KEPCO makes moves but can it avoid a death spiral?

Key Findings

IEEFA's previous analysis attributed Korea Electric Power Corporation’s (KEPCO) deteriorating operating margins over the last decade to its heavy reliance on imported fossil fuels for power generation and the high and volatile fuel prices that were not completely passed through to customers under the South Korean electricity system.

Had KEPCO made an earlier transition to renewables, its operating expense line would have been more predictable, stable, and much lower today. Yet the company's capital expenditure plan for renewable energy in 2023 is negligible (and unknown beyond that), which suggests that its future operating base would still be predominantly fossil fuel reliant.

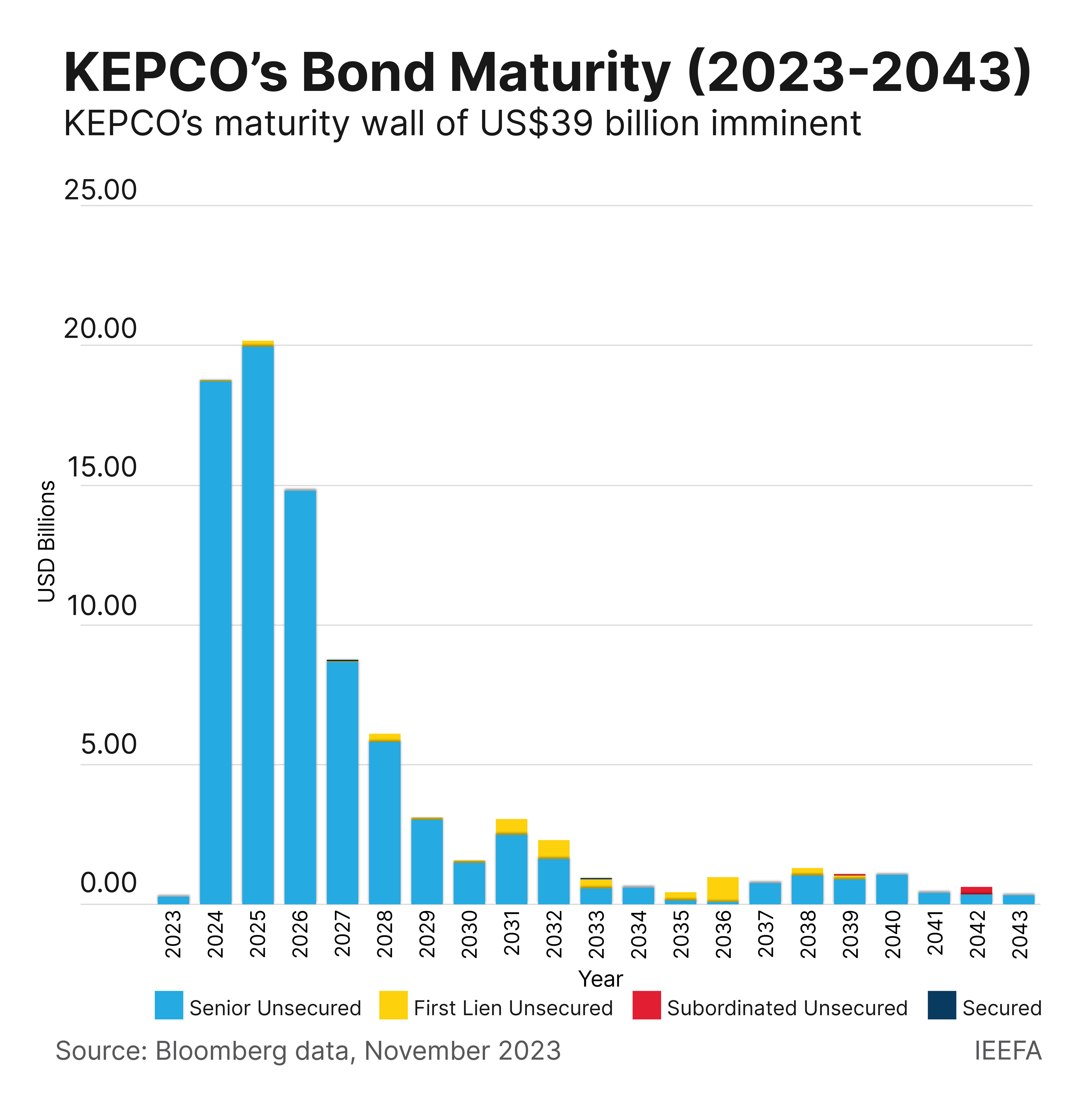

The company plans to take on more debt in the form of commercial paper and bank loans, which poses a new risk to the domestic financial system, as KEPCO has reached its recently revised corporate bond issuance limit and is about to hit a bond maturity wall of US$39 billion between 2024 and 2025.

It is unclear whether KEPCO's new board would have the commercial discipline and capabilities to steer the company back on track as long as the company hides in the shadows of the government.

2023 is another worrying year for Korea Electric Power Corporation (KEPCO).

A year after the Institute for Energy Economics and Financial Analysis (IEEFA) report, “KEPCO’s clean energy transition hangs in the balance”, the South Korean state-owned utility company has not made any major improvement in realigning its business position. Still riddled with expensive operating expenses and high financing costs, its President and Chief Executive Officer (CEO) Kim Dong-cheol said the company would struggle to meet its working capital commitments and debt service obligations this year without material intervention on the company and an electricity tariff reform.

KEPCO recently unveiled new self-rescue measures to deal with its burgeoning financial crisis in addition to the ones proposed last May. The company’s plan now involves saving US$19.3 billion (₩25.7 trillion) by 2026 and includes selling its stake in real estate in Seoul and a solar power plant in the Philippines, as well as corporate downsizing.

