PNG gas ambitions a high-stakes gamble

Looming glut of LNG and declining global demand pose challenges for potential financiers of $13bn project

Key Takeaways:

Financiers of PNG’s second major LNG project face high risk with no sales or supply agreements in place

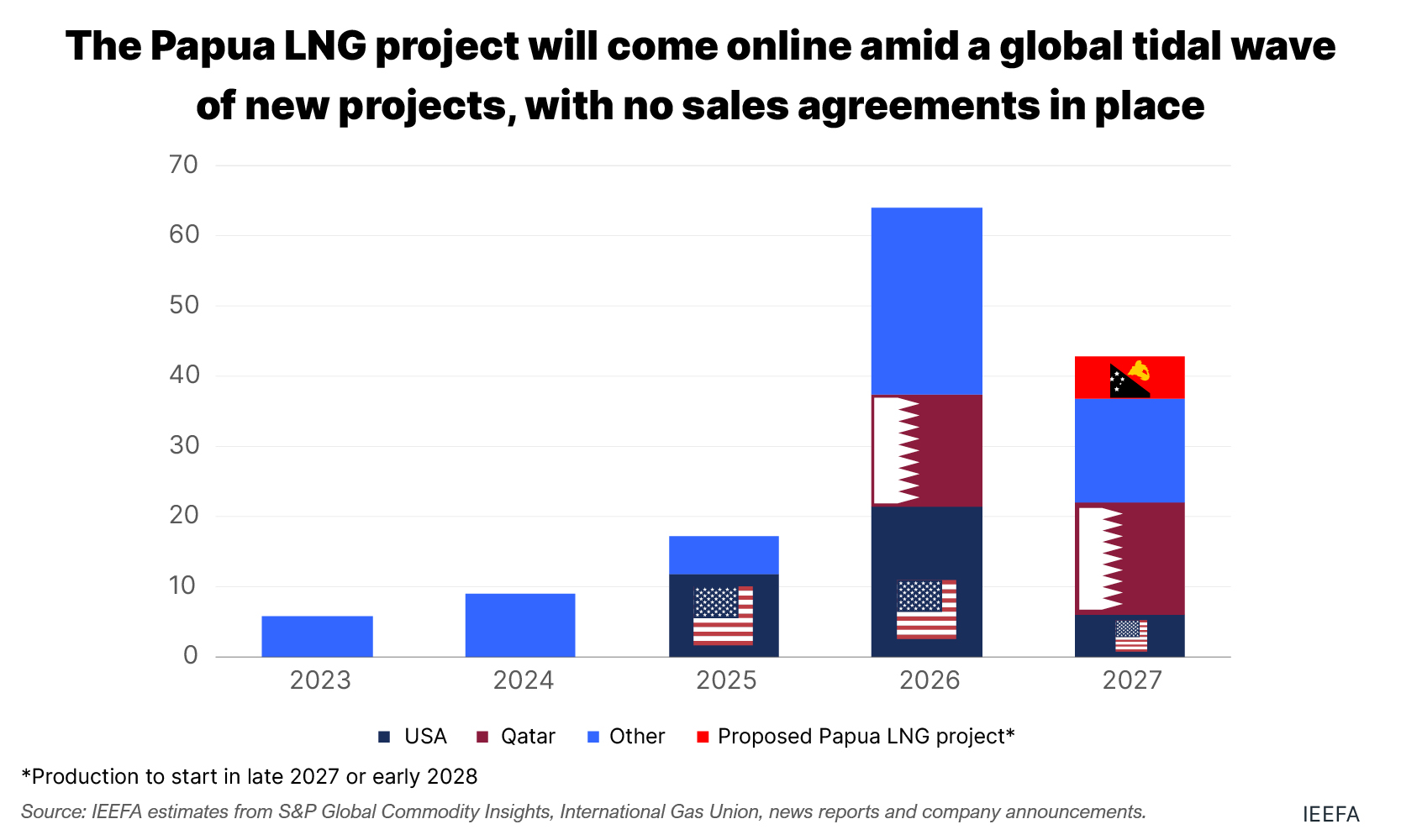

The Papua LNG project will deliver at a time of projected glut in global supplies and declining demand

The project has no plans to reduce scope 3 emissions – expected to add 220 million tonnes of carbon dioxide equivalent emissions over its lifespan

Papua LNG has a history of uncertainty, political tensions and legal woes

22 May 2023 (IEEFA Australia): Backers of Papua New Guinea (PNG)’s second proposed liquefied natural gas (LNG) project face significant risks on two fronts: the failure to attract any sales or supply agreements for its gas, and the fact it could be entering a saturated global LNG market already facing declining global demand, according to a new report .

