The Truth About Prairie State Energy Campus (Part 1): Failing, Year by Year

The Plant Doesn’t Run Like Its Creators said it Would, and Its Electricity Is Overpriced

Prairie State Energy Campus failed in 2014 — as it failed in 2012 and 2013 — to provide the reliable, low-cost electricity that Peabody Energy, American Municipal Power, and its other promoters promised when they persuaded more than 200 communities around the Midwest to sign long-term contracts to buy power from the plant (we’ve documented these failures in detail in a recent research memo posted here).

Prairie State Energy Campus failed in 2014 — as it failed in 2012 and 2013 — to provide the reliable, low-cost electricity that Peabody Energy, American Municipal Power, and its other promoters promised when they persuaded more than 200 communities around the Midwest to sign long-term contracts to buy power from the plant (we’ve documented these failures in detail in a recent research memo posted here).

The Prairie State promise went like this: the plant would operate at 85 percent capacity, providing a reliable source of electricity to its many member towns and cities, and it would provide electricity at competitive prices.

The ugly and undeniable truth that has emerged over time, however, is that Prairie State Energy Campus has done neither. Its failure can be documented year by year in two ways: by its capacity-factor performance and by its disastrous record in living up to its promise of providing low-cost electricity.

Because the cost of Prairie State electricity is so high, many of the municipal power agencies that issued the $5 billion in bonds for the plant have been under pressure from the communities to make the price more palatable. One way to do this is by refinancing the debt and pushing the payment of the principal into the future, and some of the major municipal power agencies involved did so in late 2014 and early 2015.

