Electricity price rises hitting consumers – key to focus on renewables, storage and system efficiency

Key Findings

Building renewables and storage will reduce exposure to volatile fossil fuel prices and, therefore, will put downward pressure on wholesale prices.

Small-scale, consumer-owned energy resources could also provide large amounts of new capacity to the grid and help bring power prices down if the correct regulations, policies and programs are introduced to effectively integrate these resources into the grid.

The Australian government should work with state governments to reduce supernormal electricity network profits to ease electricity bill increases.

The Australian Energy Regulator recently released its final determination indicating that annual electricity bills will increase by 20-25% for residential customers on the default market offer (DMO) in southeast Queensland, New South Wales (NSW) and South Australia.[1] The 25 May 2023 final decision on DMO prices for 2023-24 is similar to the draft decision, with only minor changes of 1 to 3 percentage points.

The Essential Services Commission of Victoria (ESCV) also released its final decision for Victorian default offer (VDO) retail prices, proposing residential annual electricity bill increases averaging 25%,[2] lower than the 31% increase in the draft.

The DMO and VDO decisions set a ceiling on how much energy retailers can charge consumers on default plans. The DMO and VDO price rises are indicative of the size of the market-wide price rises that can be expected.

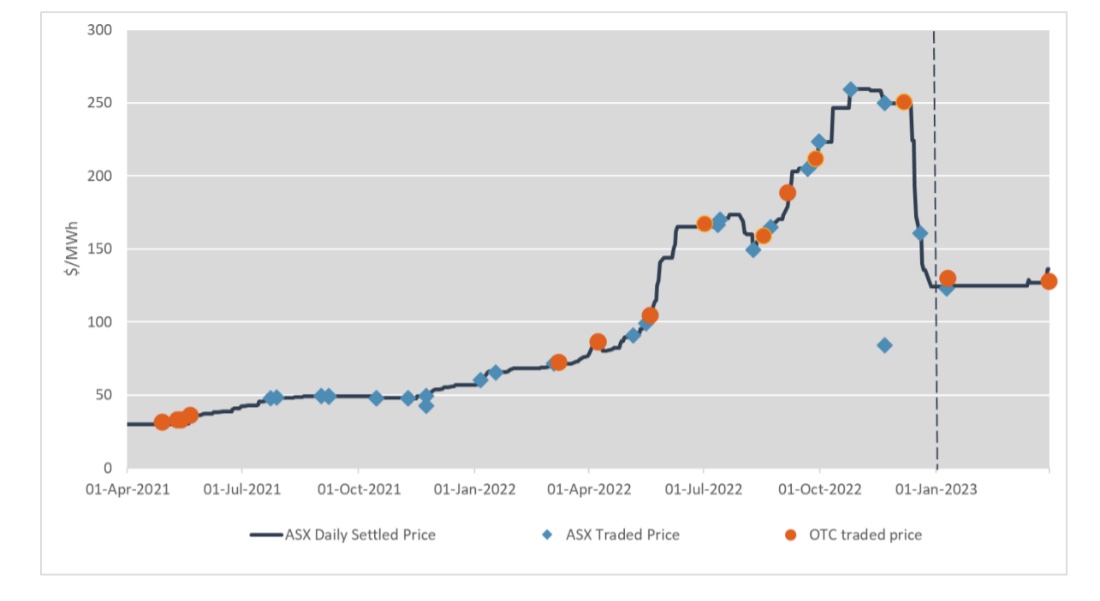

The DMO and VDO electricity bill increases are well above the inflation rate. The price rises mainly reflect the impact of high global coal and gas prices on National Energy Market (NEM) wholesale prices since Russia’s 2022 invasion of Ukraine. Forward contract prices were moderated substantially by the federal government’s cap on gas prices but remain elevated.

Figure 1: 2023 Quarter 3 OTC and ASX Traded Base Contracts in SA

Source: AER DMO Final Determination 2023-24

Building renewables and storage will reduce exposure to volatile fossil fuel prices and therefore will put downward pressure on wholesale prices.

Fifteen coal generators in the NEM are scheduled to be retired over the coming decades. To smooth price swings while those plants are decommissioned and new supply is brought in, careful planning is required.

