Pioneer deal: Another overpayment by ExxonMobil?

Key Findings

ExxonMobil’s $60 billion acquisition of Pioneer Resources is raising questions from investors who worry about the steep price tag

Pioneer stock has trailed the market over the last decade, increasing just 17%—vs. a 148% increase in the S&P 500

ExxonMobil’s upstream U.S. segment has underperformed virtually every other segment, as measured by segment earnings vs. capital spending

The oil giant has an extremely spotty dealmaking record, given the results of its XTO purchase, bet on Canadian oil sands, and partnership with Rosneft

Investors are looking askance at the $60 billion price tag of ExxonMobil’s acquisition of Pioneer Resources. They should.

Pioneer Resources has been one of the better financial performers in the U.S. shale industry, producing $7.3 billion in free cash flow over the past decade—more than all but one other shale-focused U.S. exploration and production companies. Its cash flow performance has improved dramatically since the Ukraine invasion, with $4.9 billion in free cash flow over the past four quarters alone.

Even so, Pioneer stock has trailed the overall stock market over the past decade, with its stock value increasing just 17% vs. a 148% increase in the overall S&P 500 index—a sign that even the best companies in the U.S. shale industry have underperformed the broader market.

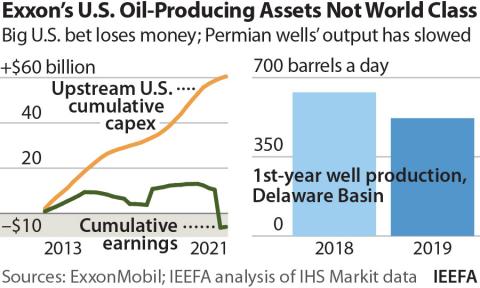

The Pioneer acquisition should represent an overall improvement of ExxonMobil’s troubled North American upstream portfolio. ExxonMobil's U.S. upstream segment has spent $38 billion on capital projects over the past five years, while recording an overall earnings loss over the period—largely due to a steep, $16.8 billion write-down of its U.S. assets in late 2020.

This makes ExxonMobil’s U.S. upstream segment by far the worst performer in the company’s portfolio, and the company’s only segment that has lost money over the past five years.

Even without the 2020 write-downs, ExxonMobil’s U.S. upstream segment has underperformed virtually every other segment in the company, as measured by reported segment earnings vs. capital spending.

Although the Pioneer acquisition could improve ExxonMobil’s overall U.S. upstream performance, investors are questioning the massive $60 billion price tag. Stock markets had driven ExxonMobil’s share price down more than 4% by Wednesday morning—the equivalent of erasing $18 billion in market value from the company. Although oil prices spiked last weekend due to violence in the Middle East, ExxonMobil’s stock price is down more than 10 points since the beginning of last week—meaning that the company’s market capitalization has fallen by more than $40 billion since rumors of a Pioneer acquisition started to circulate. Not all of the decline can be attributed to the Pioneer deal, but ExxonMobil’s market losses over the past week have been starkly higher than U.S. integrated oil industry peers including Chevron, ConocoPhillips, and Occidental.

Markets have good reason to question the price tag for the Pioneer acquisition, since ExxonMobil has a history of overpaying and misreading the dynamics involved with major upstream asset purchases.

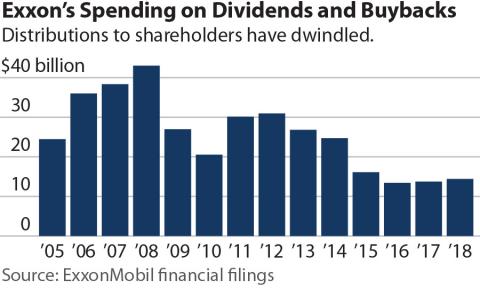

ExxonMobil’s dealmaking has been rocky for most of the last decade. When Darren Woods took over as CEO in 2017 he walked into the tail end of a losing bet on the company’s $41 billion purchase of U.S. shale gas producer XTO, and a Russian gas deal with Rosneft that slammed to a screeching halt when a round of sanctions was placed on Russia.

Since then, ExxonMobil’s big bet on Canadian oil sands has resulted in a confusing series of events in which the company debooked, rebooked, debooked and rebooked between 2 and 3 billion barrels of oil sands. The reserve manipulations prompted investors to file a lawsuit that is winding its way through the U.S. courts, with a judge granting class certification to the investors in August. In 2021, the company sold North Sea oil assets for about $1 billion less than initially expected. Last year’s Ukraine invasion cost the company another $4 billion. The company appears to be making money in its Guyana offshore production, but has lost a handful of court cases and faces challenges on even more, having cut a lot of corners.

ExxonMobil’s record of spotty corporate dealmaking appears to have undermined investors’ confidence in the company’s massive Pioneer acquisition.