India's renewable energy journey: Short-term hiccups but long-term trajectory intact

Download Full Report

View Press Release

Key Findings

India’s renewable energy capacity is projected to grow rapidly with 35-40 gigawatts added annually through to the fiscal year 2029/30.

Thermal power is set to progressively lose market share in India. The recent push to expand use of domestically produced thermal energy is likely to be a short-term hiccup.

India has been one of the champions globally in adopting renewable energy as part of its energy transition. Installed renewable energy capacity (including large hydro) rose from a few megawatts (MW) in 2010 to ~163 gigawatts (GW) as of August 2022. India’s ambitious renewable energy targets and the associated policy and reform framework have been an important tailwind for the sector's development. Additionally, the transition has also resulted in shunning coal power capacity, with additions hitting rock bottom in FY2021/22. More than 606GW of coal-fired power projects have been cancelled or shelved, and 15.6GW retired in India during the 2010-2022 period.

That said, there have been several headwinds faced by the renewable energy sector lately, along with rapidly rising power demand from across the country. These factors have led to the government taking a re-look at thermal power as a fix against any power crunch in the foreseeable future. NTPC, the country’s largest power producer, announced diversifying away from coal in October 2020 but recently awarded its first new coal-fired plant in about six years to meet the country’s surging demand for electricity.

Besides having the potential to derail India’s energy transition journey, a higher reliance on coal-fired power also exposes the country to the vagaries of global energy markets. Due to a shortage of domestic coal, the country has accelerated its import of the commodity. However, the Russia-Ukraine war has led to imported prices skyrocketing tenfold in the last two years, making use of imported coal expensive and widening India’s current account deficit. This high coal price has also fuelled inflation in the country, with the Wholesale Price Index (WPI) crossing double digits (15%) in May/June 2022.

