Five Years On, Millions in Costs From AMP’s Cancelled Coal Plant Still Hang Over Towns and Cities

By Sandy Buchanan

Five years ago this Thanksgiving, newspaper headlines across Ohio announced the cancellation of a coal-fired power plant that American Municipal Power (AMP) had planned to build along the Ohio River. AMP and 81 of its member communities in Ohio, Virginia, West Virginia, and Michigan was scrapping plans to build the 1000-megawatt coal plant in Meigs County because the construction tab had become too high.

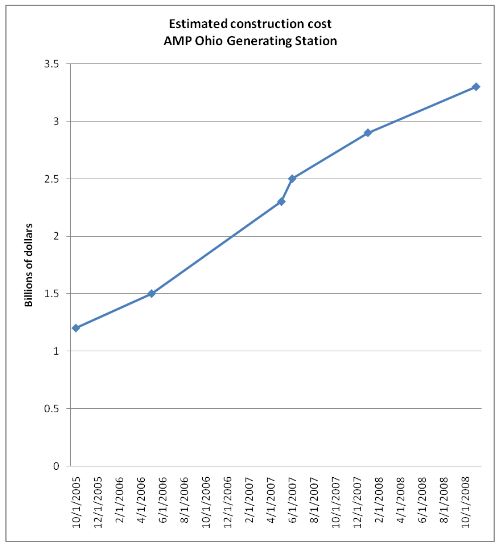

These weren’t minuscule cost overruns.

Original estimates put construction expenses at $1.5 billion, but that price had more than doubled by the fall of 2009, to almost $3.5 billion. The member communities that had agreed to take part in the deal, much to their detriment, had signed 50-year take-or-pay contracts in 2007 and early 2008 to build the facility, just as many of them had done at about the same time on the Prairie State coal-fired power plant in Southern Illinois.

A few communities in Ohio did have the good sense to take a pass. In Westerville, Ohio, for example, the City Council declined to make significant commitments in either the Meigs County plant, the Prairie State plant, or AMP’s proposed hydropower facilities on the grounds that all of the contracts were too expensive and too long term.

“The only thing I’m committed to for fifty years is my marriage,” one wise Westerville councilwoman remarked.

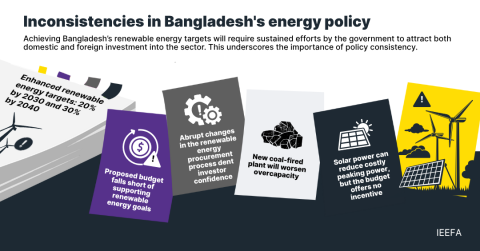

Other towns took the deal over the advice of observers that included the Institute for Energy Economics and Financial Analysis, which had warned against signing either the Meigs County or Prairie State contracts because they left participants so vulnerable to the likelihood of soaring costs. (Soaring construction costs and environmental risks ultimately led to the cancellation of 183 proposed new U.S. coal plants have been cancelled since the early 2000’s.)

The 81 municipalities that took the Meigs County deal are saddled today with what are known as “stranded costs” — those incurred when a project was abandoned.

Construction began in November 2009 with Bechtel Corp. as the lead contractor. The relationship had soured by 2011, when AMP sued Bechtel for $97 million, claiming that Bechtel had not properly warned AMP of soaring costs. Bechtel, perhaps not so coincidentally, was also the main contractor on the Prairie State plant, where AMP is the lead participant, and where costs overruns exceeded $1 billion after contracts were signed in 2007.

AMP lost a major ruling in the Meigs County case in April of this year, when a federal court ruled that Bechtel could be held liable for only $500,000 in cost overruns because of a damage-cap provision in the contract. AMP has now sued in case before the Ohio Supreme Court to get the federal ruling overturned.

Much is at stake here because AMP insists that its member communities pay for the costs of the Meigs County debacle. Here’s a breakdown of the bill:

- Stranded costs: AMP has given the communities various options on how and when to pay the stranded costs, which it says total $113 million. Some cities have simply written checks to AMP. Painesville, Ohio, for one, has sent AMP $2.1 million and Front Royal, Va., has paid $500,000. Some municipalities, like Cleveland, is letting AMP add a surcharge to other bills to cover a portion of the Meigs County overruns. (Cleveland has also said it will delay full payment until litigation is settled). Martinsville, Va., agreed to a “stabilization plan” in 2012 in which AMP was supposed to collect for the Meigs County stranded costs by charging the city extra for its electricity. That plan backfired, however, because Prairie State plant were so high that all of Martinsville’s reserve funds were eaten up by that, and Martinsville canceled the stabilization plan in April of this year. No one knows how much member cities will owe when all is said and done, especially if Bechtel wins in court. But the numbers are big, especially for towns that are already struggling to pay for electricity. The two largest participants in the plan were Danville, Va., which was in for 100 megawatts, and Cleveland,which had subscribed for 80 megawatts. In October 2012, AMP put Cleveland’s Meigs County damages at $7 million, and in 2013, AMP’s fiscal officer told officials in Galion, Ohio, that their town was on the hook for as much as $1.1 million.

- Costs of “replacement power.” In 2013 and 2014, many communities who were party to the Meigs County deal have had an item called “AMPGS Replacement Power” turn up on their bills from AMP. American Municipal Power says those charges have been added to pay for power contracts it made in the event that the Meigs County plant failed to go on line. The charges for this “replacement power” vary from town to town, but for the most part are at least 50 percent higher than electricity would cost on the open market.

- AMP communities are contractually bound to cover legal fees associated with the Meigs County case. Because it is a lengthy and complicated case, those fees will most likely run into the hundreds of thousands of dollars as AMP has retained a well-connected Washington firm to represent it.

All of these costs only add insult to injury for towns and cities across the Ohio River Valley, especially for AMP member communities already struggling to pay the high costs of electricity from its Prairie State Energy Company, which is another story in itself.

That councilwoman from Westerville is no doubt grateful this Thanksgiving that the City Council chose not to take part in AMP’s doomed offer. Municipal officials in those communities that did bite are surely wishing they had not.

Sandy Buchanan is the executive director of IEEFA.