Key Findings

Multilateral development banks (MDBs) can better use their guarantee products to make tens of billions of additional dollars available to member countries without additional capitalization or risking their AAA credit status.

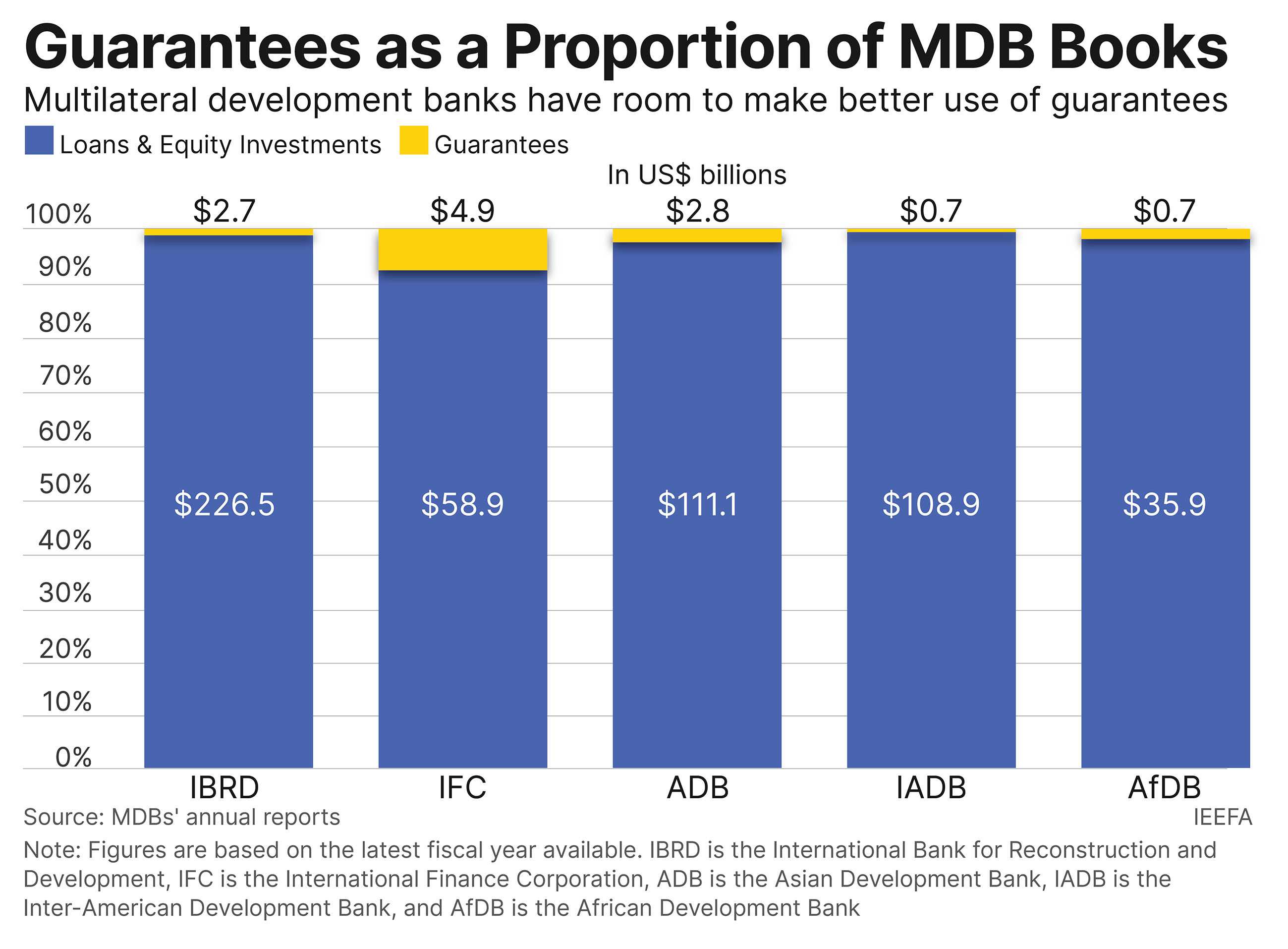

Currently MDBs severely underuse their guarantee capacity because most of them treat $1 of guarantee the same as $1 of loan, without risk differentiation. As a result, guarantees account for only about 2% of total business across the longest-established of these institutions.

MDBs that incorporate experience-informed metrics to more liberally manage risk in guarantees could leverage risk capital at 5:1 or even 10:1, potentially mobilizing an extra $100 billion for developing countries from diverse sources.

