Shale producers find they have little wiggle room in 2022

Download Full Report

Key Findings

High oil and natural gas prices are not translating into increased production due to investor pressure to maintain capital discipline.

As oil prices climb higher, publicly-traded oil and gas producers are proving reluctant to increase drilling and output.

This trend shows that the top issue for oil and gas operators in the U.S. is not increasing production but rather paying down debt and rewarding shareholders.

Executive Summary

Publicly traded oil and gas producers are not responding to higher oil and natural gas prices as they once did. Despite high prices, oil and gas executives are now reluctant to ramp up drilling and rapidly increase output. As a result, U.S. producers are unlikely to take effective action to ameliorate the current undersupplied global crude and natural gas markets because of investor pressure.

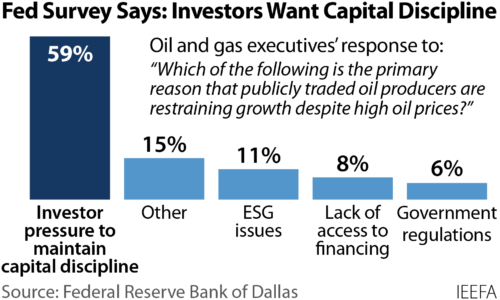

The recently published Federal Reserve Bank of Dallas Energy Survey reveals the primary motivation behind the restraint: fear of upsetting investors (see Figure 1). Almost 60 percent of the executives surveyed cited investor pressure to maintain capital discipline as the chief reason the industry is keeping output growth in check. Only 6 percent blamed government regulations—the lowest response of any answer.

Figure 1: Special Survey Question and Response From Dallas Fed Energy Survey 1Q22

The pendulum has clearly swung: The chief goal of the U.S. oil and gas industry is no longer production growth that’s fueled by borrowing and new equity raises from capital markets. Instead, publicly traded domestic producers are sticking to strict capital expenditure plans, allowing operating revenues to balloon due to higher prices, and using the abundant free cash flows to pay down debt and reward shareholders.