South Korea’s East Sea gas development will not strengthen the country’s energy security

Key Findings

The demand for natural gas in South Korea is expected to fall significantly by the time the East Sea gas field could become operational, due to accelerated decarbonization efforts.

Investing heavily in the exploration and development of the East Sea gas field carries a high risk of stranded assets.

The recent price volatility of liquefied natural gas (LNG) due to geopolitical tensions casts doubt on LNG’s reliability and affordability as an energy source.

South Korea’s transition to clean energy will better support its national energy security and sustainability rather than an overreliance on fossil fuels.

South Korea’s Yoon Suk-yeol administration recently announced the exploratory drilling of potentially massive oil and gas reserves in the East Sea, estimated to hold up to 14 billion barrels of oil and gas. This project aims to address the country’s natural gas demand for 29 years and oil demand for four years.

The government will launch the project, which costs around ₩100 billion (US$73 million), by the end of the year, with initial results expected in the first half of 2025. However, as South Korea’s natural gas demand declines, large oil and gas developments in the East Sea could become stranded assets due to the country’s accelerating decarbonization efforts.

In the long term, the transition to clean energy will better support national energy security and sustainability rather than an overreliance on fossil fuels.

Declining natural gas demand amid energy transition

By the time the East Sea gas field becomes commercially operational around 2035, South Korea’s natural gas demand will have significantly decreased due to the energy transition. The country’s natural gas demand is already declining, falling 4.9% in 2023 due to higher nuclear and renewable power generation and reduced city gas demand, impacted by high import costs.