The capacity investment scheme announced by the federal government, to underwrite investment in renewable dispatchable capacity, could help. The scheme could be used as a vehicle to coordinate the entrance of new renewables and storage with the exit of ageing coal-fired power plants. However public details about its design have so far been limited.

Small-scale, consumer-owned energy resources could also provide large amounts of new capacity to the grid and help bring power prices down if the correct regulations, policies and programs are introduced to effectively integrate these resources into the grid.

Saturation DER modelling undertaken by ITP Renewables showed that in a modelled suburb with where 70% of homes have rooftop solar and batteries, and where electricity can be traded locally with no net cost, the 4–8pm market-wide wholesale evening peak was reduced by 67–92%.

This has major implications for energy prices, since wholesale prices are usually highest during the evening peak. If the evening peak was reduced significantly, wholesale prices could decline in turn.

In the modelled suburb, the average summer network peak was also reduced by up to 64%. A lower network peak has implications for network expenditure.

The modelling also showed that a large uptake of solar, without incorporation of energy storage, can create a low belly in the ‘duck curve.’ This has been seen most vividly in South Australia, where wholesale prices are frequently going negative in the middle of the day.

Incorporating load shifting and energy storage into the system is key to making the most of abundant daytime solar generation.

A recent report by the Institute of Sustainable Futures identified that smart domestic hot water heaters could help soak up abundant daytime solar, providing up to 22GW of flexible demand capacity, with a storage depth of up to 45GWh/day by 2040.

Further, a report by Energy Synapse and NERA identified between $8 billion and $18 billion in potential savings from demand flexibility due to reduced investment requirements for large-scale generation and storage capacity, lowering system costs and electricity prices for consumers. The report notes that barriers to demand-side participation must be addressed to unlock the potential savings.

Policies and programs should aim to maximise flexible demand, especially shifting water heating with controlled load to the middle of the day.

Other measures that can help reduce energy bills are implementing energy efficiency and electrification measures. The federal government’s $1 billion initiative to unlock more than 110,000 low-interest loans for energy-saving home upgrades financed via the Clean Energy Finance Corporation, and the $300 million initiative to partner with states and territories to make energy performance upgrades to 60,000 social housing properties, will both assist with bringing electricity bills down for consumers.

Finally, the Australian government should work with state governments to reduce supernormal electricity network profits to ease electricity bill increases.

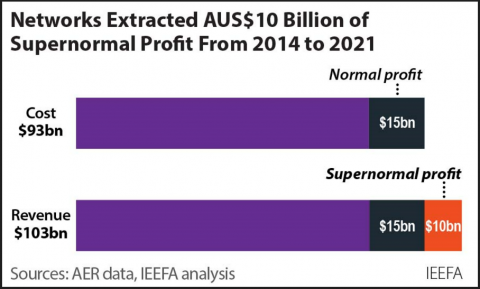

An October 2022 IEEFA report found that weaknesses in electricity network economic regulation have allowed high returns or “supernormal profits” in favour of network shareholders over 2014-21.