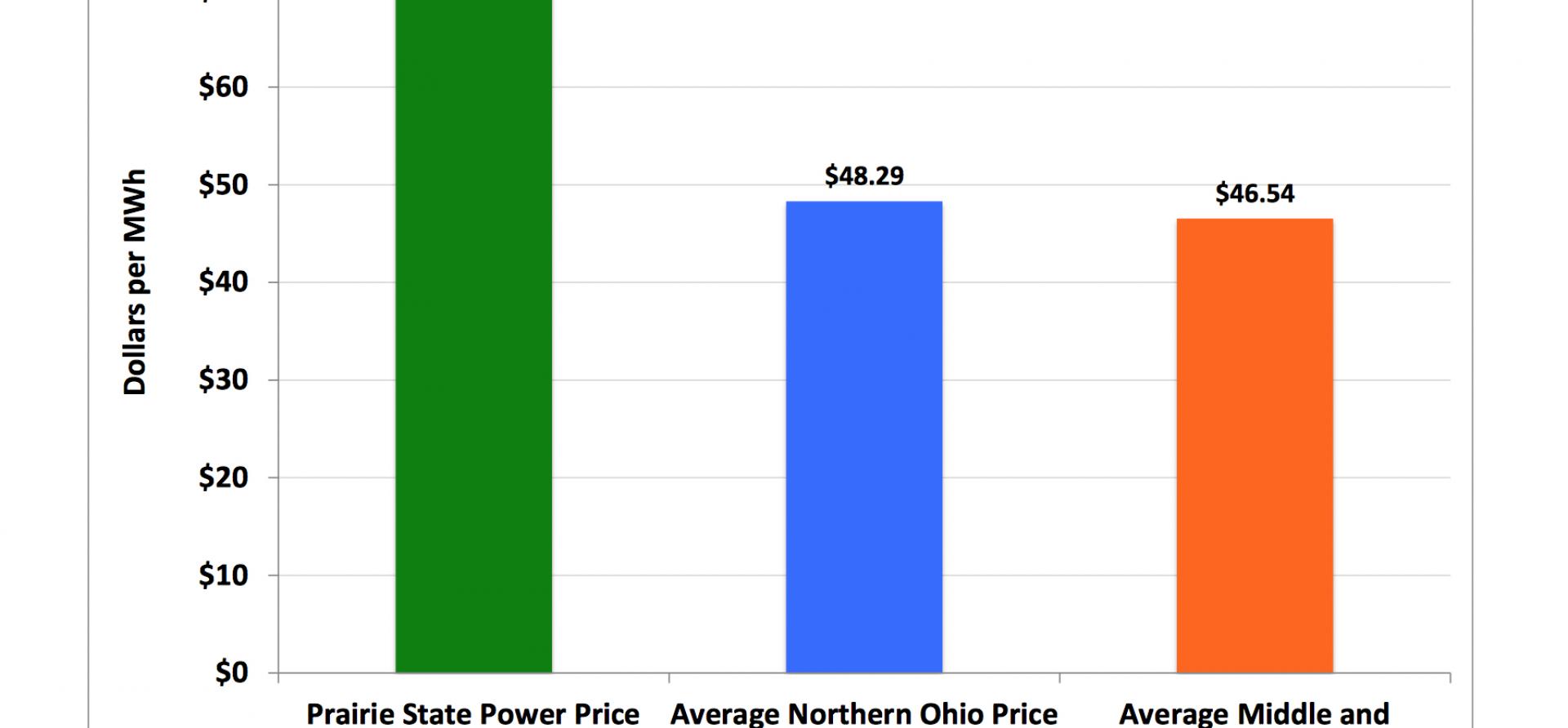

These refinancings, combined with better plant operating performance in early 2015, pushed the price of Prairie State electricity down some in January and February—by about 15 percent across American Municipal Power communities, for instance, from the same time period in 2014. However, the market price of power has gone down too, which means Prairie State power is still relatively expensive.

Prairie State Energy Campus has nine owners that sell its electricity to member communities: American Municipal Power (23.26 percent), Illinois Municipal Electric Agency (15.17 percent), Indiana Municipal Power Agency (12.64), Missouri Joint Municipal Electric Utility Commission (12.33 percent), Prairie Power Inc. (8.22 percent), Southern Illinois Power Cooperative (7.9 percent), Kentucky Muni Power Agency (7.82 percent), Northern Illinois Municipal Power Agency (7.6 percent), Peabody Energy subsidiary Lively Grove Energy (5.06 percent).

POOR PERFORMANCE AND HIGH PRICES

Here’s the main two-part breakdown of the plant’s performance from mid-2012, when it opened, through 2014:

- Failure to operate at promised capacity factor. When it was promoting Prairie State to communities in 2007, AMP cited a study by R.W. Beck, its consultant, to assert that Prairie State would immediately operate at a sustained average 85 percent annual capacity factor. Capacity factor compares how much power a plant actually produces with how much it would have produced if it had run full time at full power over a particular period of time. The higher the capacity factor, the better the plant is operating and the more power it is producing. (The plant’s owners made the same 85 percent claim in the documents used to sell bonds to investors.) The plant’s actual performance in 2012, 2013 and 2014 has fallen far short of the owners’ promises. Prairie State has operated at less than 64 percent capacity since it opened in June 2012, and in 2014 it operated at less than the 78 percent capacity than the owners forecast.

- Failure to provide either low-cost power or transparency into true costs. In 2014, Prairie State’s operating costs were more than $13 million higher than its owners forecast. The bad-for-ratepayer combination implied here and above—higher costs and lower-than-budgeted generation—means the plant’s actual operating costs in 2014 were 18 percent higher than forecast. AMP has shrouded this fact from customers by relying on accounting practices it calls “rate stabilization and levelization” that defer some of the current true cost of the power from Prairie State. AMP also hides the true cost of Prairie State power in another way: by blending the high cost of Prairie State power with the cost of less expensive “replacement power,” which it buys on the open market when the plant is not operating as well as it was supposed to.

TOWNS AND CITIES WILL NEVER RECOVER MILLIONS IN ALREADY LOST COSTS

Even if Prairie State were to begin to operate finally as well as its owners have been promising since at least 2007, it will remain a lingering albatross around the necks of participating communities.

Towns and cities ensnared by the project will never get back the tens of millions of dollars they have paid since 2012 for the high cost of Prairie State electricity. And for decades to come, should they choose to continue their current relationship with Prairie State Energy Campus, they will continue to pay higher prices than necessary. This would mean increasingly uncompetitive electricity rates; deferred investment in maintenance and new projects; layoffs; and pressure to use other taxpayer resources to finance this mistake.

Over the rest of this week, we’ll be posting further commentaries and research that explore some of the rock-bottom problems with the plant and that detail how the municipal economic damage has reaches far and wide. We’ll note also that any impetus for finding the light at the end of this tunnel will most likely come from someplace other than Prairie State Energy Campus itself.

David Schlissel is IEEFA’s director of resource planning analysis.

Tomorrow: The Truth About the Coal Burned by Prairie State Energy Campus

Related posts:

(Part 2): Its Coal Isn’t Cheap

(Part 3): A Crippling Burden to Its Many Towns and Cities

(Part 4): There Are Ways Out of This Bad Deal