The million-dollar question is whether these efforts are sufficient to turn things around for KEPCO.

The blame game

Warned by IEEFA in October 2022, the issues that KEPCO were likely to face if no significant improvement was made to its investments and governance seem to have come to fruition.

The financial year 2022 saw KEPCO record its highest operating loss at US$24 billion (₩32.7 trillion), over five times the losses of the previous year. Its financial liabilities increased by 39% from the prior year to US$104.5 billion (₩139 trillion). Based on its half-year results for 2023, KEPCO is expected to see another year of significant losses.

KEPCO CEO Kim was recently quoted attributing the company’s financial crisis to the previous South Korean government’s unreasonable nuclear phase-out and rapid expansion of new and renewable energy policies, a surge in global energy prices, and a rigid electricity rate determination structure.

Kim’s assertions are simply refutable because then-South Korean President Moon Jae-In’s policies in 2017, which called for a rapid expansion of renewable energy to 20% of electricity generation by 2030, were hardly implemented. By 2021, the country’s power generation from renewable energy crawled to 6% from 3% in 2017. Nuclear power generation rose 6% from 2018 to 2021.

At the same time, KEPCO’s power generation from renewable energy, which includes hydropower, was sitting at a meager 3% in 2021 from 2% in 2017. Its nuclear generation went from 36% in 2017 to 38% in 2022, instead of a phase-out. It is therefore hard to conceive that an inconsequential expansion of renewable energy is to be blamed for KEPCO’s financial calamity.

The KEPCO CEO was at least right about one thing: the surge in fossil fuel prices.

As fossil fuels dominate KEPCO’s generation mix and fuel costs are not completely passed through to customers, high and volatile fuel prices have been the major culprit behind its deteriorating margins over the last decade.

To make matters worse, IEEFA’s previous analysis found that KEPCO had been doubling down on fossil fuel assets even though the evidence was clear that coal and liquefied natural gas (LNG) prices largely determined its operating margins.

The report showed that the lack of course correction had led to the company’s recurring operational losses for most of the last decade and a steady increase in debt despite already being overleveraged.

KEPCO also recently announced it was raising tariffs for large-scale industrial users, which represented around 49% of total electricity use in 2022, effective immediately. Despite the slight reprieve, the company’s revenue line — which ultimately depends on government approval of tariff adjustments — is unlikely to shift dramatically as significant price increases would put unnecessary cost of living pressure on South Korean households and businesses.

KEPCO can only control its operating expenses and capital expenditures. Had the company made an earlier transition to renewables, its operating expense line would have been more predictable, stable, and much lower today. The company projected only 6% of its capital expenditure to be allocated to renewable energy in 2023. Additional renewable energy capacity beyond that remains unknown. This suggests that its operating base would still be predominantly fossil fuel reliant and its decarbonization strategy unclear.

IEEFA’s analysis last June found that the longer KEPCO resists the transition and maintains its exposure to fluctuating fossil fuel feedstock, the more it will see shocks and disruptions.

This could exacerbate further, particularly as the world has moved away from fossil fuels. The global fossil fuel supply is expected to reduce and apply additional fuel price pressures. If KEPCO does not take more immediate and decisive steps, it risks being in a death spiral.

KEPCO creates new risks for the domestic financial system and the sovereign

CEO Kim has alluded that KEPCO will struggle to repay its debt and working capital if drastic measures are not taken. This includes a reform to electricity tariffs. Instead of resorting to more bond issuance, for which it is approaching its issuance limit since it was raised to US$67.8 billion (₩90 trillion) last January, it also plans to take on more debt in the form of commercial paper and bank loans.

This poses a new risk to domestic banks which are expected to support the company.

And as KEPCO is about to hit its peak bond maturity of US$39 billion between 2024 and 2025, its bondholders should also be concerned. If refinancing proves tight, then it is likely that KEPCO will resort to a government bailout. However, it is uncertain whether the government would meet all bond repayments without adding financial risk to itself. If the government steps in, it may be required to redirect funds into debt repayment for KEPCO within a short time frame, otherwise earmarked for other investments.

KEPCO’s credit outlook slipped last May. Moody’s slashed the company’s baseline credit assessment by one notch from Baa2 to Baa3 — that is the precipice of non-investment grade. This month, an increase in tariff for large-scale industrial users led to a credit positive. As Moody’s maintained KEPCO’s long-term debts at Aa2 rating — an excessive seven notches higher than its baseline to match the sovereign’s rating, and a few notches higher than the sector average in Asia Pacific — the combination of rating actions signifies that KEPCO’s ultimate rating depends on government intervention in the form of a “bailout” rather than the strength of its business fundamentals.

As long as KEPCO hides in the shadows of the government and does not risk real default, it runs the risk of continuous poor management and a lack of thoughtful investment.

Who will save KEPCO?

Years 2022-2023 saw a change of guards at the KEPCO board. However, it is unclear whether the new board would have the commercial discipline and capabilities to steer the company back on track. The blame game exercise certainly does not help the company CEO’s image from a governance standpoint.

While it is expected that KEPCO will be propped up, the stakes are also high for the South Korean government which is exposed to significant financial risk if it continues to allow KEPCO to go down this route. Any electricity tariff hikes would only be a distraction to placate investors in the short term and can only do so much to ease KEPCO’s burgeoning debt and working capital burden, without adding pressure on the public and the rest of the economy.

The bitter pill that KEPCO needs to swallow is to make significant changes to its investment policy and strengthen the quality of its management team.