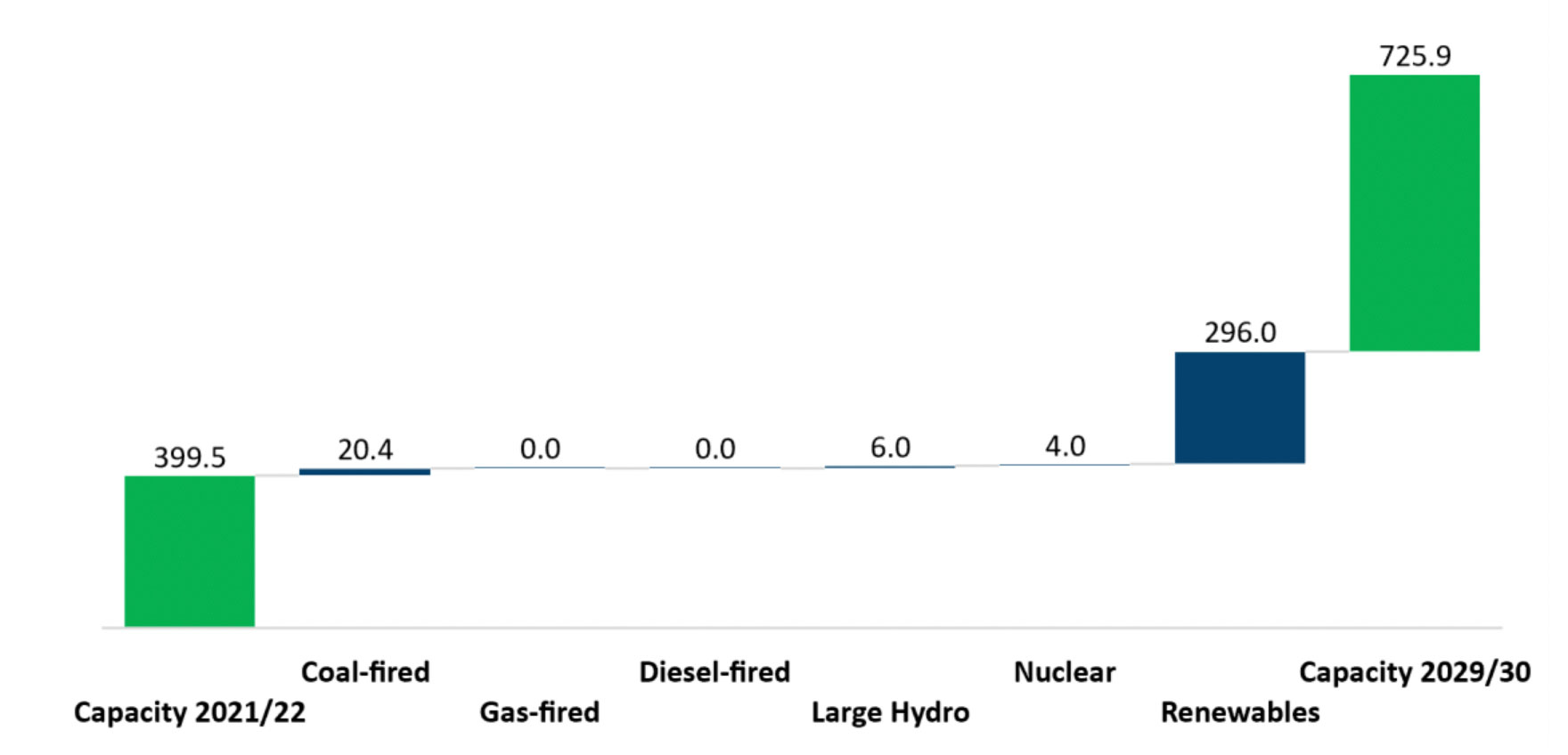

IEEFA and CEF forecast India’s renewable energy capacity to grow rapidly with 35-40GW of new capacity additions annually through to FY2029/30, reaching 405GW.

IEEFA and CEF believe that even though there is some renewed momentum building on expanding the use of domestic thermal energy, the long-term trajectory for renewable energy is still intact. IEEFA and CEF forecast India’s renewable energy capacity to grow rapidly with 35-40GW of new capacity additions annually through to FY2029/30, reaching 405GW. Due to the competition from variable renewable energy sources, hyperinflation in fossil fuel commodity prices and increased global capital pledges under the US$130 trillion Glasgow Finance Alliance for Net Zero (GFANZ) to align investments with a 1.5°C limit to global warming, we forecast that thermal power will progressively lose market share, with its generation share falling from 72.3% in FY2021/22 to just 53.4% in FY2029/30.

Figure 1: India’s Electricity Capacity Addition Forecast Until 2030 (in GW)

