IEEFA: European-based regulatory model has global implications for complex plastics questions

In May 2018, the European Commission unveiled a process to establish a classification system of suitable economic activities to achieve low-carbon goals for the European Union. The “taxonomy,” as it is called, is designed to result in a framework for sustainable investment, a supportive disclosure protocol and a baseline for low-carbon initiatives. The regulations will create the rules of the road for the long-term economic transition in Europe and shape global discourse.

The regulatory process sends a signal to capital markets and petrochemical producers that the circular economy will be operationalized with supportive policy initiatives. The message is already having an impact. Major players on the petrochemical sector are designing new facilities that comply with the basic tenets.

The regulations will create the rules of the road for the long-term economic transition in Europe

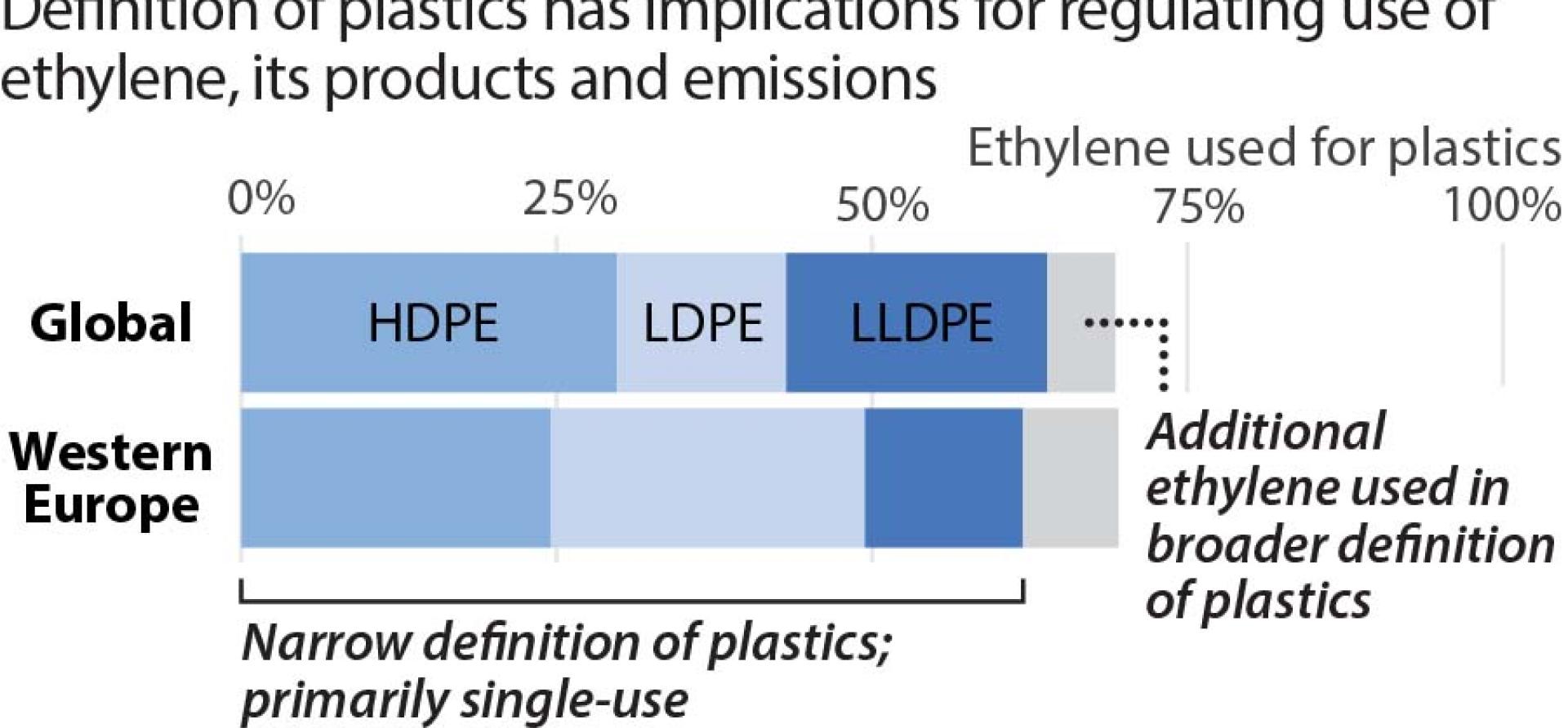

As the dialogue about plastics has expanded, the type and amounts of feedstocks have become a matter of great public concern. The major feedstock of plastic is ethylene. The question is, how much ethylene in the world is used to make plastics? Using a narrow definition of plastics that adheres very closely to the production of single-use plastics—polyethylene production—the answer is 63.4%.

