IEEFA Australia: The case for introducing a carbon tax

The Prime Minister’s “Australian way” policy means moving to zero emissions without reliance on carbon taxes. Taxpayers’ money will be used to pay carbon credits to companies that do good things, such as not cutting trees and capturing and burying carbon (all on a “cash now, outcomes later” basis). Electricity prices won’t be allowed to skyrocket. Coal mining jobs will be protected.

Politicians skirt around having a meaningful climate policy – while pretending otherwise to voters

It’s already working, apparently. The government claims we are 20% down in carbon dioxide emissions if you take 2005 as a base year, right after broadscale land clearing in Queensland was abolished by a state Labor government in 2004. That’s clever. A tree chopped down puts carbon dioxide into the atmosphere. Just stop it and emissions are reduced compared with the year before.

That’s not what you get if you focus on industry carbon – the fossil fuel you burn and put into the atmosphere. Carbon emissions were up 5% by 2019 compared with 2005 (and down by only 2.7% in 2020 if anyone wants to take credit for the impact of COVID-19).

Our politicians repeatedly put out misleading claims, and spread fears. The truth becomes blurred for the average citizen. That’s anomie.

Let’s try to straighten the record just a little. The carbon we burn in producing our domestic GDP is about 400 million tonnes, about 1.1% of global emissions. But we consume far less than we produce, and the large excess (nearly four times what we consume) is sold abroad, where it is burned.

The combined amount of carbon released domestically and abroad from the burning of our fossil fuels is approximately 1.1 billion tonnes a year, roughly 4.3% of global emissions.

That’s enormous for a country that represents just over 1% of global GDP. The combined emissions are up 60% since 2005.

The country’s combined emissions are up 60% since 2005

Here is a simple truth. It doesn’t matter where the fossil fuel is burned. The carbon dioxide pumped into the atmosphere has exactly the same effect on climate change, regardless of whether it’s burned here or abroad. That’s what matters for our grandchildren.

Canada, another resource-rich country, is larger than Australia and might be expected to produce more carbon from its fossil fuels. Canada contributes about 3.1% globally. Now that’s nothing to be proud of – it exports a lot of oil to the U.S. – but for a resource-rich country it is doing better than us.

No meaningful climate policy

Australia is worse than Canada for two main reasons. First, we sell more of the really nasty stuff: coal. Second, we rank 60th out of 61 countries in the world on climate policy. The U.S., at 61st, is stone last.

We have nothing like a meaningful climate policy.

Canada, ranking 29th on policy, sets a minimum carbon tax, currently at $US32 per tonne and set to rise to $US170 by 2030. The regressivity of the carbon tax is addressed by tax rebates and revenue redistributions.

Australia’s Coalition government abolished the carbon pricing scheme of the Gillard government in 2014. Since then, it has repeated the mantra that putting a meaningful tax on carbon – notwithstanding that many countries have one – will destroy our Aussie way of life.

