Oil and LNG supply gluts spell double trouble for Australian LNG producers

Key Findings

The IEA has forecast an oil supply glut for the end of the decade, similar in magnitude to the excess oil capacity recorded during the COVID-19 pandemic.

Australian LNG producers are highly exposed to declines in oil prices, as the majority of their existing LNG contracts have pricing directly linked to oil prices.

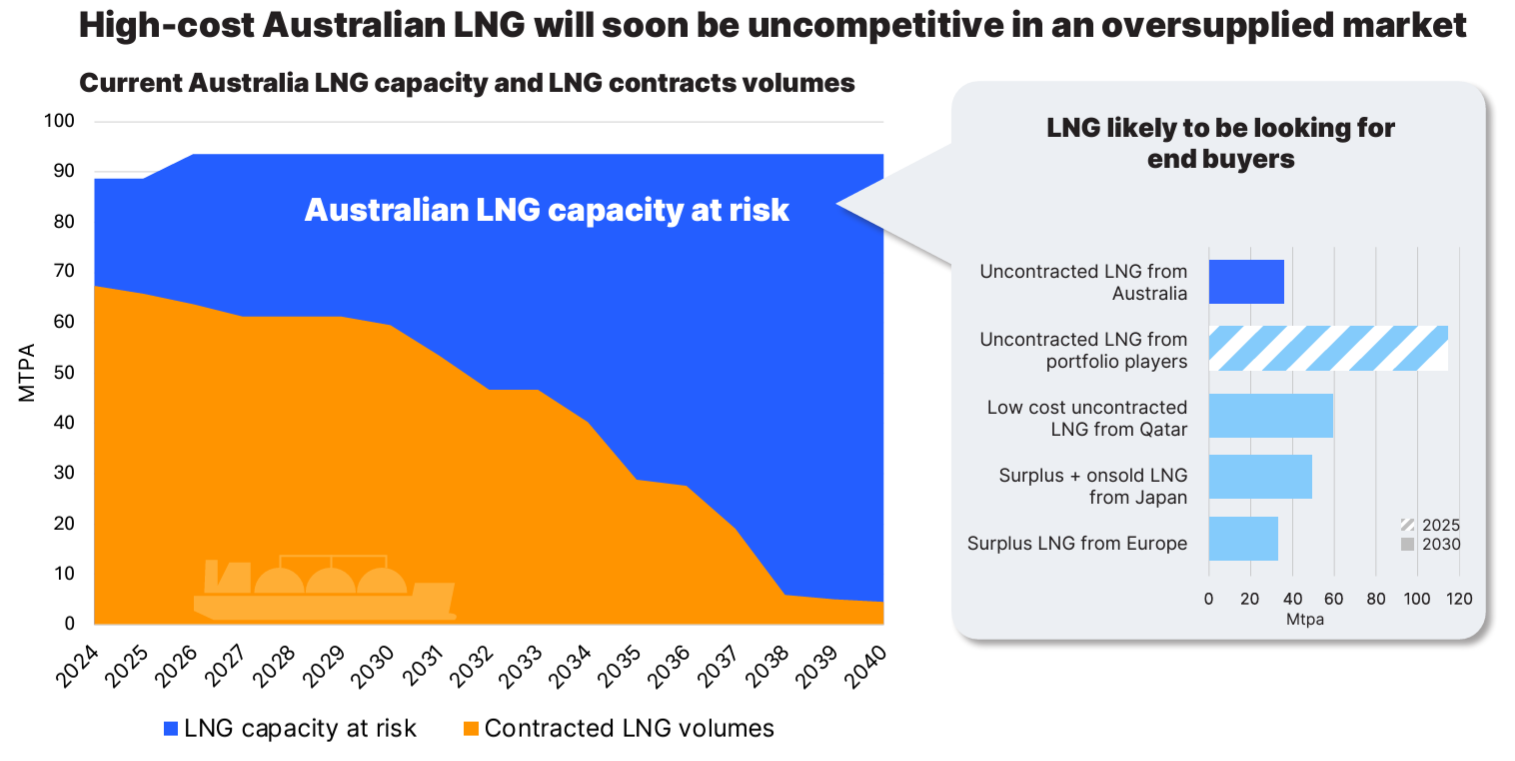

Australian LNG producers are also at risk due to an upcoming global LNG supply glut, as declining contracted volumes will be exposed to growing competition from lower-cost producers.

