Peabody’s Bankruptcy Will Shed Light Where Transparency Has Been Lacking

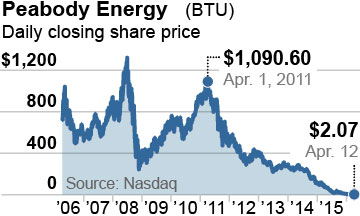

There will be much said today—and in the days to come—about Peabody Energy’s fall from grace. Here’s one takeaway: It’s good for the markets that the company has finally filed for bankruptcy because it lets investors get a more transparent look at what’s going on.

The story has many wrinkles of note. Among them:

- First, the Peabody transaction with Bowie Resources slated to bring in $358 million for two Peabody mines in Mexico and one in Colorado is now officially cancelled. Most saw the deal as a fire sale.The stated reason: Bowie couldn’t secure financing for these reserves. One could say the purchaser was defective and no one would lend to them (a topic for another blog), or one could say the coal reserves are worthless.

- Peabody just ahead of its bankruptcy filing tried to use four other mines as collateral for their failed debt exchange. Three of these mines are in the Illinois Basin and one in Arizona. Investors, for once, did not buy this pledge of value. Perhaps these mines are worthless or perhaps their value was already pledged to a host of creditors, regulators and who knows who else.

- The company has not tried to pledge or sell any of its Powder River Basin assets. So there are more shoes to drop.

We think, too, that the Securities and Exchange Commission has some work to do.

Peabody’s last three 10K filings included large asset impairments taken against the value of mining reserves in Australia, where they did not file for bankruptcy. The company asserts that its portfolio of land and mines are worth $10.5 billion. According to its filings, Peabody’s U.S. domestic coal reserves have retained value despite the onslaught of bad economic news that has shrunk the U.S. domestic coal market by more than 30 percent over in the past decade.

Absent a thoroughgoing review of how coal companies post their reserves and how the SEC interprets company guidance, flagrant overstatements of reserves and of coal valuations will plague the nation’s economy and confound the next cycle of investment in coal. If disclosures are supposed to be accurate, objective information that allows investors to make reasoned judgments about potential market performance, the coal industry can do better.

Peabody in its 10K filing also states that they have $1.4 billion in self-bonding liabilities for mines across the U.S. According to Peabody, the debtor in possession loan it acquired appears to have secured $200 million as a set-aside for its reclamation obligations. The one thing we agree with Peabody on is that its pledge to make good on $1.4 billion in reclamation expenses is, in fact, worthless. One question that comes to mind on this point: Is it worthless only as of today or have past representations been as dubious as we have thought for years now? A few weeks back Peabody responded to the Illinois Attorney General that the company was complying with all self-bonding requirements. Peabody released no documents to support its assertions. What other regulators have been stonewalled or worse?

If regulators were to accept $200 million in cash for $1.4 in cleanup liabilities, that would be an 85 percent haircut on the protections provided to the public for mine cleanup activities. That would be a real benefit to any company in bankruptcy.

One other takeaway on the Peabody news: Public policy lapses have allowed investors and regulators to be made fools of over these past several years..

Tom Sanzillo is IEEFA’s director of finance.