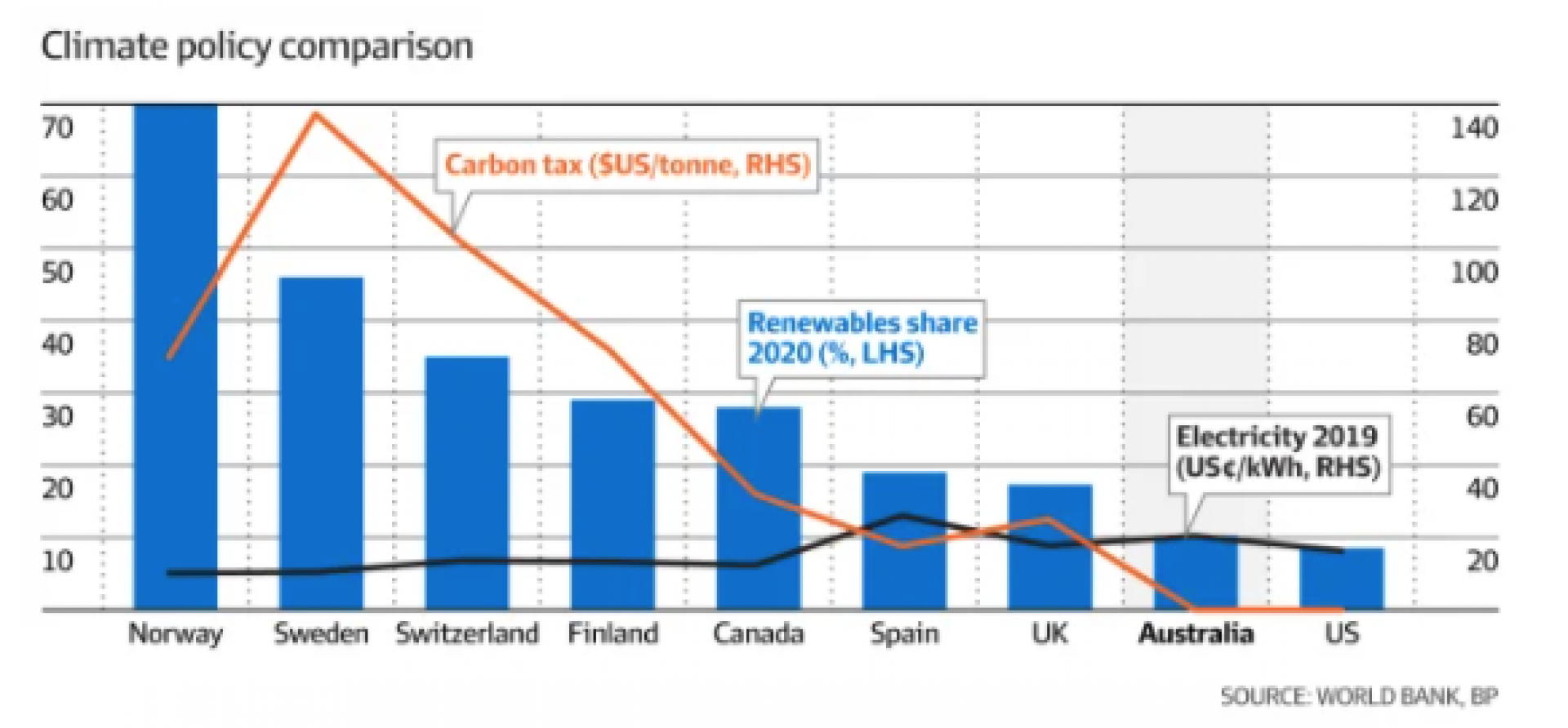

The progress Australia has made on renewable energy reflects where it sits on the climate policy ranking scale. The chart shows a selection of OECD economies that consume a significant quantity of energy (more than 1 billion gigajoules), with carbon taxation, renewable energy, and power prices compared.

No-tax Australia and no-tax U.S. sit at the bottom. The Scandinavian countries and Switzerland, facing very high carbon taxes (especially Sweden), sit at the top on green energy. These countries (and Canada) have very high living standards despite taxing carbon.

We take pride in exporting coal

In addition to refusing to tax carbon, the Federal government subsidises fossil fuels through tax breaks and grants. State governments also provide support for fossil-fuel power stations and port infrastructure to better supply coal and gas to the rest of the world.

Our current governments are actually proud of exporting coal: “Australia will keep selling coal for as long as the world keeps buying it” (Keith Pitt). It’s about digging out our huge reserves of coal (and gas) and selling it abroad before the world stops us from doing so.

With a carbon tax, other countries would buy less of our coal. That’s the whole point.

Phasing out coal and reducing subsidies should be central to our policy approach

Phasing out coal and pushing a national plan that accelerates our path towards renewable energy via taxes and reducing subsidies should be central to our policy approach. Help for coal mining families to transition to other sectors that have a future would be a counterpart to this approach.

It speaks volumes that entrepreneurs such as Twiggy Forrest have stepped in, or Mike Cannon-Brookes before withdrawing his AGL bid this week. They aren’t doing it because of moral values. It’s because it makes economic sense. They are not constrained by trying to hold on to power in marginal seats while holding together fragile political alliances.

A sound climate policy would broaden and accelerate these sorts of investments and act to reduce electricity prices (not increase them) because renewables are much cheaper.

The blue line on the chart shows that higher carbon tax and renewables are associated with lower electricity prices.

Meaningful climate policy won’t be part of the coming election

Both parties have projects such as public money for electric cars, solar power and batteries. Nothing wrong with that. But the policies are not in place to catch up with what some other important OECD countries have already achieved. Anomie reigns.

The blurring of basic truths on both sides of politics means, sadly, that meaningful climate policy won’t be part of the coming election. Cannon-Brookes and others have attempted to do things that make sense, but without policy leadership it won’t improve the climate outlook for our grandchildren quickly enough.

An Australian carbon tax and global co-operation on border taxes are essential for achieving that goal.

By IEEFA guest contributor Adrian Blundell-Wignall

This excerpt is from a commentary that first appeared in the AFR.

Related articles:

IEEFA: Postcard from 2030. Energy is clean, finance is moral, wish you were here

IEEFA Australia: How fossil fuel subsidies are thwarting Queensland’s renewable energy ambitions