IEEFA Update: Proposed switch from coal to LNG threatens renewable energy development in Asia

A concerted effort by the U.S. gas industry to push LNG onto developing Asian nations is jeopardising renewable energy investment across the continent.

Vietnam’s new draft long term energy plan indicates lowering coal power ambition but increased focus on LNG is included at the expense of solar power development. Meanwhile GE has been working to convince Bangladesh to buy its LNG power technology.

Replacing Bangladesh coal projects with LNG a missed opportunity

The Bangladesh government is set to cancel 9 proposed coal power projects

Continuing reports suggest the Bangladesh government is set to cancel 9 proposed coal power projects. This should be an opportunity for the country to address significant issues within its power system.

However, a signalled move to replace 13 under-construction coal power projects with LNG will see this opportunity missed.

Bangladesh has a growing overcapacity problem in its electricity sector. Power plants receive capacity payments despite lying idle much of the time, pushing up the average cost of electricity. This risks the financial sustainability of the sector as demonstrated in Pakistan where capacity payments are on course to reach US$10 billion/year by 2023.

Switching from coal to LNG will do nothing to solve the growing overcapacity issue in Bangladesh.

Furthermore, a shift to LNG would expose Bangladesh to even greater fossil fuel price volatility. Japan – currently highly dependent on imported LNG – saw its electricity prices surge to record levels in January 2021 as LNG prices spiked.

A shift to LNG would expose Bangladesh to even greater fossil fuel price volatility

The recent energy crisis in Texas is another warning for Asian nations planning an increased reliance on LNG.

Bangladesh’s new 8th Five Year Plan highlights that further reliance on imported LNG and coal will increase the cost of electricity generation. The result will be higher electricity prices for consumers or further subsidies – an unsustainable burden on Bangladesh’s economy.

The high cost of LNG is already causing Bangladesh’s fossil fuel subsidies to increase unsustainably so as to avoid significant electricity price rises that could hold back its developing economy.

The new Five Year Plan also notes fossil fuel subsidies have held back renewable energy development in Bangladesh. The nation’s Sustainable and Renewable Energy Development Authority (SREDA) is now recommending a new solar target to address this.

Fossil fuel subsidies have held back renewable energy development

SREDA’s draft National Solar Energy Roadmap recommends aiming for a high-deployment solar installation target of up to 30,000 megawatts (MW) by 2041. However, this target risks being crowded out by an increased focus on LNG-fired power investment.

Amid continued electricity demand growth, a switch in focus to renewable energy can help address overcapacity relative to the continued rollout of large fossil fuel-fired power stations if it’s also accompanied by grid investment to make better use of existing capacity.

SREDA sees 12,000MW of its 30,000MW target coming from the significant potential of rooftop solar in Bangladesh: 5,000MW could be installed on garment, textiles and other industrial building rooftops. Similarly, it has been calculated that 2,000MW could be installed on government buildings.

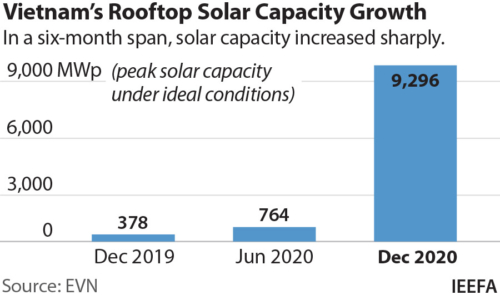

Capacities of this scale look entirely achievable given Vietnam was able to add an astonishing 9,000MW of rooftop solar in 2020.

LNG pushing out solar in Vietnam’s new power plan

However, despite Vietnam’s major renewable energy installation achievements, solar power development is now at risk from an increased focus on LNG.

Vietnam has been scaling back focus on coal-fired power

Like Bangladesh, Vietnam has been scaling back focus on coal-fired power as more banks distance themselves from coal finance and due to the very long development timeframes of such projects.

