IEEFA U.S.: North Carolina regulators need to require revisions in Duke’s demand growth forecasts

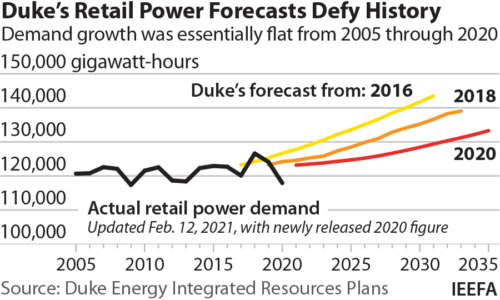

Duke Energy reported this month that total retail sales at its two North Carolina utilities dropped to 117,970 gigawatt-hours (GWh) in 2020, down 6,114GWh from the year before—undercutting the entire growth analysis in the companies’ pending integrated resource plans (IRPs). The starting point for those plans was roughly 124,000GWh, with projections of 1% annual growth.

The statistics—showing a decline of almost 5% in retail sales—give greater urgency to the need for North Carolina regulators to require Duke to revise the electricity sales growth forecasts in its IRPs before signing off on them.

The statistics—showing a decline of almost 5% in retail sales—give greater urgency to the need for North Carolina regulators to require Duke to revise the electricity sales growth forecasts in its IRPs before signing off on them.

Taking the projected 1% annual growth rate included in the IRPs for the companies’ retail sales, it would now take five years for Duke to recover the sales lost in 2020. At that rate, total retail sales would hit 123,988GWh in 2025, finally bringing the company back roughly to its 2019 level. Even allowing for slightly faster growth in 2021 and 2022 (of 2% and then 1.5%), the company’s sales would still not hit the 2019 mark until 2024. It is worth noting that Duke’s growth estimates for 2021 as outlined in its earnings call are between 1% and 2%. In other words, it is expecting sales to grow from their current level as opposed to returning quickly to pre-pandemic levels.

It is also important to note that the 2020 decline in sales occurred even though the company continued to add customers. Its year-end results show the total number of customers at its two utilities climbed by more than 88,000, an increase of 2%. Duke used projections of future customer growth as a central rationale for its expectation of electricity sales growth during the 15-year span of the IRPs. But it is clear from the 2020 results, which continued a decade-long trend, that the two factors are not tightly linked. Duke’s customer totals have risen significantly since 2010; its retail sales have not.

This effective reset in the company’s sales growth, clearly seen in the figure below, calls into question the company’s estimated need for future generation, particularly any large gas-fired combined cycle units. In essence, the company now has a five-year window to reconsider its forecasts without the risk of running short of capacity or the time required to add new generation resources. IEEFA expects that when it conducts that reassessment, Duke will find that renewable resources and battery storage are the least-cost option.

North Carolina regulators need to act and require Duke to revise its growth estimates to reflect reality.

Dennis Wamsted ([email protected]) is an IEEFA analyst/editor.

Related Links:

IEEFA U.S.: Duke IRPs focus on new gas-fired generation, creating serious stranded-asset risks

IEEFA U.S.: Duke IRPs overstate likely future demand growth

IEEFA U.S.: Duke Energy’s North Carolina gas IRPs fail to consider battery storage as viable option