Australian government has questions to answer over Future Gas Strategy

Key Findings

The Australian government’s new Future Gas Strategy presents an optimistic long-term outlook for gas, but IEEFA research raises questions over the strategy’s claims.

Analysis by IEEFA suggests any supply gap in Australia’s domestic gas market would be better met by targeted measures to reduce residential and industrial demand, rather than increased supply.

The strategy anticipates long-term international demand for Australian LNG, but our key export markets are in decline, while a global supply glut is imminent in the coming years.

The government sees carbon capture, utilisation and storage (CCUS) as crucial to industry decarbonisation and emissions reduction, but this is an expensive, unproven technology with a long track record of failure.

This analysis is for information and educational purposes only and is not intended to be read as investment advice. Please click here to read our full disclaimer.

In its newly released Future Gas Strategy, the Australian government states that “gas is needed through to 2050 and beyond”, but research by IEEFA suggests this claim should be viewed with some scepticism.

Key points from the Analytical Report supporting the strategy include:

- Additional gas investment and supply will be needed to avoid supply gaps in the domestic market and ensure sufficient supply for households, power generators and industry.

- Australian liquefied natural gas (LNG) will see strong demand out to 2035 (to meet existing LNG contractual commitments).

- Key trading partners rely on Australian LNG and demand for Australian LNG “is expected to sustain throughout the transition”.

- Carbon capture, utilisation and storage (CCUS) will be needed to help the industry decarbonise and mitigate their emissions.

IEEFA’s analysis raises serious questions about these findings. In the domestic market, both the Australian Energy Market Operator (AEMO) and the Australian Commission and Consumer Commission (ACCC) have called for increased gas supply for at least the past five years to avert anticipated supply gaps. However, IEEFA research has shown that cost-effective and targeted measures to reduce residential and industrial demand would eliminate the risks of annual and peak demand day supply gaps while also lowering household energy bills. The alternative of increasing gas supply or importing LNG is likely to have the opposite effect of increasing energy bills. We found that Australian households are locking in $1.2 billion in unnecessary costs for each year that new gas appliances continue to be installed.

The tightening supply outlook in recent years has seriously impacted Australia’s industrial gas users. Manufacturers Incitec Pivot and Qenos have either mothballed plants or announced plans to do so due to insufficient gas supply at reasonable prices. However, a focus on increasing gas supply is not likely to improve market conditions for industrial users given the likely corresponding increase in gas costs as more marginal gas fields are developed. In IEEFA’s opinion, reducing household and industrial gas demand will be more effective in ensuring adequate gas supply for industries that are not yet able to use alternatives to fossil gas.