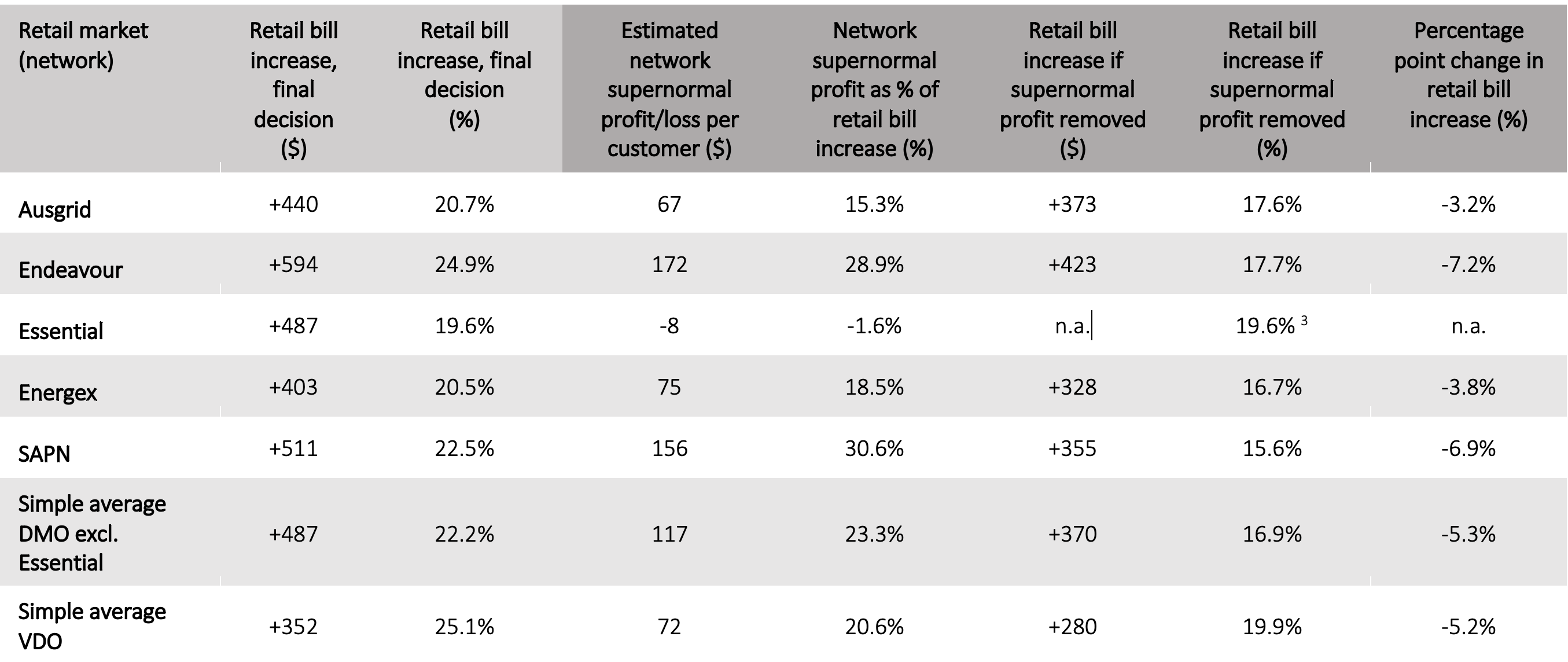

If the supernormal profits in electricity networks were removed entirely, between 15% and 31% of the recent DMO and VDO final residential retail bill rises could be avoided. Electricity bill rises would be $67 to $172 less than anticipated in the affected markets (excluding regional NSW served by Essential Energy, and CitiPower in Victoria). A prior IEEFA report determined the impact of avoiding supernormal network profits based on the draft determinations, which can be read for more detail.

Table 1: Estimated Impact of Supernormal Network Profits on Retail Bills

Notes: DMO figures are shown for residential households with controlled load. Similar but not identical results apply to customers without controlled load. Nominal figures have been used. Note that a prior report explained the figures based on the AER and ESCV draft determination, and this table shows the updated figures based on the final determinations.

Making sure network prices are efficient will be key to managing the costs of the energy transition, as transmission buildout is required to connect new Renewable Energy Zones with the load centres. If supernormal network profits continue to be baked in, the cost to consumers will be higher than necessary.

To reduce energy prices in the long term, the focus should be on accelerating large- and small-scale renewables and storage to replace ageing coal generators; managing customer-owned energy technologies effectively; implementing energy efficiency and demand response measures; and building the required transmission while improving the economic regulation of electricity networks to keep costs down.

[1] Analysis applies to residential customers with controlled load. Similar but not identical results apply to customers without controlled load. Figures are nominal

[2]Essential Services Commission. Victorian Default Offer 2023-24 Final Decision Paper. 25 May 2023. Page 4. Note values have been derived from Figure 2: Change in Victorian Default Offer annual bills for domestic customers on flat -- tariffs (assuming annual usage of 4,000 kWh)

[3] Essential Energy had no supernormal profit was observed - therefore the retail bill increase without supernormal profit is the same as the original DMO decision: 19.6%.