Vung Ang 2, one of the latest coal power projects to have concluded the pre-investment phase, required 12 years for the sponsors and Vietnamese state agencies to reach an agreement on the contract terms alone. A further 5 years is expected for the plant’s construction, without accounting for new construction risks.

However, new LNG-fired power proposals are more challenging to execute than coal power.

The need for new associated, additional infrastructure – regasification, storage, pipelines, and market development – means new LNG-fired power proposals can’t be implemented at the rate suggested by the many sponsors promoting overambitious targets for their project’s development milestones.

LNG-fired power proposals are more challenging to execute than coal power

While many conventional coal and LNG-power projects in Vietnam failed to progress during the development process, only managing to meet half of the country’s targeted capacity for 2016-2020, solar power developers over-delivered by five times, and they have done so in a fraction of the time.

Moreover, renewables project developers come into these cost-sensitive markets with a growth mindset, acknowledging that they will need to share some market development risk with consumers.

Notwithstanding this, Vietnam’s latest draft long term power plan (Power Development Plan VIII) sees increased LNG-fired power ambition crowding out solar. A total of 18GW of LNG-fired power is now planned to be added by 2030 while solar additions are suddenly capped at just 2GW.

Like Bangladesh, Vietnam would benefit from a switch in focus away from more lengthy, large-scale fossil fuelled power additions and towards grid and battery storage investment. This would enable a continuation of Vietnam’s solar and wind development progress rather than a curtailment. It would also enable the nation to optimize investments in the renewables plus storage technologies that are expected to see sharply declining costs over the coming decade.

Vietnam would benefit from a switch in focus towards grid and battery storage investment

Japan – which has been a major promoter of its own coal-fired power technology – now appears to be backing away from further coal power development in Vietnam. Most recently, Mitsubishi Corp pulled out of the Vinh Tan 3 coal power proposal as it and other Japanese trading houses withdraw from thermal coal power and mining activities globally.

In addition, the Japan Bank for International Cooperation (JBIC) has stated it will no longer finance coal power projects overseas.

However, if the emphasis switches to LNG, Vietnam will face much the same set of risks it faced when its focus was on coal, with the added problem of increased fuel price volatility and massive new investments required to build a full value-chain of LNG infrastructure.

In Bangladesh, the Japan International Cooperation Agency (JICA) signed an agreement this month to assist with the development of the nation’s new long term power and energy plan. JICA – which financed Bangladesh’s long-delayed Matarbari coal power plant and is considering funding another – has stated its work on the plan will promote a “transformation to a low or zero carbon energy system”.

It will be hard for JICA to justify a focus on LNG in Bangladesh

Given LNG’s full lifecycle greenhouse emissions are comparable to that of coal-fired power, it will be hard for JICA to justify a focus on LNG in Bangladesh’s new power and energy plan, rather than on renewables.

As a development agency, JICA should also be aware that a switch from one fossil fuel to another that is exposed to even greater fuel price risk, does nothing to improve the sustainability of a power system exposed to capacity payments, large financial losses and government subsidies.

North Asian nations, like Japan, have their own market development goals related to increasing the demand for gas and hydrogen. This should not be allowed to colour the analysis of the energy transition needs of the rest of the region. Developing Asian nations do not need growing fossil fuel subsidies dialling up stress on government finances and necessitating power tariff hikes that impact consumers and businesses.

Instead, nations like Bangladesh and Vietnam will be better served by ever-cheaper modern technology that can reduce the cost of electricity generation and support their development. That means the focus must be on cheaper renewable energy.

Related articles:

- Renewables should be focus of Vietnam’s Draft PDP8, not coal and gas

- Over US$50 billion in gas power projects and LNG import facilities at risk of cancellation in Bangladesh, Pakistan and Vietnam

- There will be no smooth sailing for LNG investors in Vietnam

- Bangladesh’s power system overcapacity problem is getting worse