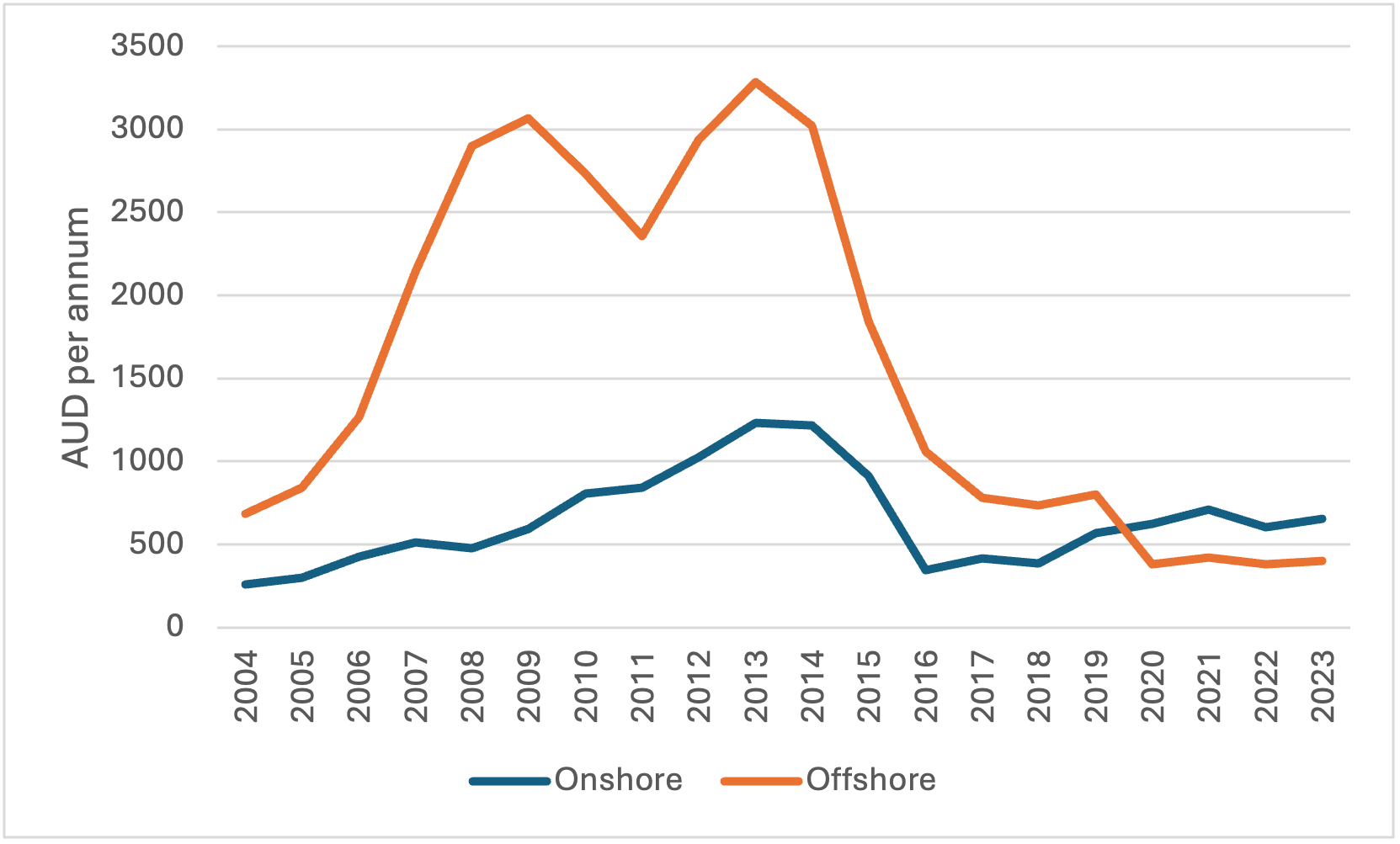

The supply outlook for gas is unlikely to materially change without significant investment in new exploration, a point acknowledged in the Future Gas Strategy. Oil and gas exploration expenditure in Australia, however, has fallen significantly over the past decade to levels not seen since the early 2000s (see Figure 1). Notably, aggregate investment has remained largely unchanged since 2017, when concerns about supply gaps prompted the Australian government to introduce the Australian Domestic Gas Security Mechanism.

Australian gas analyst Graeme Bethune has noted that: “Australian energy companies, like their global peers, are slashing their exploration budgets, sacking their explorers and shifting their investment to renewables or handing money back to the shareholders.” This raises questions about whether the Future Gas Strategy will actually drive any additional investment.

Figure 1: Australian oil and gas exploration expenditure

In contrast, LNG markets have seen an investment boom, which is driving an unprecedented wave of new, low-cost LNG supply. IEEFA estimates that global LNG liquefaction capacity will increase by 40% in the next five years, driven primarily by Qatar and the US, which both have lower LNG production costs than Australia.

This new supply will create a glut of LNG in the second half of this decade, with expectations of a “buyer’s market” already leading some LNG buyers to seek lower LNG contract prices or renegotiate existing contracts. As noted by S&P Global Commodity Insights: “The shifting market dynamics have put sellers in a quandary as they compete for a shrinking share of high-value customers like Japan and South Korea, and are pressured to agree to a range of contractual terms and conditions to appease LNG buyers.”

This new LNG supply is entering the market at a time when global gas demand is likely to peak. The International Energy Agency (IEA) has forecast that global gas demand is likely to peak by 2030 – even under its most conservative scenario. The IEA expects global gas demand will decline rapidly if countries implement climate pledges that they have already announced.

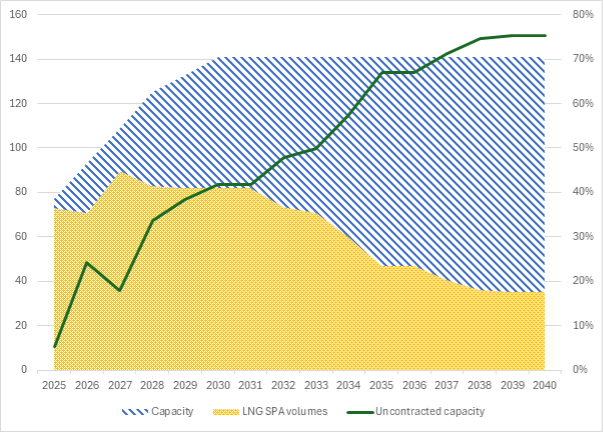

Much of this new LNG supply has not yet been sold to end users under LNG contracts, meaning LNG markets will soon be awash with available LNG. Qatar, the world’s lowest-cost supplier, will have increasingly large volumes of excess LNG from 2025 (see Figure 2).

Figure 2: Qatar will have large amounts of LNG to sell

Source: IEEFA estimates.

Portfolio traders, who have added significant LNG supply to their portfolios in recent years, have not been able to on sell this LNG. The IEA estimates that portfolio traders have contracted only nly slightly more than half of their LNG portfolios to end buyers.

LNG demand in Japan, Australia’s largest LNG buyer, has been falling since 2014, and will continue to fall as Japan continues to bring more nuclear power plants back online. Japan now has a surplus of LNG and is increasingly competing with Australia to supply LNG to emerging markets in Asia. From 2020-22, Japanese companies sold more LNG to third countries than it imported from Australia, underscoring the case that Japan does not actually need Australian LNG.

LNG demand is also falling in South Korea, a major destination for Australian LNG. China, which is anticipated to drive global LNG demand growth, is likely to have excess LNG supply in 2030.

The Future Gas Strategy also suggests that the future of Australia’s LNG sector will rely on CCUS to meet emissions reduction targets. IEEFA’s analysis, however, shows that CCUS is an expensive, unproven technology, with a history of failure and underperformance.

The Future Gas Strategy cites the Gorgon CCS project in Western Australia as “one of the most successful CCUS projects globally”. However, IEEFA notes that this project has massively underperformed, with carbon dioxide (CO2) injection rates less than half of its capture target, despite a hefty $3 billion in costs. Globally, CCUS captured about 0.1% of global energy-related CO2 emissions in 2022.

CCUS projects also face a range of risks, including carbon leakage and water contamination. Even in heavily regulated Norway, successful CCUS projects have seen unanticipated migration of CO2, indicating the ongoing risks.

However, Australia has limited protection against the failure of CCUS projects. If CCUS projects are to proceed in Australia, more stringent bonding requirements will be needed to cover the ongoing costs associated with monitoring CCUS sites.

Questions over the viability of CCUS, and over the need to increase supply and the long-term outlook for international gas markets, raise serious questions over the Future Gas Strategy, which the government ought to address.