Papua LNG Project – Financiers taking the risk

Download Full Report

View Press Release

Key Findings

Financiers of Papua LNG face high risks as no binding or non-binding sales agreements have been made.

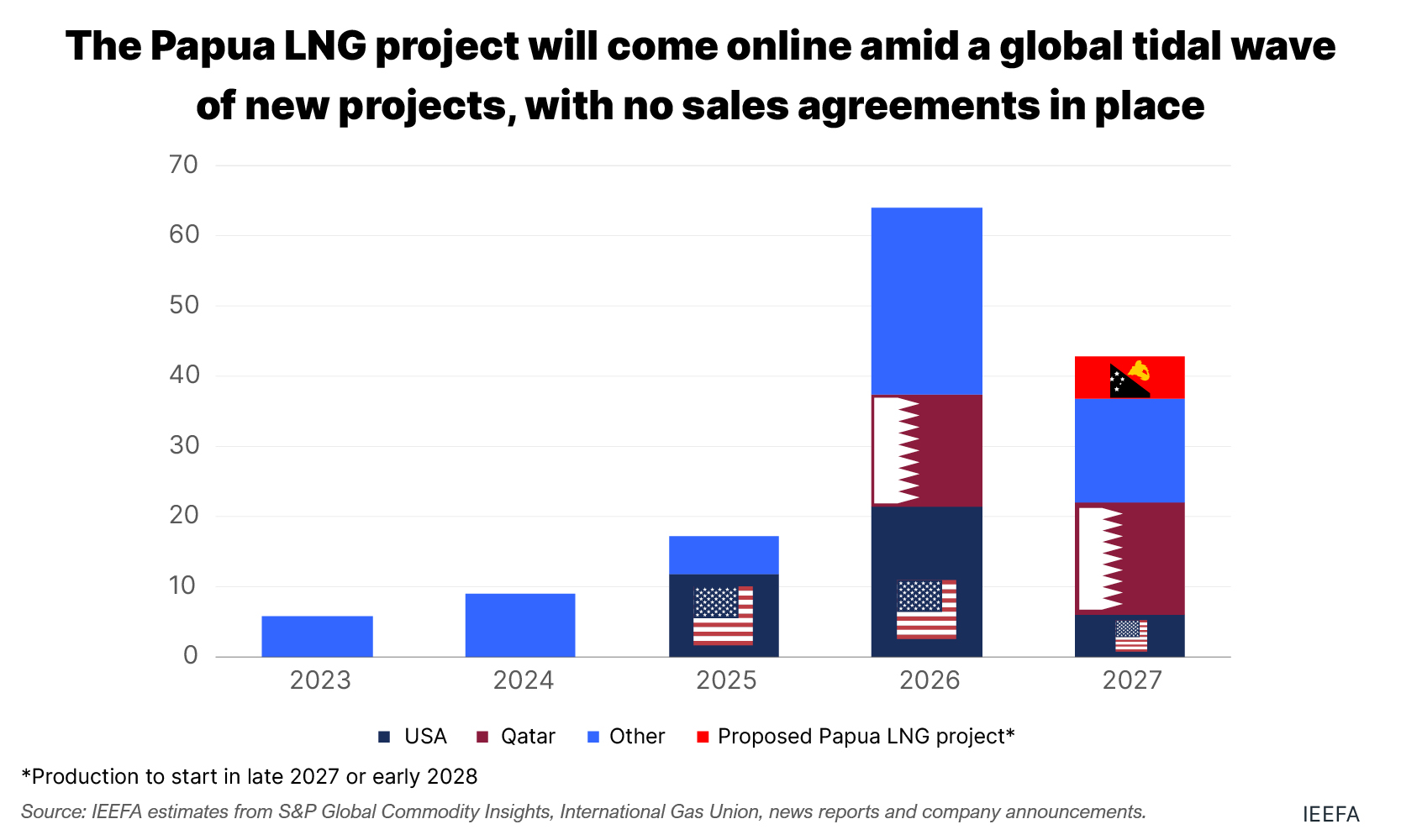

The project will deliver LNG at a time of projected glut in global supplies and increasing uncontracted volumes.

No efforts are being made to reduce the project’s scope 3 emissions – expected to add up to 220 million tonnes of carbon dioxide equivalent (MTCO2e) over the project’s lifespan.

The project has a history of uncertainty, political tensions and legal woes.

Executive Summary

French energy company TotalEnergies and its partners in the 6 MTPA Papua LNG venture in Papua New Guinea (PNG) are looking to sanction the project by the end of the year and start delivering gas by either late 2027 or early 2028. It would be the second LNG project for the country, making it a major exporter in the region.

The project presents considerable financial risks. As of 22 May 2023, it had secured no guaranteed sales – with no long-term sales and purchase agreements (SPAs) or non-binding heads of agreement supply deals. This is particularly problematic as the world could face a glut of LNG supplies after 2026, following a large expected expansion of new supply between 2025 and 2027. The spot market is likely to be flooded with uncontracted gas by then, as uncontracted volumes from Qatar are expected to increase from zero in 2023 to 68 million tonnes a year (MTPA) by 2028.

The longer-term demand prospects are also in question. The International Energy Agency (IEA), in its Net Zero by 2050 roadmap, states that no new gas projects are required if the world is to reach net zero by 2050. The IEA forecasts gas demand to decline by 55% by 2050.

The Papua LNG partners are looking for external financing to fund the US$13 billion project, and it is unclear where this funding will come from. Export credit agencies that supported the country’s first LNG project are now considering ending finance support for oil and gas. Commercial lenders are also increasingly reducing their exposure to fossil fuel projects. TotalEnergies’ second largest lender, the French bank BNP Paribas, announced in May 2023 it would no longer provide any financing for the development of new oil and gas fields.

The project’s emissions footprint is also a concern. It will increase PNG’s energy and industry emissions by more than 7%. While some actions are being taken by the project partners to reduce their operating emissions, those only represent 10% of Papua LNG’s total carbon footprint.

The total scope 3 emissions of the project over its lifespan are estimated at 220 MTCO2e. This is about the total annual emissions of Bangladesh – a country of 170 million inhabitants.

The majority of its emissions are scope 3 – the emissions from consumers burning the gas produced. The total scope 3 emissions of the project over its lifespan are estimated at 220 million tonnes of CO2 equivalent (MTCO2e). This is about the total annual emissions of Bangladesh – a country of 170 million inhabitants. None of the project partners have any ambition to reduce their scope 3 emissions, raising concerns with investors who are starting to ask for more action to align with the Paris Climate Agreement objectives. Keeping global temperatures well below 2 degrees will be critical for PNG, a country particularly vulnerable to the impacts of climate change.

Finally, the project’s history has been marred by uncertainty and controversies, some of which remain today. Since their discovery, there have been significant questions about the amount of gas available in the Elk and Antelope fields supplying the project. The total reserves as well as the project capacity have each been downgraded materially.

There have been tense political relations with the government, which questioned several times the pace of development of the project and tried to renegotiate the terms of the agreement. The shareholders have been involved in multiple legal woes, the latest being filed on 21 April this year.

There is also a high level of uncertainty on the stake the PNG government will take in the venture. It has a right to acquire 22.5% of the project but faces fiscal challenges where revenue is not keeping pace with spending, and debt is rising.

In conclusion, the sum of the financial, environmental, political and legal risks facing the Papua LNG project are issues financiers to the project must carefully consider.