Expanding the definition to include half of ethylbenzene because of its use in the production of styrene (packaging), and perhaps less than one-third of ethylene oxide because of its use in the production of polyethylene terephthalate (PET, used in beverage bottles), the number exceeds 70%.

Table I: Global Ethylene Demand 2020(Source: IHS Markit, Ethylene Supply and Demand, Fall and December 2021 |

||

| Volume (000 Metric Tons) | Percentage % | |

| Alpha olefins | 3,991 | 2.3 |

| Ethylbenzene | 8,872 | 5.2 |

| Ethylene dichloride (EDC) | 14379 | 8.5 |

| Ethylene oxide | 25,859 | 15.2 |

| High-density polyethylene (HDPE) | 50,272 | 29.6 |

| Low-density polyethylene (LDPE) | 22,610 | 13.3 |

| Low linear density polyethylene (LLDPE) | 34,904 | 20.5 |

| Vinyl acetate | 1,647 | 1.0 |

| Other | 7,477 | 4. |

| Total | 170,008 | 100.0 |

Globally, 63.4% of ethylene is used in the production of HDPE, LLDPE and LDPE. The ethylene derivatives are used principally in the production of plastics—largely single-use plastics—but also in harder, more durable plastic end products (IHS Markit, 2021 Annual Chemical Performance Review, or ACPR).

Another 2.3% of ethylene is used to produce alpha olefins (AO), a family of compounds that are largely used in the production of lubricants and detergents.

The production of ethylbenzene accounts for another 5.2% of global ethylene use. Half of this ethylene derivative is consumed in the production of styrene, according to the IHS Markit ACPR. Styrene is used largely for packaging and to produce acrylonitrile butadiene styrene resins (ABS), a rigid and durable commodity used in appliances, electronics and electrical equipment, transportation, and construction.

Ethyl oxide (EO) production accounts for another 15.2% of ethylene use. Ethyl oxide is used to produce ethylene glycol (in many forms) and a feedstock of PET. The use of EO for PET as feedstock places it in the plastics production chain.

The ACPR reports that the production of ethylene dichloride (EDC) consumes 8.5% of global ethylene. EDC is used in the production of polyvinyl chloride (PVC), manufactured for pipes, coatings and film.

Finally, 1% of global ethylene production is used to produce vinyl acetate monomer (VAM). VAM is used principally to make paints, adhesives and coatings, according to the ACPR.

Table II: West European Ethylene Demand 2020(Source: IHS Markit, Ethylene Supply and Demand, Fall and December 2021) |

||

| Volume (000 Metric Tons) | Percentage % | |

| Alpha olefins | 302 | 1.6 |

| Ethylbenzene | 1,227 | 6.5 |

| Ethylene dichloride (EDC) | 2,618 | 13.9 |

| Ethylene oxide | 1,766 | 9.3 |

| High-density polyethylene (HDPE) | 4,629 | 24.4 |

| Low-density polyethylene (LDPE) | 4,689 | 24.7 |

| Low linear density polyethylene (LLDPE) | 2,357 | 12.4 |

| Vinyl acetate | 129 | 0.7 |

| Other | 1,241 | 6.5 |

| Total | 18,958 | 100 |

Western Europe is considered the fourth-largest consumer of ethylene in the world. Applying the same method to the Western European ethylene demand data used for global data discussed above, the number using a narrow definition of plastics is 61.5%. If a more expansive definition is used, the percentage of ethylene used for plastics is below 70%.

For the EU to complete this definitional exercise, it will take more data sources, professional collaboration and greater dialogue from all stakeholders. For example, only a portion of all plastics is derived from ethylene. A common definition would greatly assist policymakers all over the world and assist the public’s understanding of issues related to plastic production and use.

This is just one small question that the taxonomy process should address. The overall effort is one worth watching, as it will be the basis not only for a common language but also for setting capital allocation, production standards and governmental subsidy decisions.

Tom Sanzillo ([email protected]) is IEEFA director of financial analysis.

Abhishek Sinha ([email protected]) is an IEEFA petrochemicals analyst.

Related items:

IEEFA Europe. INEOS Proposed Cracker Plant for Antwerp

IEEFA U.S.: Skyrocketing plastics prices a major concern for public health, economy

IEEFA. Why External Review of Price-Setting Mechanism for Plastic Resins Is Warranted