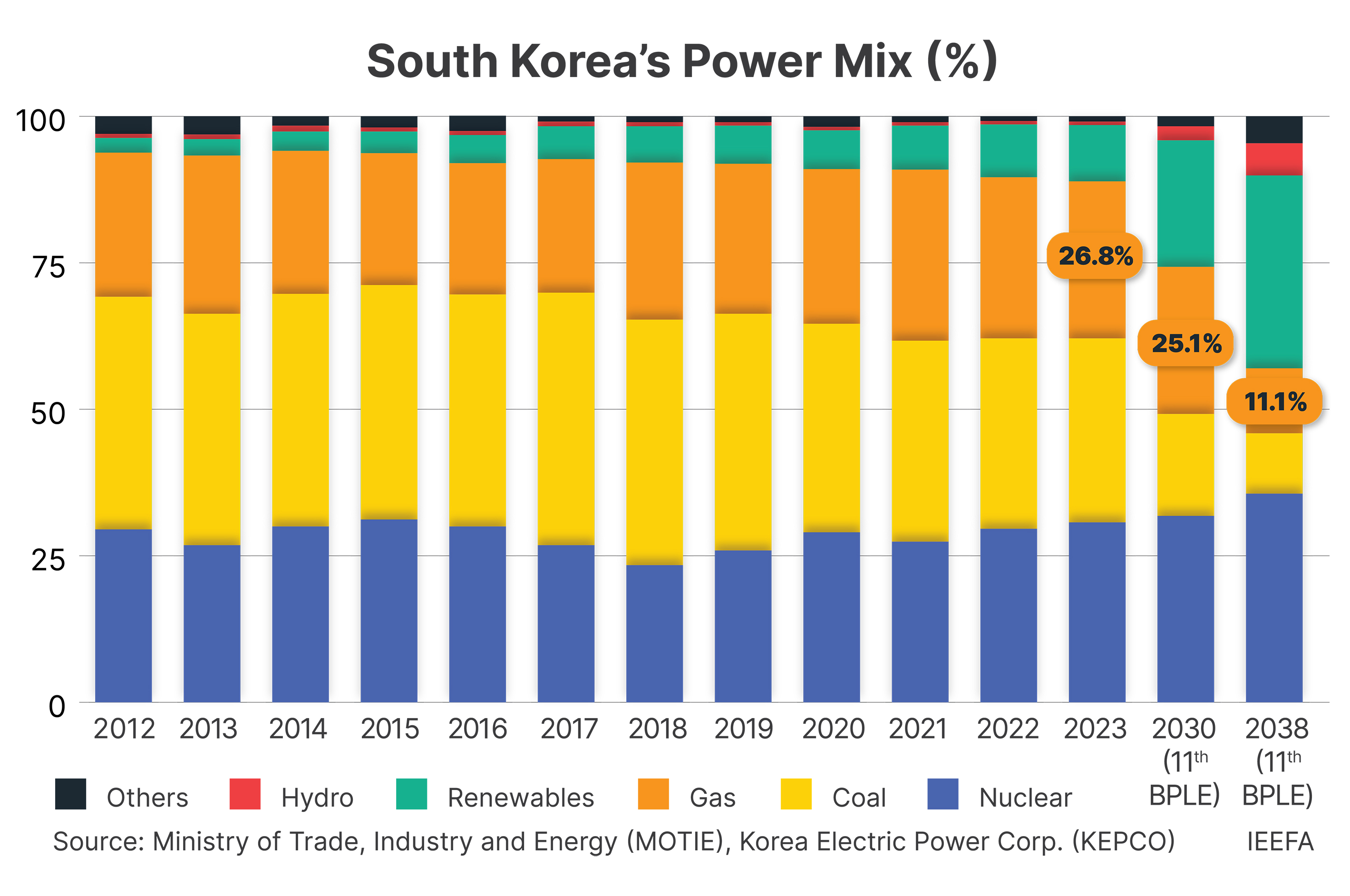

Given South Korea’s strengthened decarbonization targets, this trend will persist in the coming years. The recent 11th Basic Plan for Long-Term Electricity Supply and Demand (BPLE) implementation guideline indicated that the share of liquefied natural gas (LNG) in the power mix will decline to 11.1% by 2038, a substantial drop from 26.8% in 2023.

South Korea’s Ministry of Trade, Industry and Energy also estimates that natural gas demand will decline to 37.66 million metric tons per annum (MTPA) by 2036, with an average annual decline of 1.38%, due to a shrinking population and slowing economic growth rates.

In addition, the global natural gas market is expected to face an oversupply from 2026 onwards, driven by massive expansions from the United States and Qatar. The Institute for Energy Economics and Financial Analysis (IEEFA) estimates that the world’s total nameplate liquefaction capacity could reach 666.5 MTPA by 2028. This suggests that a cheap natural gas supply will be available in the market, with existing contracts and purchases from the glutted spot market able to cover future gas needs.