The report by IEEFA Energy Finance Analyst, LNG/Gas, Kevin Morrison, highlights the risks the US$13 billion Papua LNG project, which is operated by TotalEnergies, poses not only for the project’s financiers but also for the debt-laden, environmentally fragile Pacific nation.

The Papua LNG partners, which include ExxonMobil and Australia’s Santos, are looking for external financing to fund the US$13 billion project, and it is unclear where this funding will come from. Export credit agencies that supported PNG’s first LNG project are now considering ending finance support for oil and gas. Commercial lenders are also increasingly reducing their exposure to fossil fuel projects.

Just this month, French bank BNP Paribas announced it would no longer finance the development of new oil and gas fields. The fact the bank is a major financier of Papua LNG’s lead investor, French company TotalEnergies, further clouds the project’s financing.

“No sales and purchase agreements means there are no guaranteed sales and no asset financiers can lend against,” Mr Morrison said.

“In a market that could be saturated with new supplies, financiers of the project that don’t have the security of a SPA face greater risk on their loans.”

The project’s long-term demand prospects are also in question. The International Energy Agency (IEA), in its Net Zero by 2050 roadmap, says no new gas projects are needed if the globe is to reach net zero greenhouse gas (GHG) emissions by 2050.

Papua LNG’s total scope 3 emissions – from end users burning the gas it produces – over its lifespan are estimated at 220 million tonnes of CO2e. This equates to the total annual emissions of Bangladesh – a country of 170 million people.

The lack of action by the oil and gas industry to reduce scope 3 emissions, when the gas is burnt by end users, poses greater threats to poorer countries such as PNG, which are vulnerable to the impacts of climate change. The World Bank cites numerous existing hazards that could be exacerbated by climate change in PNG. These include landslides, soil erosion, deforestation, loss of biodiversity, as well as recurrent floods and droughts.

“None of the project partners have any ambition to reduce their scope 3 emissions, raising concerns with investors who are starting to ask for more action to align with the Paris Climate Agreement objectives,” Mr Morrison says.

“Furthermore, by 2027 and certainly over the 15-year life of the project, global policies on reducing greenhouse gas emissions may result in tighter restrictions on emissions.

“Gas demand, under the IEA net zero pathway, declines by 55% by 2050, heightening the risks thatnew gas projects will become stranded assets, meaning that the project will not see out its economic life.”

By law, the PNG government is entitled to acquire a 22.5% stake in any resource project once it is approved, through the state-owned Kumul Petroleum Holdings group.

Financing for PNG gas projects has a chequered history. A royal commission was set up to inquire into the A$1.3 billion loan by Swiss investment bank UBS to the PNG state to fund its share of the country’s first major gas project, PNG LNG. That loan cost the state A$432 million.

Last year, PNG’s national debt was estimated at $47.9 billion by the International Monetary Fund, rising to $51.2 billion this year. In March, PNG secured a US$910 million loan by the IMF, but rising debt and expenditure mean it could struggle to meet its US$2.9 billion commitment to the project.

Regardless, the PNG government plans to push ahead with approval of the project later this year.

Papua LNG has long been subject to legal wrangles and the vagaries of PNG politics, as the newest stakeholder, Santos, found when its acquisition became enmeshed in a long-running legal battle between investors in the first, stalled iteration of the project back in 2014.

“The sum of the financial, environmental, political and legal risks faced by the Papua LNG project are issues financiers to the project must consider,” Mr Morrison says.

Read the report: Papua LNG project – Financiers taking the risk

Media contact: Amy Leiper [email protected] 0414 643 446

Author contacts: Kevin Morrison [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)