In an age of multibillion-dollar energy transition mechanisms, MDBs adopting a probability-based approach to guarantees, akin to insurance practice, could be the difference between those mechanisms' success and failure.

Between pandemic stresses and formidable climate change needs, demands upon multilateral development banks (MDBs) are peaking. Questions have arisen whether MDBs can do more with the money and tools they have, or if major reforms are required.

In July 2022, the Group of 20 Industrialized Countries (G20) published a manifesto on overhauling MDB risk management practices to make tens of billions of additional dollars available to member countries. Proposals range from more aggressive risk capital treatment, to selling non-voting shares in MDBs, to extending riskier loans. Impact of these measures on MDBs is unclear. It may be neutral. It could result in credit rating downgrades, thus increasing borrowing costs. It could lead to a general capital call among MDB shareholders, something many governments may not be in a position to entertain.

Last month, the Financial Times reported a group of dozens of mostly developing economy governments wrote to World Bank executives calling to retain their tight risk management policies. These countries want to preserve the bank’s ultra-high credit rating so they can continue to access low-cost capital, according to the report.

Thus, a dichotomy exists: can MDBs simultaneously loosen risk policies to provide low-cost financing at larger scale while serving their developing economy clients well?

MDBs have maintained AAA credit ratings since their inception. They keep in reserve large callable capital commitments from shareholders. Among long-established MDBs, the ratio of paid-in to callable capital ranges between 1:15 and 1:20, a formidable cushion. Never has that contingency been called. MDBs concurrently enjoy “preferred creditor treatment” where a borrower country under financial distress would prioritize MDB obligations.

Such backing provides credit rating agencies with comfort to maintain MDBs’ top ratings, consequently allowing MDBs to tap capital markets with minimal margins. Last month, the World Bank issued a US$5 billion, seven-year bond at 0.17% over similar United States Treasuries, almost the same as the U.S. government itself.

This indicates MDBs have significant headroom to stretch their risk appetite without downgrades. Nonetheless, MDB risk tolerance should align with evidence-based, pragmatic assessments of risks posed by operations and be less guided by a rating. Which stance will find favor with MDB shareholders lies at the heart of the debate, so a compromise could take significant time to agree.

While proposed reforms take shape, one near-term action MDBs could consider is to make better use of their guarantee products. MDBs can credibly manage country risks due to robust relationships with member governments and deep knowledge of their political, fiscal, economic and social evolution. Unlocking MDBs’ potential as a guarantor involves leveraging their unique country-level experience against their under-exercised buffers by accounting for guarantee risk, and the capital behind it, differently. This can free up billions of dollars without additional capitalization or jeopardizing credit status.

Currently, most MDBs treat $1 of guarantee the same as $1 of loan, without risk differentiation. With a loan, the MDB has full control over all aspects of its origination, structuring and monitoring but is exposed to all risks. A guarantee, by contrast, covers a subset of risks, like changes in political policy or regulatory oversight, on someone else’s loan. If a guarantee eats up as much risk capacity as a loan, the MDB will always prefer to execute loans. As a result, guarantees are rarely used, totaling little more than 2% of business among the longest-established MDBs (see graph).

A guarantor may need to pay out the full value of the loan it covers; however, the probability a covered risk will lead to such a payout is low. Insurers have taken this approach from day one. MDBs possess decades of performance data on their borrowing countries, invaluable information that can be converted into actuarial adjustments to risk capital then shared with credit rating agencies to support expanded use of guarantees.

Incorporating experience-informed metrics with guarantees, MDBs could leverage risk capital at 5:1 or even 10:1. If an MDB’s annual risk capital allocation for a country is US$100 million, instead of doing a single project loan in-house, with guarantees it could catalyze US$1 billion in loans from other financiers, funding multiple projects. Applying this actuarial approach to the meager US$11.8 billion guarantee provisions now on the books of MDBs (see graph) could mobilize US$100 billion of investment.

In the age of multibillion-dollar energy transition mechanisms, where private-sector participation is a must, taking major swathes of political and country risk off the table could mean the difference between success and failure. A probability-based approach to guarantees, akin to insurance practice, could unlock great potential. MDB guarantees would provide comfort to reluctant but interested investors and lenders to throw their support behind the transition—a game changer. The beneficiary country is happy, private-sector participants are assured, and the MDBs can do more.

This commentary first appeared in the South China Morning Post.