Energy Efficiency Measures can Save Bangladesh $460m a Year in LNG Imports

Plan to power economic growth with cheap LNG has backfired, exposing the nation to global market shocks

Key Takeaways:

Bangladesh’s plan to power its economic development with LNG imports was not designed to cope with extreme global fuel market volatility, depreciation of the local currency and weak fiscal conditions.

Greater efficiency in gas-fired captive power generation and productive use of waste heat can help reduce the import of LNG by 50.18 billion cubic feet (Bcf) and save Bangladesh US$460 million a year.

This study finds that the average efficiency of industrial gas-fired captive generation is 35.38%, which can be improved to 45.2% with high-efficiency generators.

The high dependence on gas is raising import bills and with it, the tariffs paid by consumers. Therefore, Bangladesh must urgently re-evaluate its energy strategy, and take steps to improve energy efficiency to contain the growing demand for gas.

13 May 2024 (IEEFA South Asia): Rather than import more liquefied natural gas (LNG) to meet escalating domestic demand, measures to improve energy efficiency could save Bangladesh US$460 million a year and help wean the country off its expensive import dependence, according to a new report by the Institute for Energy Economics and Financial Analysis (IEEFA).

The report surveys 51 industries with 124 gas-fired captive generators with a combined generation capacity of about 250 megawatts (MW) to find solutions to reduce the country's LNG demand growth.

“An insatiable appetite for gas could lock Bangladesh into a vicious cycle of spiralling prices and supply issues pertaining to LNG, and threaten to stall its economic transformation,” says the report’s author, Shafiqul Alam, Lead Analyst – Bangladesh Energy, IEEFA.

Alam examines the nation’s brief, turbulent relationship with imported LNG, and how the once cheap fossil fuel quickly became an economic burden.

What seemed a safe bet when Bangladesh started importing cheap LNG in 2018 began to unravel a year later with COVID-19 and its supply-chain disruptions. Then came the global fuel price shocks brought on by Russia’s invasion of Ukraine in 2022, compounded by domestic economic woes.

“The plan to import sufficient energy for development was not designed to cope with the high level of volatility in the international fuel market, depreciation of the local currency and weak fiscal conditions,” he says.

Nonetheless, different industries and the power sector have embraced LNG. For instance, industries use gas in their manufacturing process and for captive power generation in the absence of reliable grid electricity. Therein lies the problem, and one of the solutions, the report finds.