This analysis is for information and educational purposes only and is not intended to be read as investment advice. Please click here to read our full disclaimer.

In its Oil 2024 report published on 12 June, the International Energy Agency (IEA) forecast that global oil markets are heading for a glut in supply, with global oil capacity in 2030 potentially exceeding demand by a staggering 8 million barrels per day.

The glut is due to rising oil supplies led by non-OPEC+ producers, in particular the United States and South America, while demand is forecast to level off. The oil demand slowdown is driven by the fast increasing uptake of electric vehicles worldwide, combined with improved efficiency of petrol or diesel vehicles. Oil use is also decreasing for power generation, replaced by renewables or gas.

The forecast excess oil capacity is similar in scale to that experienced during the COVID-19 pandemic. At that time, travel demand had fallen so fast that oil producers couldn’t decrease their production in time to match the slump in demand. As a result, the price of oil went below USD20 a barrel and even negative for a short time, before stabilising, at USD40.

This has implications for Australia’s liquified natural gas (LNG) sector, which is heavily exposed to oil prices due to the majority of its existing LNG contracts having pricing directly linked to oil prices. Australian LNG contracts usually include a limited fixed-price component as well as a variable component based on a benchmark such as the Brent crude oil price or the Japan Crude Cocktail (JCC) price. While the fixed component is typically increased slightly under a predefined threshold, low oil prices for a prolonged period of time would likely lead to financial losses for contracted LNG.

This could be particularly problematic for Australian producers, who are also facing high risks of declining prices for the uncontracted portion of their production. IEEFA’s Global LNG Outlook 2024-28 recently found that global LNG markets are also headed towards a supply glut within two years.

Between 2024 and 2028, global LNG supply will increase by 40%, an unprecedented level of growth for the LNG industry in such a short time period. Capacity additions are dominated by Qatar and the United States, which have much lower costs of production than Australia.

At the same time, demand for LNG is already starting to decline in mature markets. European demand for LNG is expected to peak by 2025 then decline. Europe’s gas consumption has already decreased by 20% in the last two years. Japan’s LNG demand has decreased by 25% since 2014, and is expected to decrease by a further 25% by 2030 as LNG is displaced by increasing nuclear and renewables generation. South Korea’s LNG imports fell by 5% last year, and are expected to fall further by 2030.

To compensate for these declines, LNG producers instead rely on demand growth in emerging markets, but IEEFA identified material structural barriers to demand growth in those markets. High and volatile prices, and fiscal challenges are limiting the appetite of emerging Asian markets for LNG. Long contracting timelines, a preference for domestic energy sources and the favourable economics of alternative energy sources including renewables are also constraining demand growth. As a result, little contracting activity has been seen for South and South-East Asian markets. China has signed large volumes of contracts, but the IEA expects that they are likely to be overcontracted by 2030 based on existing contracts.

While the majority of Australian LNG is currently sold through long-term contracts, a large share of those contracts will start expiring after 2030. As a result, producers will increasingly find themselves exposed to growing competition – either through spot market sales if they can’t secure new contracts, or through competition from lower-cost producers and overcontracted intermediaries for securing new long-term contracts. A range of buyers are already seeking to reopen negotiations on their contract pricing due to the changing market conditions.

This double pressure on LNG prices – contracted and uncontracted – will put financial returns at risk for Australian LNG producers. The Future Gas Strategy analytical report showed that Australia has very high costs of production compared with other major LNG suppliers, so that they are at a higher risk of making financial losses in an oversupplied market. This will affect existing assets and further compromise the financial case for new investments. New LNG developments are unlikely to be financially viable, and backfills of existing LNG trains are also likely to be at risk.

The double oil and LNG supply gluts are really a double whammy for the Australian LNG industry, which now faces an ever gloomier future.