A Shrinking Industry in Dire Straits

Weaker then ever, the U.S. coal industry is in dire need of cash but in no position to attract much.

Weaker then ever, the U.S. coal industry is in dire need of cash but in no position to attract much.

A spike in coal prices would help, because such spikes generate cash, and spikes do happen, as when demand soars and supplies drop.

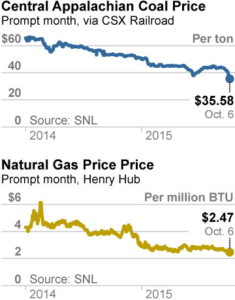

The odds of coal-price spikes are diminishing, however, as time goes by and as energy markets shift. The price of natural gas, for instance, continues to fall and today is approaching historic lows. Analysts see it as a long-term trend, which is bad news for the coal industry because natural gas competes so directly with coal.

The rise of renewables, too, is hurting coal, as solar becomes cheaper and as more wind-generated and solar-generated electricity comes on line.

The dearth of the kind of “cash bumps” that coal companies can get from price spikes means a dearth in the kind of revenue necessary for debt retirement and investment. It’s a harsh and unforgiving circle. No price spike, no cash bump, no debt retirement, no money for expansion investment.

THE COAL INDUSTRY’S TROUBLES, SO MANIFEST AND ACROSS THE BOARD, CAN BE SEEN company by company in an assortment of events, trends and data points:

- Foresight Energy’s stock is at less than $7 a share after the company priced it at $20 a share in its initial public offering last year.

- Murray Energy, which has laid off thousands of workers over the past year, has seen its bonds drop 47 percent in value, and Moody’s Investors Services

in its September downgrade of the company cited “reflects recent deterioration in seaborne and domestic coal prices, which we expect to persist.” - Armstrong Energy this past summer abruptly dropped its plans for an IPO.

- By far the two biggest coal producers in the U.S.—Arch Coal and Peabody Energy—have recently announced reverse stock splits just so they can stay listed on the New York Stock Exchange.

Meantime, fundamental questions about core problems facing U.S. coal producers only grow more complicated and tangled. What of the industry’s vast environmental liabilities and how will these companies make good on their cleanup commitments? How will it manage an expanding array of litigation and public-policy fights? Where will it find the resources to battle divestment campaigns and SEC inquiries?

Above all, perhaps, how will it make good on its obligations to the communities across the country that have supported the industry for so long in blood, sweat and tears?

It’s a pivotal energy-transition time for the country, the most pressing question perhaps is will it be chaotic or orderly?

Tom Sanzillo is IEEFA’s director of finance.