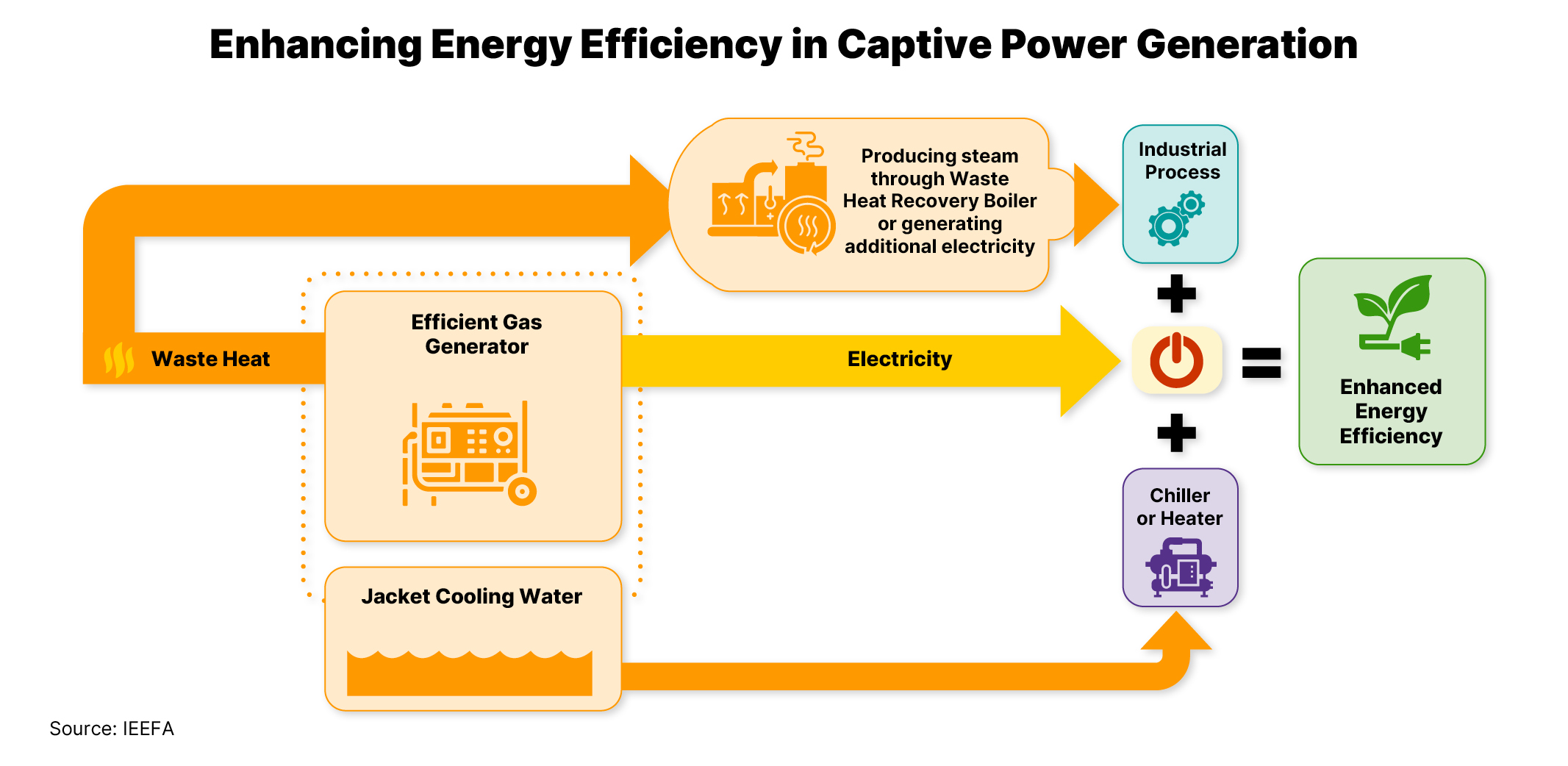

“Low efficiency in gas-fired captive power generation consumes a significant amount of gas annually. This is despite the average efficiency in captive generation increasing to 35.38% from 30% in the last decade,” Alam says. “Additionally, a significant percentage of industries do not utilise the waste heat released by these generators.”

The report found that by replacing the vast stock of ageing, inefficient generators with more efficient models already available, and harnessing the waste heat produced by generators for other applications, Bangladesh could reduce the demand for imported LNG by a massive 50.18 billion cubic feet a year, or 21%, representing an annual saving of US$460 million.

While replacing generators will require significant upfront investment, this capital outlay can be recouped within 1.5 to five years. The payback of investment in waste heat recovery is only about one year, the study found.

The alternative is to spend far more in building additional infrastructure to cope with the increasing local demand for fossil fuel imports against a global backdrop of tightening regulations to produce environment-friendly products.

“As the era of cheap energy comes to an end, with the government likely to make energy pricing more competitive in the foreseeable future, enhancing energy efficiency will be financially more rewarding. Any complacency in undertaking energy-saving measures will likely erode the competitiveness of industries in the international market,” Alam adds.

The policy foundations for such a shift already exist in Bangladesh. For instance, energy auditing of designated consumers, including industries, is mandatory. The Sustainable and Renewable Energy Development Authority (SREDA), established to accelerate the deployment of clean energy, may design measures to swiftly scale up energy efficiency. However, greater support, incentives and access to finance are essential to drive the country’s energy sector towards a more secure and sustainable future, the report found.

Notably, slow progress in deploying renewable energy and a lack of investment in developing local resources, have put Bangladesh at a fundamental disadvantage as it does not produce enough energy. Therefore, this study calls on the government to spearhead a comprehensive approach in the medium- to long-term, by:

- Enhancing the reliability of the electricity grid to encourage industries to shift to grid power from captive generation.

- Increasing renewable energy capacity.

- Building some gas-fired peaking power plants instead of only base-load plants to allow integration of more renewable energy. Alternatively, retaining the gas turbines of old combined-cycle gas-fired plants, which are due to be phased out, as a source of power when renewable energy is not available.

- Addressing inefficient energy use in the industrial process in a holistic way.

- Facilitating the purchase of renewable energy by industries through corporate power purchase agreements.

These measures will help Bangladesh reduce its dependence on gas far more than efficiency improvements in captive generation alone.

“Full energy independence may be a utopian dream, but the country must find ways to rein in its import dependence,” Alam says.

“Weaning Bangladesh off LNG imports will take time, but decision-makers must plan and act now lest the country is left badly exposed to the next global shockwave.”

Read the report: Industrial Energy Efficiency to Curb Bangladesh’s Short-term LNG Demand Growth

Media contact: Prionka Jha ([email protected]) Ph: +91 9818884854

Author contacts: Shafiqul Alam ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)