Source: CEA, CEF Calculations

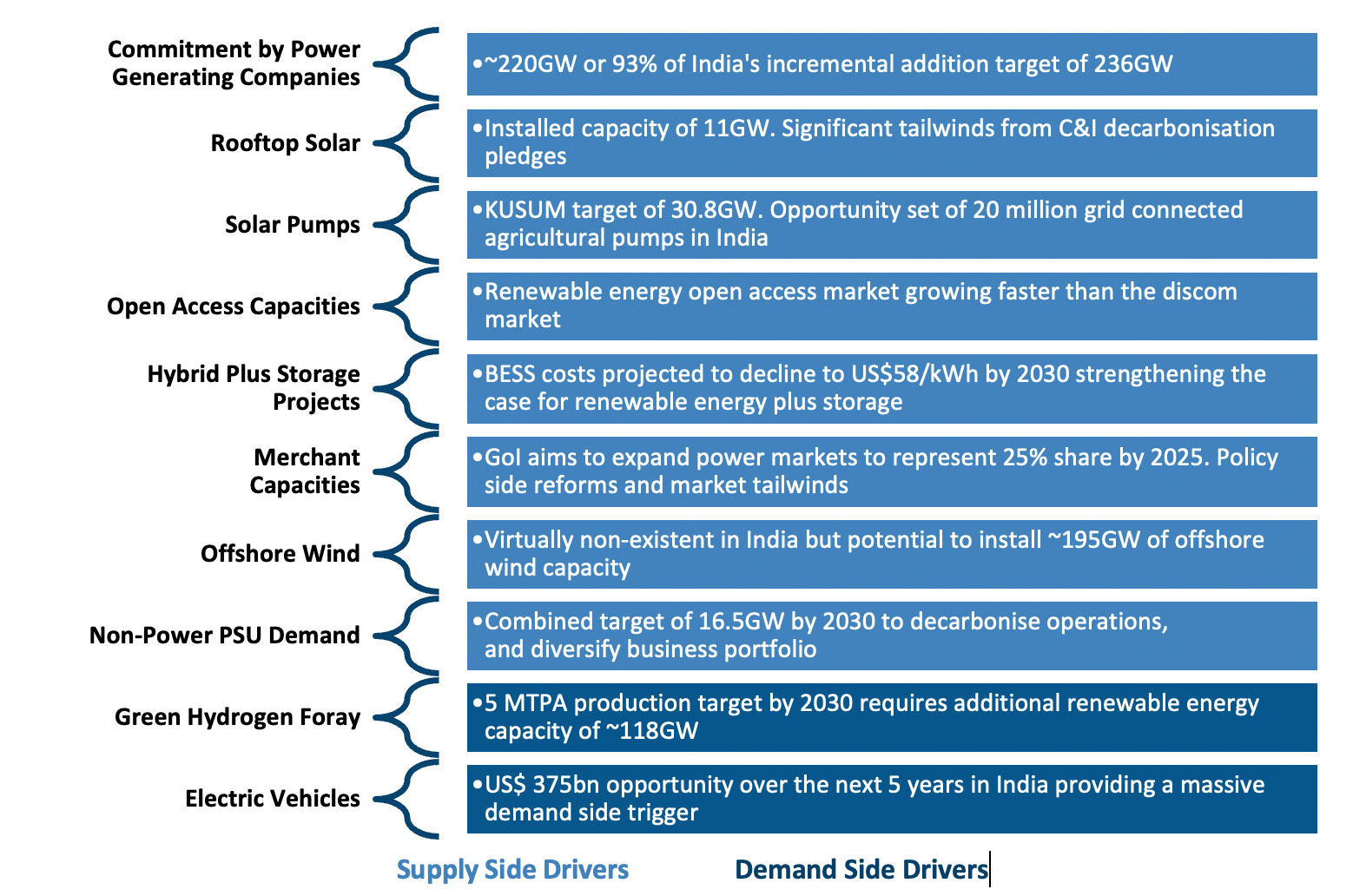

Our projections are supported by the ambitious capacity addition targets of the Indian government and commitments by a slew of players, both state and non-state, operating across industries, such as power and oil & gas, to steel and cement through the utility and distributed renewable energy segments.

In the utility-scale segment, the combined additional capacity targets through to 2030 by some of the top players operating in the industry stand at ~231GW. This includes commitments by state-owned NTPC at 60GW, Adani Green Energy at 45GW and Tata Power, ReNew Power and Acme Solar at 25GW each. While these targets seem aggressive, the Indian government seems unbending in ensuring its targets are met through facilitating growth across the renewable energy spectrum. Financially strong investors, such as the Indian government, domestic conglomerates and some of the biggest global investors, back most industry players, lending them the financial firepower needed to fulfil their capacity addition targets.

Our projections are supported by the ambitious capacity addition targets of the Indian government and commitments by a slew of players, both state and non-state, operating across industries.

On the decentralised renewable energy side, several segments have the potential to grow multifold as policy-side reforms streamline current bottlenecks and demand-side drivers provide lucrative returns. Even though the country has been a laggard in rooftop solar, state-level reforms, corporate decarbonisation, and net-zero pledges from commercial and industrial (C&I) customers will accelerate this segment exponentially. Similarly, solar pumps have a target of 30.8GW under the KUSUM scheme. But, the scheme has not made much headway to date due to several bottlenecks. With more than 20 million grid-connected agricultural pumps in India, consuming over 17% of the nation’s total electricity, the opportunity for solar pumps is enormous.

Several Indian public sector undertakings (PSUs) have also been committing to install renewable energy capacity in a bid to decarbonise their operations, diversify their business portfolio and also contribute to the government’s renewables plans. Non-power sector PSUs, including Oil and Natural Gas Corporation (ONGC), Indian Oil Corporation (IOC), Bharat Petroleum Corporation Limited (BPCL) and GAIL, have a combined renewable capacity addition target of 16.5GW by 2030.

On the demand side, green hydrogen is a major force that promises to massively drive India’s clean energy ambitions. India’s green hydrogen target of 5 million tonnes per annum (MTPA) by 2030 will require an additional renewable energy capacity of ~118GW. Corporates, such as the Adani Group and Reliance Industries, have wholeheartedly supported the country’s green hydrogen policy, announced in June 2022, and its 5MTPA target, with several major commitments.

Several other upside triggers are also present, which can contribute to the country’s clean energy target.

- Open access capacity installations buoyed by higher demand from C&I customers for procuring clean energy.

- Future wind-solar hybrid projects integrated with storage assets will become more competitive than thermal power, with the cost of battery energy storage systems (BESS) projected to keep falling.

- Merchant capacities traded through power exchanges are also projected to grow exponentially. Policy-side reforms and favourable market dynamics will continue to act as a driver for green merchant capacity additions in the foreseeable future.

- Offshore wind, a non-starter in the Indian markets, has been given a new lease of life through recent government reforms and targets. With a coastline of about 7,600 km, offering the potential to install ~195GW of offshore wind capacity, the segment can contribute to India’s clean energy target.

