Renewable energy sector in the Philippines is poised to grow faster as investor interest rises

The top players are attracting capital with innovative strategies and successful execution, gaining recognition by financial markets, and accelerating the transition to renewables

22 August (IEEFA Asia): The Philippines’ renewable energy sector has seen greater interest and notable growth as investors are willing to place a higher value on pure plays in renewables than on traditional utilities, a new report by the Institute for Energy Economics and Financial Analysis (IEEFA) says.

To grow faster and attract even more financiers, companies should focus further on renewables and execute their business plans, says the report, titled “Business Model Innovations Drive the Philippines' Energy Transition.”

A standout feature of the Philippines is the emergence of Philippine Stock Exchange-listed renewables developers and operators, including ACEN Corporation, Citicore Energy REIT Corp. (CREIT), and Solar Philippines. Many Southeast Asian nations lack such listed pure plays, says Ramnath N Iyer, report author and IEEFA’s Climate and Renewable Energy Finance Lead, Asia.

“In terms of how investors view asset values, pure play renewables companies command a valuation premium over utilities having lower levels of renewables in their mix,” Iyer says.

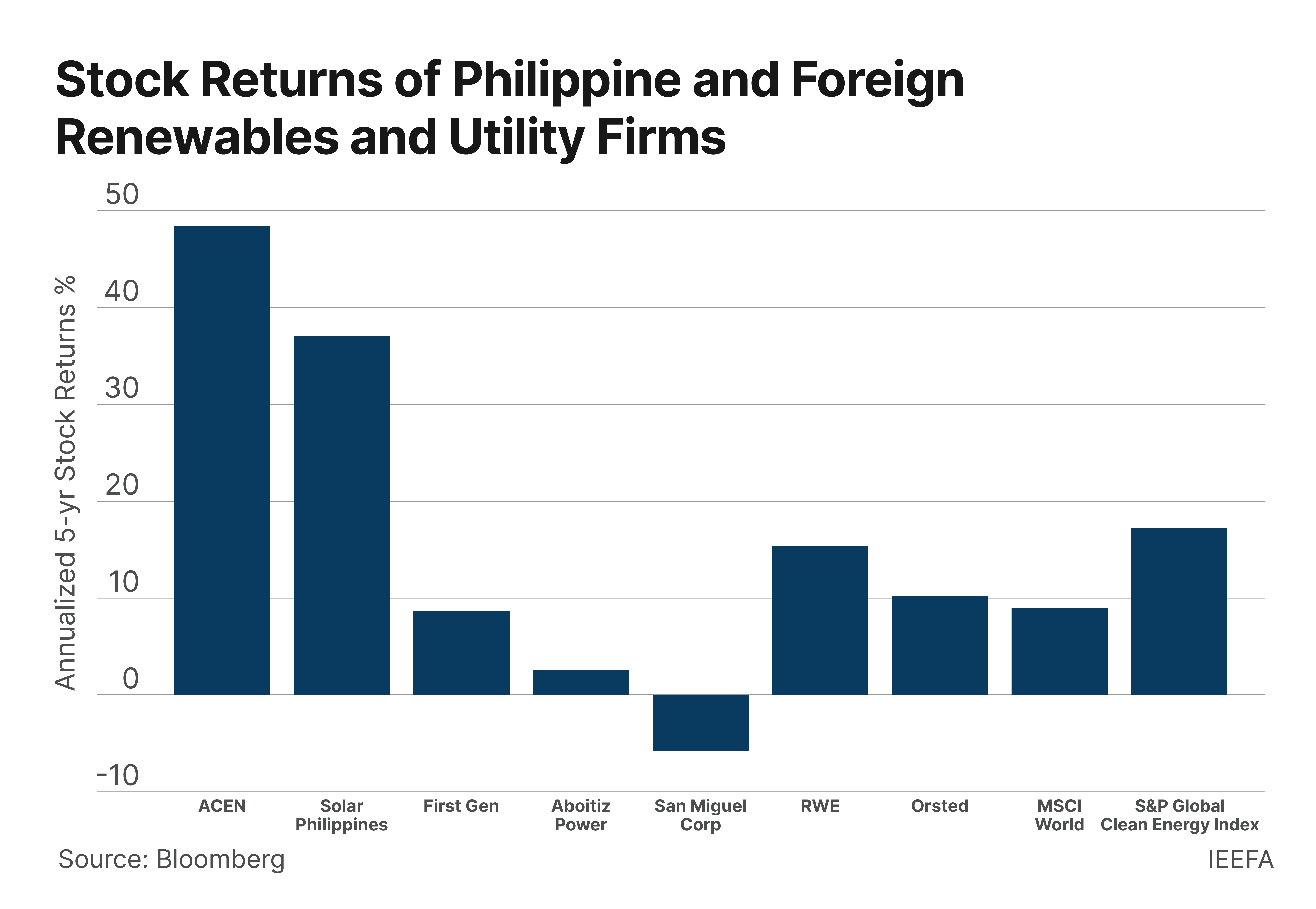

“Valuation premiums for pure play renewables companies – as seen in their higher price-to-book ratios, stronger market valuation of installed capacity, and stock performance over the past five years – suggest that this focus on renewables as a concentrated strategy has paid off.”

