Monopoly power networks should not continue to receive supernormal profits while households pay rising electricity bills

(IEEFA Australia): In a new report, IEEFA is calling on state and federal governments to step in to stem monopoly electricity networks from extracting supernormal profits, in order to reduce the upward pressure on electricity bills.

The recent draft default market offer (DMO) affecting NSW, South East Queensland and South Australia, and the Victorian default offer (VDO) in Victoria, indicate that consumers will be facing electricity price rises. However, 15–33% of the recent DMO and VDO draft residential retail bill rises could be avoided if monopoly electricity networks (excluding regional NSW served by Essential Energy, and CitiPower in Victoria) were no longer allowed to extract supernormal profits.

Simon Orme, Guest Contributor with IEEFA, said, “This is the perfect time for state governments to make changes that families will appreciate by reducing power price rises. Since our report published last October, no action has been taken to stem supernormal monopoly network profits. In fact, in February 2023, the Australian Energy Regulator completed a three-year review of the largest cost in electricity network charges and concluded the system used to set the ‘allowed’ return on capital from 1 July 2023 to 30 June 2028 should remain almost entirely unchanged.”

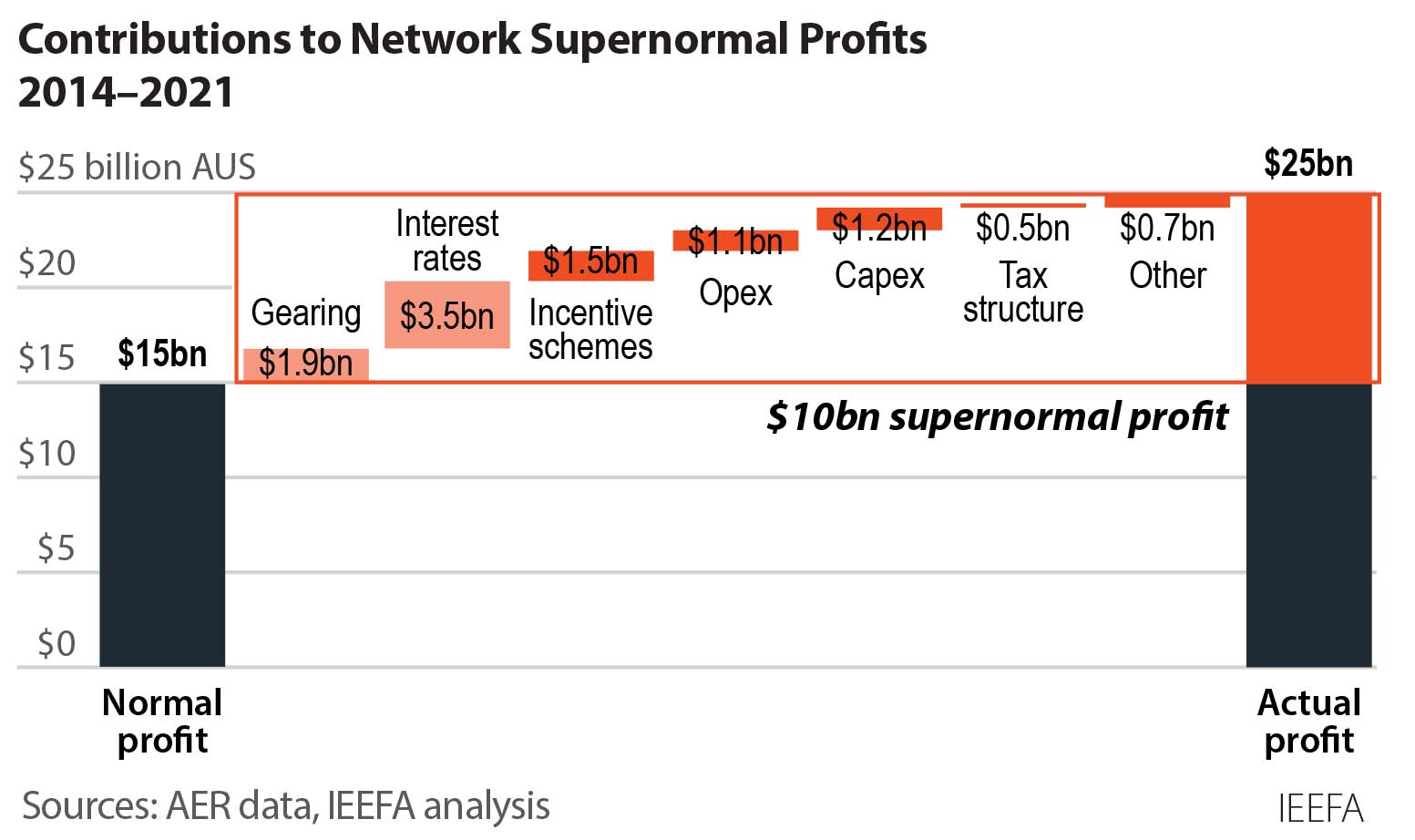

As shown in a October 2022 report by IEEFA, Regulated Electricity Network Prices Are Higher than Necessary, outcomes between 2014 and 2021 do not appear to align with AER’s corporate plan objective of “ensuring that consumers pay no more than necessary for safe and reliable electricity”.

Regulated electricity network prices are nearly 11% or $10 billion higher than necessary over 2014–2021.

“While data on supernormal network profits for 2023–24 are not available, and regulated network prices have yet to be finalised for this period, there is no reason to believe they will be different from the trend for 2014–21, previously observed by IEEFA,” Simon Orme said.

Applying the trend for 2014–21 to 2023–24, it was estimated that 15–33% of the recently announced residential retail bill price rises could be avoided for the network areas in NSW (excluding regional NSW), South Australia, South East Queensland and Victoria (excluding CitiPower areas) by addressing network supernormal profits. If supernormal monopoly network profits were removed, it would avoid $67 to $166 of bill increase per residential consumer in these areas.

The combined institutions that govern network regulation in Australia continue to fail to protect energy consumers from the monopoly pricing power of network companies. The AER’s failure to recognise or tackle this problem confirms that monopoly network regulation can only be fixed by government leadership.

The federal government should work with National Electricity Market (NEM) jurisdictions to stem supernormal network profits, in accordance with the relevant Commonwealth and State laws.

In the short term, with effect from 1 July 2023, NEM governments could overwrite the AER’s recent rate of return decision to correct errors in estimating debt financing costs resulting in more than half of network supernormal profits. There is no sound case for allowing certain networks to continue to extract supernormal profits simply because they were able to do this between 2014 and 2023.

In the longer run, changes are required to the laws and rules governing the economic regulation of monopoly networks, alongside the introduction of greater transparency and independent monitoring of regulator performance by the Australian government. If the government steps in and acts quickly, as it did with the gas and coal price caps, these changes could be made by the end of 2023, and could be effective from 1 July 2024.

Read the report: No Relief From Electricity Network Supernormal Profits

Read the October 2022 report: Regulated Electricity Network Prices Are Higher than Necessary: An assessment of the economic regulation of Australia’s electricity networks

Media Contact: Amy Leiper ([email protected]) +61 414 643 446

Author Contact: Simon Orme ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)