- Lastly, electric vehicle uptake, projected to be a multi-billion-dollar opportunity in the country, will be a major demand-side driver for clean electricity generation assets.

Figure 2: Demand and Supply Side Drivers of Renewable Energy Capacity Addition in India

Source: IEEFA & CEF Analysis

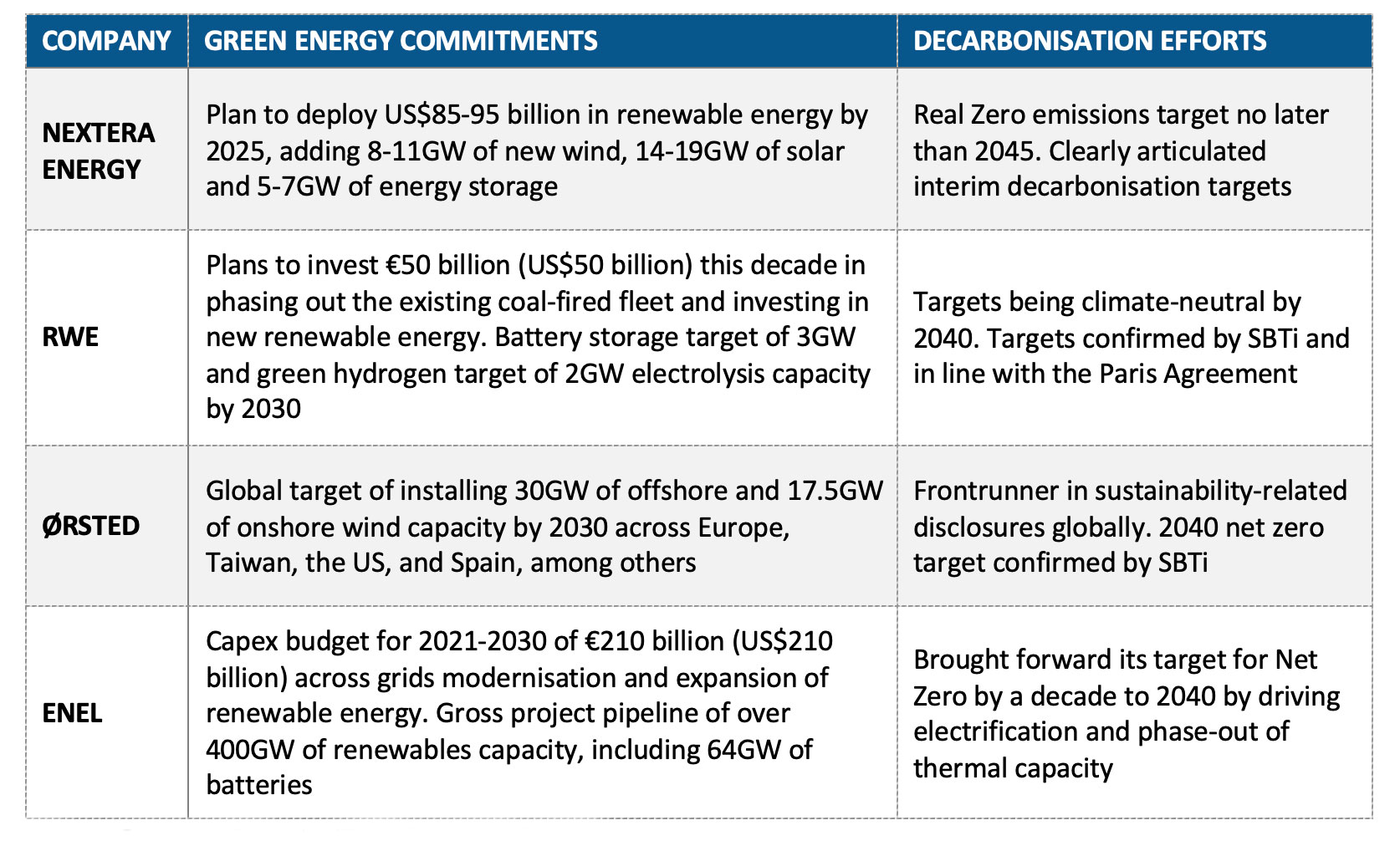

Understanding the clean energy commitments of domestic players compared with global counterparts also provides perspective on where India’s renewable energy plans stand relative to international developments and what Indian utility players can leverage from the experience of global leaders. An analysis of the clean energy trajectory and plans of four global energy transition utility leaders: NextEra Energy (US), RWE (Germany), Ørsted (Denmark) and Enel (Italy), shows that they are betting heavily on the global energy transition opportunities. Across all the jurisdictions where they operate, a recurrent theme has been accelerating action to progressively reduce fossil fuel-based asset reliance and doubling down efforts in supporting the clean energy sector.

