If Edwardsport Is the Future of Coal-Fired Power, It’s Not a Very Bright Future

Back in the early 2000s, integrated gasification combined cycle power plants—IGCC—were touted by proponents as the future of coal-fired electricity generation.

The theory was that while IGCC would be more expensive to build than traditional coal plants, those costs would be offset by gains in efficiency and by IGCC’s purported advantage in capturing and sequestering its carbon dioxide emissions. Put another way, the pitch behind IGCC was that it would bring, at reasonable cost, a form of highly efficient coal-fired generation online that would be comparable in cost to traditional technologies and would better meet tightening pollution regulations.

Several IGCC plants were proposed at about the same time, but most were canceled. One exception was the Edwardsport IGCC plant in southern Indiana, a project of Duke Energy, one of the biggest electric power holding company in the U.S.

Though the company has promoted Edwardsport as an innovative leap forward in power generation, the plant today seems more an experiment gone wrong—and one that Duke’s customers have largely had to pay for.

Though the company has promoted Edwardsport as an innovative leap forward in power generation, the plant today seems more an experiment gone wrong—and one that Duke’s customers have largely had to pay for.

Duke sold the Indiana Utility Regulatory Commission on the plant on three points:

The premium in price would be reasonable;

- It would be the most efficient and lowest-cost plan in its system;

- It would most likely be retrofitted with carbon-capture technology and stood to be “the cleanest coal-fired power plant in the world.”

None of those promises have come to pass. In fact, quite the opposite has happened on every point.

- Plant construction has ended up costing almost twice as much as Duke said it would. Edwardsport was originally billed as a $1.9 billion project but overruns have brought that figure to $3.5 billion.

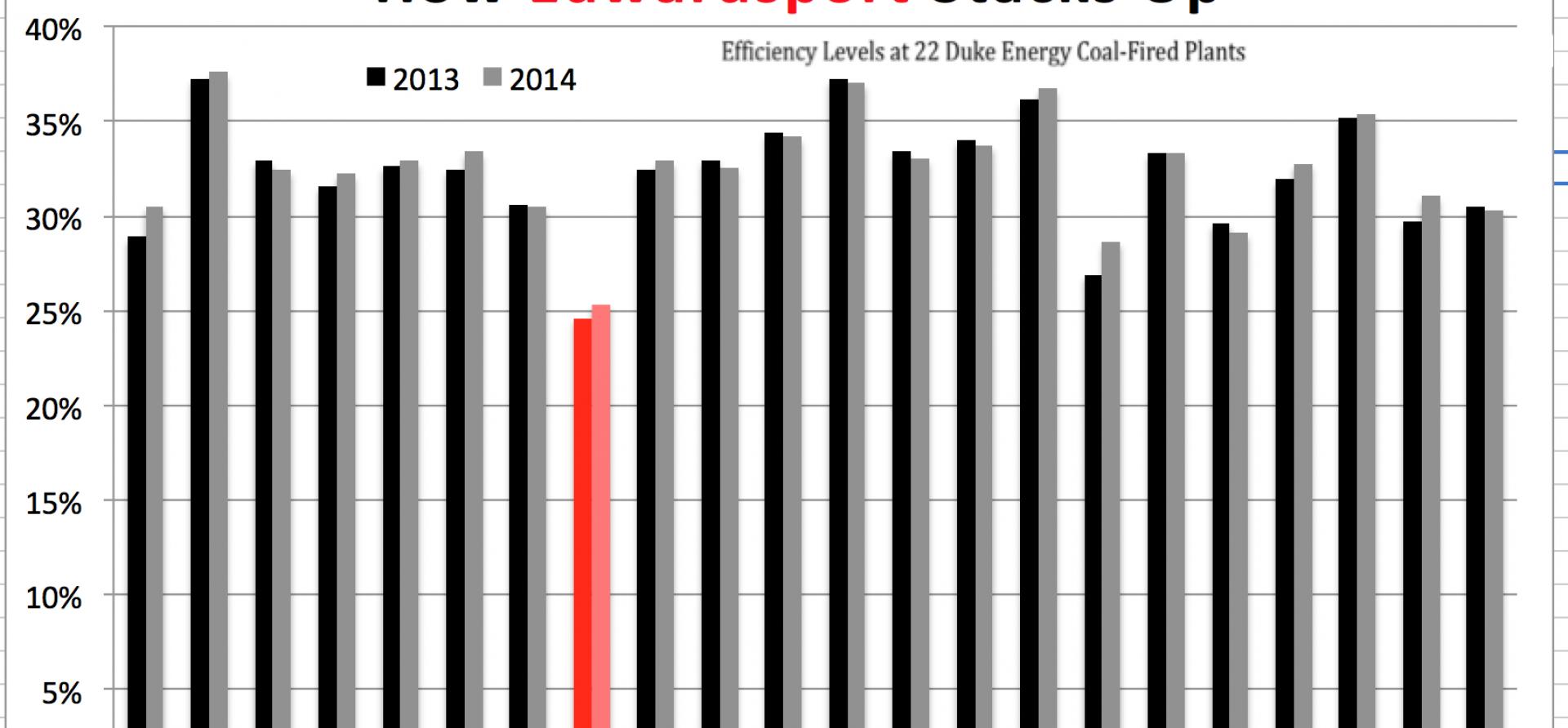

- Since it began operation roughly 19 months ago, Edwardsport has been far and away Duke’s least–efficient coal plant and it has been more costly to operate than most of the company’s coal-fired plants.

- Edwardsport has suffered from frequent problems that have caused extended outages—even shut down the entire plant—and reduced the power output of the facility well below what Duke promised, and Duke has concluded that carbon sequestration near the plant is not feasible and that the plant will not be retrofitted with carbon capture.

The result is that ratepayers are already on the hook for construction-cost overruns at the plant and may have to pay the price of the operational problems as well. The issue, as we speak, is before the Indiana Utility Regulatory Commission, which is considering Duke’s request to pass these costs on to customers.

If Duke has its way, residential customers will pay at least an additional $17.11 a month—more than $200 per year—in Edwardsport capital and maintenance costs alone. Business and industrial users will pay even more, and costs for fuel will add to all users’ monthly bills. Ratepayers, in short, will have been saddled with this failed experiment.

If Edwardsport is the future of coal, it is not a bright future.

Indeed, the project only adds to the evidence against IGCC as an economically feasible technology, as shown elsewhere too. The other prime exhibit: Southern Company’s Kemper County IGCC plant in Mississippi, which recently posted its latest cost overrun, raising the price tag of the plant to $6.1 billion, nearly three times what Southern said it would cost.

Anna Sommer is president of Sommer Energy, a utility-regulation consulting firm.