More Financial Pain Ahead for U.S. Coal Industry

Recent developments in U.S. energy and capacity markets are likely to bring more financial pain for many coal plants through a combination of declining generation and lower sales and revenues.

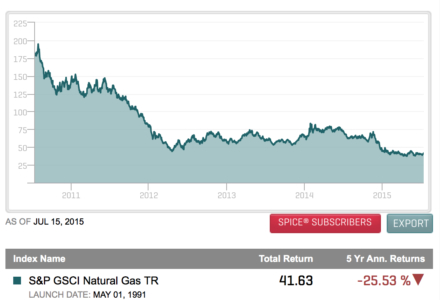

One of the driving forces affecting coal is the fact that natural gas prices continue to be significantly lower than the price of coal-fired power. This trend will probably lead to reduced sales from coal-fired plants as energy from natural gas-fired units replaces them on the market.

According to UBS Financial, natural gas prices at the Dominion South Hub/Pricing Location are down as much as 46 percent from 2012, when prices were significantly lower than they were from 2009-2011.

While 2014 was a bad year for coal-fired power plants in the Mid-Atlantic and Midwest, 2015 could be worse, with substantially lower natural gas prices driving significant coal-to-gas switching.

In addition, lower gas prices are likely to lead to lower market prices. . This is because natural gas-fired units set the market clearing price in PJM, the regional electric market that covers much of the Northeast and Midwest, in at least one-third of the hours in 2013 and 2014, and could clearly set the market price in even more hours in 2015 and future years.

Reduced sales from coal-fired power plants will mean lower revenues for the coal industry, which is already hurting. The lower natural gas prices are not only going to mean no immediate relief for the coal industry—they mean further pain in the months and years ahead.

A RECENT CHANGE IN PJM’S LOAD-FORECASTING METHODOLOGY WILL ALSO AFFECT COAL-FIRED PLANTS, which rely on prices set by forward-capacity auctions informed by such methodology.

I concluded in testimony before the Virginia State Corporation Commission in 2013 that PJM— the regional transmission organization that coordinates whole electricity markets in part or all of 13 eastern states—had systematically overestimated its future peak loads and energy requirements in every year since at least 2008.

Although my conclusion was rebutted by Dominion Virginia Power and rejected by the commission, PJM has now acknowledged that it has been systematically too optimistic in its forecasts over the past decade.

According to UBS Financial, fixing PJM’s load forecasting methodology could shave almost 9.3 gigawatts off PJM’s current projection for 161.1 gigawatts of demand in 2018, for instance. Because prices in PJM’s forward capacity auctions are set by the relationship between the supply of capacity and demand, this reduction in demand could depress capacity prices by approximately $55/megawatt-day.

This will offset, in large part, if not entirely, the higher capacity prices expected from PJM’s implementation of the Capacity Performance plan. Lower capacity prices will mean lower revenues for coal-fired power plants.

Coal units in PJM with longer start times also may be penalized under the plan because they would not be available to provide energy and reserves whenever PJM determines an emergency condition exists. Or such units will have to undertake capital investments that they might not be able to recover through the energy or capacity markets.

David Schlissel is IEEFA’s director of resource planning analysis.