These four majors have accelerated their world-leading investment plans in response to the hyperinflation of fossil fuel commodity prices, reflective of the increasing cost competitiveness of firmed renewable energy (even in the absence of a CO2 price). Further, all four have clearly articulated ambitious decarbonisation targets, and it is noteworthy that none rely on carbon offsets or the mythical use of carbon capture and storage (CCS). All are tapping into the global green bond market for long-duration funding at very commercial rates.

NextEra Energy’s investment plan to deploy US$85-95 billion over four years through to 2025 across solar, wind and storage assets supports its core strategy of expansion in the renewable energy segment. The recently announced Inflation Reduction Act of 2022 in the U.S. will likely accelerate its plans. The company has laid out a detailed decarbonisation target, announcing a Real Zero to eliminate all scope 1 and scope 2 carbon emissions across its operations by 2045. Clearly articulated interim decarbonisation targets set on a five-yearly basis will massively support NextEra’s ability to tap global sustainable finance markets, a point that Indian utilities, such as NTPC and Tata Power, should note. The company’s green pivot has struck a chord with investors too, with its share price materially outperforming the US equity market (+199%) over the last decade.

RWE of Germany has similar ambitions. The company targets to double to a net 50GW of renewable energy capacity by 2030, which requires a €50 billion (US$50 billion) investment. The German government coalition’s objective to accelerate the expansion of renewable energy as a top priority buoys RWE’s plans. RWE has doubled down on battery storage too, with a target of 3GW by 2030 up from just 47MW as of December 2021, underpinning the role that storage will play in the transition globally. Another integral part of RWE’s strategy is green hydrogen. It targets building 2GW of in-house electrolysis capacity by 2030 across Germany, the U.K. and Netherlands. Similar to NextEra, RWE has also pledged to decarbonise its operations to become climate-neutral by 2040, helping it issue two green bonds totalling €2 billion (US$2 billion) in May 2022.

RWE’s share market performance is a study in itself for Indian utilities pivoting towards clean energy. Its shares saw significant underperformance in the first half of the last decade as the fossil fuel heavy utility underestimated the speed of the stranding of thermal power assets, combined with the entirely flawed spin-off of its renewable energy division (Innogy) in 2015/16. But since then, RWE has pivoted to embrace a planned energy transition, and the company’s shares have materially outperformed the German equity market.

Another European player, Ørsted, is the perfect model of a conventional utility transitioning to clean energy and, in the process, creating immense wealth for its shareholders. The company currently has 7.5GW of offshore wind in operation and another 14.5GW of awarded capacity under development. It has a global target of installing 30GW of offshore wind capacity by 2030. After championing offshore wind technology in Europe, Ørsted is now exploring other markets, such as Taiwan, the U.S. and Spain, using its technological know-how and experience to capitalise on government reforms and market tailwinds to fulfil its 2030 capacity targets. This is a credit to its early pivot to clean energy compared to regional peers. Green hydrogen finds an important place in the company’s future strategy. Denmark’s green hydrogen foray into deep decarbonisation of transport and shipping sectors, along with developments across the Netherlands and Germany, have provided market signals to Ørsted to develop expertise in this nascent technology too.

Lastly, Italy’s Enel, with a global portfolio of 55.4GW of renewable energy, including 28GW of hydro, spanning 27 countries, is the world's largest renewable energy company. Enel’s gross capex budget for 2021-2030 is a staggering €210 billion (US$210 billion), split between grid modernisation and expansions and renewable energy generation capacity. As of June 2022, Enel had a gross project pipeline of over 400GW of renewables capacity, including 64GW of batteries. This is by far the largest investment program of any company globally in decarbonisation. While betting massively on battery storage, the company has not made many inroads into green hydrogen. On the sustainability front, Enel brought forward its target for Net Zero by a decade to 2040 by driving electrification and ongoing accelerated phase-out of its end-of-life thermal capacity with firmed renewable energy capacity. Unlike most fossil fuel firms, this puts no reliance on carbon removal and is 100% aligned and certified with 1.5°C in accordance with the SBTi. As a leading investor in decarbonisation, Enel has regularly tapped the global sustainable bond markets, being a leader in the issuance of sustainability-linked instruments.

Figure 3: Clean Energy Commitments and Decarbonisation Efforts of Global Utilities

Source: Company Reports; IEEFA & CEF Analysis

[1] Global Energy Monitor. Global Coal Plant Tracker. July 2022.