What’s really driving high power bills (hint, it’s not renewables) and how can we reduce them?

Key Findings

Recent regulator forecasts of rising energy bills have raised concerns amid Australia's cost-of-living crisis, but there are ways for governments, households and businesses to prevent or reduce the increase in their bills.

The continued dependence on coal and gas have been a key driver of wholesale electricity prices rises, while introducing more renewables into the mix could put downward pressure on prices.

Network costs could be reduced by addressing electricity network supernormal profits and reducing peak demand.

Households and businesses can also reduce their bills by upgrading old, inefficient electric appliances, improving the insulation of buildings, and installing rooftop solar and storage.

With the cost of living at front of mind for most Australians, it’s no surprise that the recent announcement of likely energy bill increases raised concerns. To avoid rising bills, we must understand what is driving up the cost of electricity over the longer term, and the ways government, as well as households and businesses, can prevent or reduce increases in key cost buckets.

In its draft Default Market Offer (DMO), the Australian Energy Regulator (AER) laid out benchmark household power bill rises of between 5% and 8% for the 2025-26 financial year, and the Essential Services Commission released the Victorian Default Offer (VDO), which saw draft benchmark household bill rises of less than 1%.

The increases in the DMO regions were largely driven by rises in the two largest components of an electricity bill: the wholesale costs, which are the costs of generating electricity; and the network costs, which are the costs of transporting electricity through the poles and wires.

At the Institute of Energy and Economic Financial Analysis (IEEFA) we examined the longer-term trends in wholesale and network costs components, to understand key drivers behind power bills and opportunities to reduce bills in a recent briefing note.

Research has shown that gas prices have historically been a key driver in wholesale electricity prices rises. According to Griffith University, the historical correlation between gas prices and electricity prices was 0.9 over 2012-2021 and gas prices influenced 50%-90% of pricing intervals in the NEM. More recent analysis by CEIG also highlighted the correlation between gas prices and electricity prices.

Recent outages at coal-fired power stations have also been driving up wholesale prices, as highlighted by AEMO in Q4 2024 and Baringa. When these power stations have outages – which occur more frequently as they age – more expensive gas-powered generation will often be used to fill the gap.

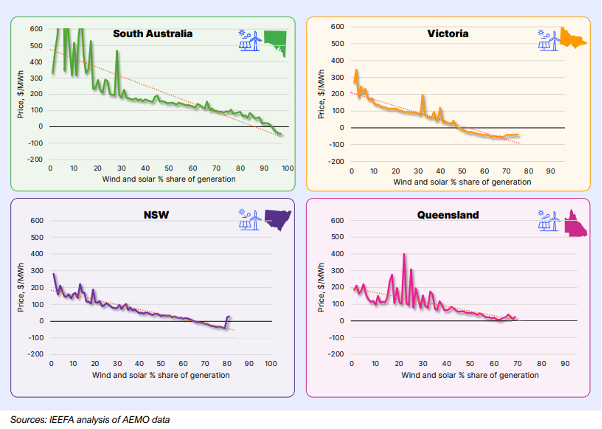

Meanwhile, IEEFA analysis of prices over the years 2014-2024 has found that higher penetrations of renewable energy in the grid have historically been correlated with lower wholesale prices. Renewable generators usually bid into the market at low prices due to their zero fuel cost and competitive strategy. If this pattern continues, introducing more wind and solar energy into the grid could put further downward pressure on wholesale spot prices.

Figure: Renewables share of power generation across NEM states (2014-2024)

Our research also identified opportunities to put downward pressure on network costs by addressing electricity network supernormal profits and undertaking measures to reduce peak demand, or limit peak demand growth in the network.

IEEFA’s research found that there is $15 billion of supernormal electricity network profits on top of $17.6 billion of normal, expected profit. Tightening the regulation of network businesses, to bring supernormal profits to reasonable levels could reduce the network component of customer bills.

Moreover, it is important to consider how to drive efficiency in the distribution network, which makes up about 80% of network revenues each year. Consumer-owned energy technologies that can reduce the maximum power demand in the network, like batteries, flexible hot water heating and smart air conditioners, could reduce network upgrade requirements to put downward pressure on network costs.

Households and businesses can also reduce their consumption from the grid to reduce their bills. Simple upgrades such as replacing old, inefficient electric appliances with efficient ones, which can use a third of the power, would be a great start – along with better insulation and installing rooftop solar and storage.

Together these measures could put downward pressure on power bills and provide much sought-after cost-of-living relief.

This article was first published in RenewEconomy.