orme

Report

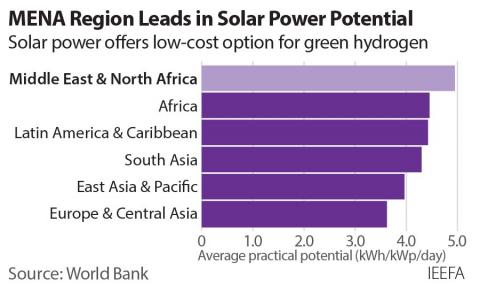

Green steel opportunity in the Middle East and North Africa

September 14, 2022

Soroush Basirat

Report

Australian thermal coal exports outlook – Volumes set to fall amid accelerating energy transition

September 07, 2022

Simon Nicholas, Andrew Gorringe

Report

India's power market design needs to evolve

August 25, 2022

Kashish Shah

Report

Assessing the decarbonisation pathways of India's power sector giants

August 10, 2022

Saurabh Trivedi, Christina Ng

Report

Latest Energy Markets Press Releases

See more >

Energy Efficiency Measures can Save Bangladesh $460m a Year in LNG Imports

May 13, 2024

Press Release

San Miguel Global Power’s fossil fuel expansion likely to exacerbate its financial challenges

September 18, 2023

Press Release

Renewable energy sector in the Philippines is poised to grow faster as investor interest rises

August 22, 2023

Press Release

Australia needs clear national energy pathways to 1.5°C not a maze

June 29, 2023

Press Release

Household solar and storage will dramatically change the shape of electricity markets and networks

April 27, 2023

Press Release

Monopoly power networks should not continue to receive supernormal profits while households pay rising electricity bills

March 30, 2023

Press Release

Energy consumers paid $10 billion too much for electricity — to energy network providers pocketing supernormal profits

October 05, 2022

Press Release

MENA region can lead global steel decarbonisation with investment in green hydrogen and renewable energy

September 14, 2022

Press Release

Australian thermal coal export decline will be accelerated by the global energy crisis

September 07, 2022

Press Release

Accelerating power scheduling and dispatch reforms can help save billions of dollars for Indian electricity distribution companies

August 25, 2022

Press Release

More ambitious emissions reduction targets will help Indian fossil fuel giants tap global transition finance

August 10, 2022

Press Release

Canada’s major banks continue funding oil and gas companies despite growing concerns over decommissioning liabilities

May 25, 2022

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

14900 Detroit Avenue Suite 206

14900 Detroit Avenue Suite 206

Lakewood, OH 44107

T: 216-712-6612

© 2024 Institute for Energy Economics & Financial Analysis.