Growing stranded asset risks

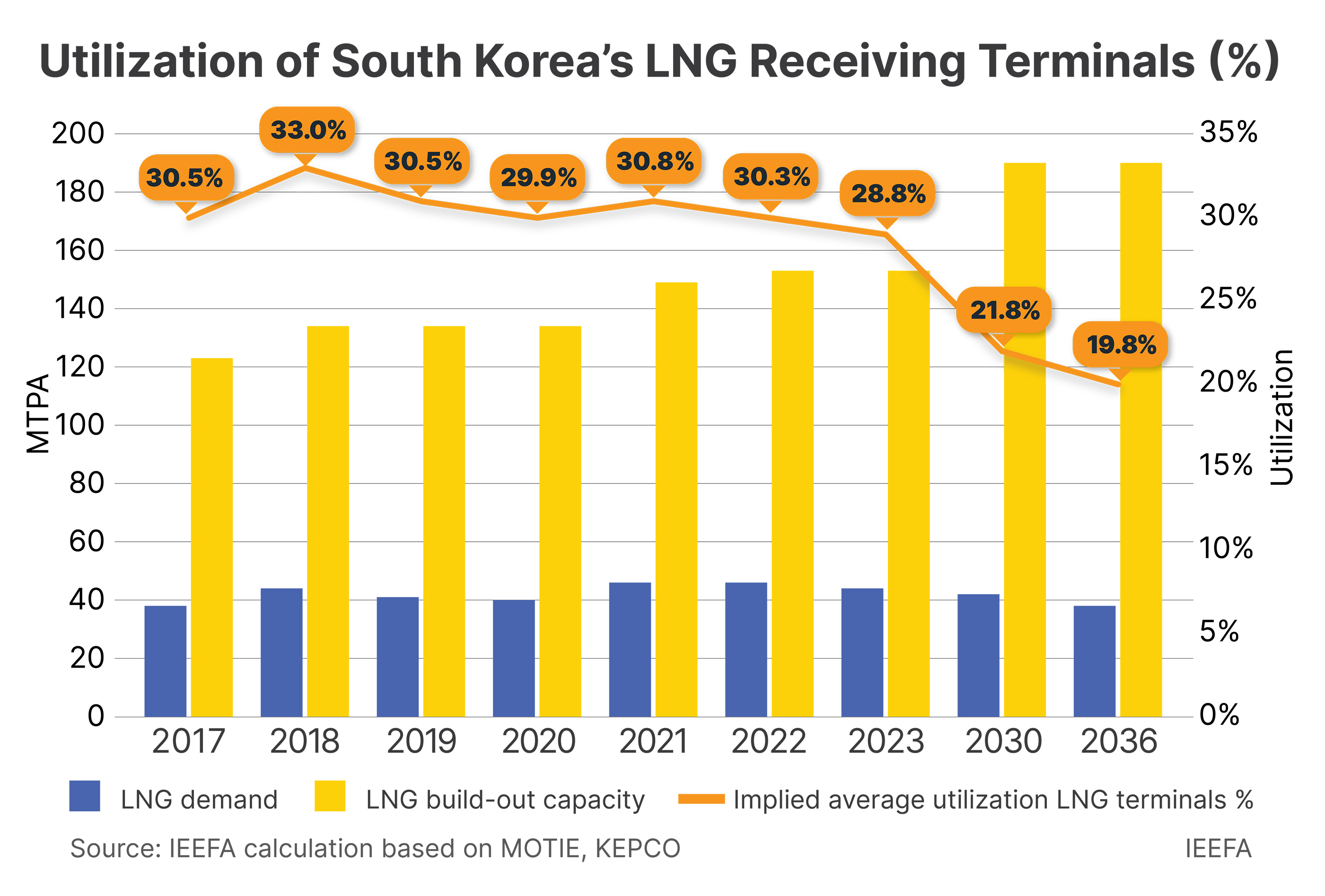

Investing taxpayers’ money in unproven, high-risk gas-fired exploration with low success rates poses significant stranded asset risks. LNG-receiving terminals and LNG-fired power plants in South Korea are already experiencing lower utilization rates amid weakening demand.

South Korea’s incumbent and new LNG market participants aim to complete 11 LNG terminal projects by 2031. These terminals account for roughly 37 MTPA of regasification capacity, which, if built, would increase national capacity to 190 MTPA, up from 153 MTPA currently. This would lower the utilization rates substantially. IEEFA estimates that South Korea’s new LNG receiving terminals could cost around ₩11.3 trillion (US$8.7 billion).

South Korea’s decarbonization target, which includes lowering LNG in the power mix, will likely reduce the operation rates of LNG-fired power plants to 10-20% by 2036, down from 41.7% in 2023.

Given the country’s net-zero target by 2050, the newly developed natural gas from the East Sea could be used for only 10-15 years, raising a high risk of stranded assets for the gas field. The infrastructure built for natural gas use might become underutilized or obsolete as demand continues to shrink.

Diminishing role of LNG in energy security and sustainability

Given the increasingly prominent role of renewables and the declining role of natural gas, developing clean resources — rather than costly oil and gas reserves — would most benefit South Korea’s long-term energy future.

The role of natural gas in South Korea’s energy security and sustainability has come under scrutiny, particularly after the surge in LNG prices following Russia’s invasion of Ukraine in early 2022. LNG markets have experienced extreme volatility amid geopolitical uncertainties, undermining the fuel’s affordability and reliability. In 2022, South Korea was burdened with US$17 billion in additional costs for LNG-fired power generation due to utilities’ overreliance on fossil fuels.

Despite emitting less carbon dioxide (CO2) than other fossil fuels, natural gas is controversial for greenhouse gas reduction due to its high methane emissions. Methane has a more significant warming effect than CO2 over a relatively short time frame.

Securing fossil fuels, including natural gas, does not equate to energy security. True energy security and sustainability for South Korea involve reducing heavy reliance on fossil fuels and rapidly shifting to domestically produced renewable energy, as the country promised to triple its renewable capacity by 2030 at the recent COP28.