San Miguel Global Power’s fossil fuel expansion likely to exacerbate its financial challenges

Without an immediate pivot to renewable energy, the Philippine company risks further locking in exposure to global fossil fuel prices

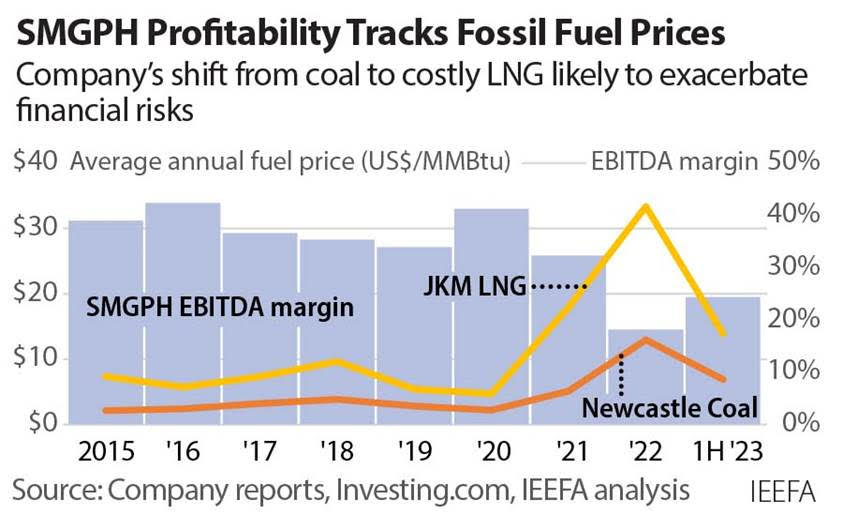

An overexposure to fossil fuels has weighed negatively on the financial health of San Miguel Global Power Holdings Corporation (SMGPH) in the Philippines in recent years, highlighting risks to its expansion strategy focused heavily on coal and natural gas projects, according to a new report from the Institute for Energy Economics and Financial Analysis (IEEFA).

Moreover, the company’s shift from coal to more expensive liquefied natural gas (LNG) could hinder SMGPH’s ability to meet growing financial obligations.

“As the largest power generation company in the Philippines, SMGPH should be well positioned to benefit from the country’s accelerating shift to renewable energy,” says Sam Reynolds, the report’s co-author and LNG/Gas research lead at IEEFA. “But without an immediate, material pivot to renewables, IEEFA believes the company is at risk of locking in financial instability caused by overexposure to volatile fossil fuel prices.”

“SMGPH investors should tread cautiously,” says co-author Hazel James Ilango, an IEEFA energy finance analyst. “The company’s elevated net debt-to-earnings, potential difficulties meeting financial obligations, and high fossil fuel exposure create additional risk of devaluation, particularly in the long term.”

Ambitious expansion plans have called for increased borrowing

SMGPH aims to complete 1,900 megawatts (MW) of new coal capacity and 1,313MW of new gas-fired capacity by 2025, with more than 10,000MW of proposed gas-fired capacity.

The company also plans to complete 800MW of solar capacity and 1,000MW of battery storage capacity in three years. Despite a 2018 goal to complete 10,000MW of renewables capacity by 2028, the company does not yet own any operational wind or solar assets.

“As a result of its ambitious expansion plans, SMGPH has increased its capital expenditures dramatically, funded largely by increased loans, bonds, and issuances of perpetual securities,” says Ilango.

Since 2019, SMGPH has issued more than P232 billion worth of perpetual securities and over P56 billion in bonds. According to IEEFA's analysis, however, just 0.1% funds from its most recent bond issuance in July 2022 went to renewable projects, compared with 76% for fossil fuel projects.

Fossil fuel-oriented expansion plans could aggravate financial issues

“While many of the company’s borrowings continue to go to new fossil fuel capacity, overexposure to fossil fuels is one of the root causes of the company’s recent financial troubles,” says Reynolds.

In the 2022 financial year, SMGPH’s operating income fell 22%, due largely to higher fuel costs following Russia’s invasion of Ukraine. It also posted an all-time-low EBITDA margin, a measure of operating profitability. Free cash flow, a measure of available cash after capital expenditures, fell to -P71.3 billion.

Moreover, SMGPH is expected to take almost twice as long, from four years to nine years, to service its current debt based on current earnings, signaling the company’s ability to service debt may be under pressure. IEEFA’s analysis also revealed major challenges in covering interest payments and capital distributions for perpetual securities holders.

“In IEEFA’s assessment, SMGPH fell short across all major performance metrics compared with top competitors in the Philippine power market,” says Ilango. “And while SMGPH’s earnings have shown improvement in the first half of 2023, ongoing challenges in meeting its financial obligations persist.”

SMGPH’s liquidity crunch could evolve into a longer-term funding shortfall, with US$3.4 billion (P167 billion) of U.S. dollar-denominated perpetual securities callable through 2026. Moreover, its access to low-cost capital could be constrained as global financial institutions increasingly recognize climate-related investment risks.

The company’s shift to LNG could make matters worse

Despite SMGPH’s financial troubles, its shift from coal to LNG could make matters worse for several key reasons.

LNG is a significantly more expensive fuel than coal, averaging nearly three times the price of coal in Asia since 2021. LNG prices are expected to remain high compared with historical levels through 2030. SMGPH does not have any active long-term LNG supply contracts, meaning it could remain entirely exposed to extreme volatility in global LNG spot markets.

Finally, none of SMGPH’s existing or proposed LNG-to-power plants have power offtake contracts beyond 2024 that might ensure long-term recovery of fuel costs. This presents a significant risk to the company’s financial well-being.

Time for a strategic rethink

In IEEFA’s view, SMGPH’s options to address financial challenges are limited.

The company may aim to raise additional capital with the backing of parent company San Miguel Corporation (SMC). However, due to its weak financial profile, tight funding conditions, and fossil fuel-focused strategy, SMGPH may struggle to access affordable capital markets. The company may also continue trying to pass all fuel costs through to end users via legal or regulatory avenues.

Ultimately, however, IEEFA believes that an urgent pivot toward low-cost, domestic renewable energy represents the best hedge against exposure to imported fossil fuels, and would best position the company within the Philippines’ accelerating energy transition.

Read the report: San Miguel Global Power: Fossil fuel-oriented growth strategy raises financial red flags

The fact sheet of this report is available here.

Report contacts:

Sam Reynolds ([email protected])

Hazel Ilango ([email protected])

Media contact:

Alex Yu ([email protected])

About IEEFA:

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)