Investors are willing to reward firms which plan to grow in the field of renewables and are able to execute their plans, the report finds. For example, investors value each megawatt (MW) of installed capacity at ACEN at P137 million (US$2.46 million) based on the market capitalization and megawatts in operation as of August 4 this year, and CREIT at P102 million/MW (US$1.83 million). CREIT is owned by Citicore Renewable Energy Corporation (CREC). Non-pure plays First Gen Corporation and Aboitiz Power are valued at only P26.7 million/MW (US$479,000) and P73.7 million/MW (US$1.32 million) respectively.

The research also finds that both Solar Philippines and ACEN have received significantly higher investor support compared to First Gen and Aboitiz Power, which have underperformed even broader equity benchmarks.

Philippines’ top renewable energy firms and their business models

The report presents the Philippines as home to innovative models in the renewable energy space. It reviews the country’s renewable energy players – including ACEN, CREC, and Solar Philippines – in terms of capacity, plans, business model innovations, and how some have differentiated themselves from others in order to raise more capital and accelerate renewables growth.

Solar Philippines, operator of 183MW of solar generating capacity, has rapidly moved from being a start-up in renewables in 2013 to possibly joining a global conglomerate. Its listed entity, SP New Energy Corporation, raised more than US$425 million in the second quarter by selling a 43% stake to Metro Pacific Investments Corporation (MPIC), whose purchase appears to validate Solar Philippines’ focused growth strategy. MPIC is itself in a takeover bid by Japan’s Mitsui & Co.

Similarly, ACEN’s valuations are likely boosted by the fact that it has taken the most initiatives to focus on renewables and to grow in both size and geography in the renewable energy space, the report says. ACEN operates slightly more than 600MW of solar and wind power generation capacity in the Philippines. It also has an attributable operating portfolio of 1,087MW internationally, with a further 941MW and 1,700MW under construction domestically and abroad, respectively.

The company exited its largest coal-fired power plant last year through a privately financed energy transition mechanism. This move boosted its green credentials and put it even more firmly on the radar of financiers and investors who exclude coal assets from their investment ambit.

CREC is a leading solar player domestically, with an installed generating capacity of 163MW and more than 200MW of renewable energy projects in development. The firm built CREIT, the Philippines’ first renewable energy real estate investment trust (REIT), by spinning off one solar plant of 22MW and the land on which a set of its solar plants were located. The REIT is an innovative structure that frees up the balance sheet and raises funding while offering a differentiated avenue of investment for investors.

Listed firm First Gen, the Philippines’ third-largest independent power producer, owns the biggest renewables company, Energy Development Corporation. It owns and operates 30 power plants across the country with 2,721MW of attributable capacity. The report notes that First Gen’s purportedly clean energy portfolio is dominated by gas, which makes the firm an ongoing case study in the energy transition as it continues to hold on to fossil fuel assets.

First Gen has shown a willingness to explore innovative options. To raise capital for growth in renewables, it has a successful track record of partnering with international investors and infrastructure players.

Listed firm Aboitiz Power has the Philippines’ second-largest net attributable capacity of 3,495MW in coal, oil, geothermal and hydropower. While it has a long history of hydropower projects, its non-hydro renewables portfolio is primarily limited to geothermal power and a relatively small 59MW solar facility. It plans to add 1GW of renewables, primarily solar energy, by end-2026.

In the near term, though, the report says Aboitiz Power remains more heavily geared to coal, which makes up more than 60% of its mix, and also has a debt-to-equity ratio of 1.1 (net) and 1.5 (gross). Combined with its publicized investment plans, this may limit how much more it can grow.

“Examples of successful renewables investments and other innovative mechanisms, such as REITs and privately financed coal phaseouts and retirements, can guide regional fossil-dependent utilities to invest aggressively in renewables to stay relevant and capitalize on opportunities offered by the energy transition,” says Iyer.

“On the other hand, laggards, who stick with fossil fuel assets as their main line of business, will likely continue to see ebbing interest among investors and financial markets unless they can change and adopt some of the more successful strategies.”

On the part of the Philippine government, it runs a Green Energy Auction Program to generate maximum tariffs via competitive bidding. Two rounds of capacity build-out auctions have taken place so far.

Read the report: Business model innovations drive the Philippines' energy transition

Author contact: Ramnath Iyer ([email protected])

Media contact: Alex Yu ([email protected]) Ph: +852 9614 1051

About IEEFA:

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)