IEEFA Update: Bylong Coal Project exhausts its last legal avenue

A last-resort bid to mine coal next to the Blue Mountains World Heritage Area in New South Wales has been rejected by Australia’s High Court. The Bylong Coal Project was proposed by South Korean power utility KEPCO and was designed to provide coal for its domestic coal-fired power fleet.

This latest setback for the company was the last legal avenue for the project.

IEEFA has been following the project since 2018. In June of that year, IEEFA submitted an expert review to the Independent Planning Commission (IPC) that was assessing the mine application, highlighting that the project was unnecessary given the shift away from coal-fired power that was about to begin in South Korea and the rest of Asia.

This was followed up by a further submission in November 2018, rebutting KEPCO’s response to our original submission.

In September 2019, the IPC refused development consent for the project on the basis of its impacts on groundwater, climate and agricultural land as well as natural, heritage, scenic and aesthetic values.

Developing new coal mines in NSW made increasingly little sense

Upon this refusal, IEEFA took the opportunity to remind stakeholders – including the NSW Government – about the building energy transition away from coal in South Korea and around Asia, which meant that developing new coal mines in the state made increasingly little sense.

In February 2020, IEEFA highlighted that KEPCO had written off the project in its books following the IPC’s refusal.

KEPCO then applied for a judicial review and in December 2020 the New South Wales (NSW) Land and Environment Court rejected the company’s appeal against the IPC decision.

A further appeal by KEPCO failed when the NSW Court of Appeal upheld the IPC’s decision in September 2021.

KEPCO’s last roll of the dice for the project in its present form was to seek special leave to appeal in the High Court. The rejection of this request by the High Court this month leaves the project with no further legal options.

South Korea’s accelerating retreat from thermal coal

Since the Bylong Coal Project was proposed, the outlook for South Korean thermal coal demand has shifted dramatically. South Korean energy policy has left the project behind.

In October 2020, the South Korean government announced its target to reach net zero emissions by 2050. At the April 2021 climate summit hosted by the U.S., South Korea committed to end public finance for coal-fired power overseas and to set a more ambitious schedule for reducing domestic emissions.

Then in October 2021, the government approved two roadmaps to reach carbon neutrality by 2050. Under each option, coal-fired power is completely phased out by 2050.

At the same time, South Korea’s new 2030 emissions reduction target was approved by the government, to reduce total carbon emissions by 40% compared to 2018 levels. This compares to the previous 2030 emissions reduction target of 26%.

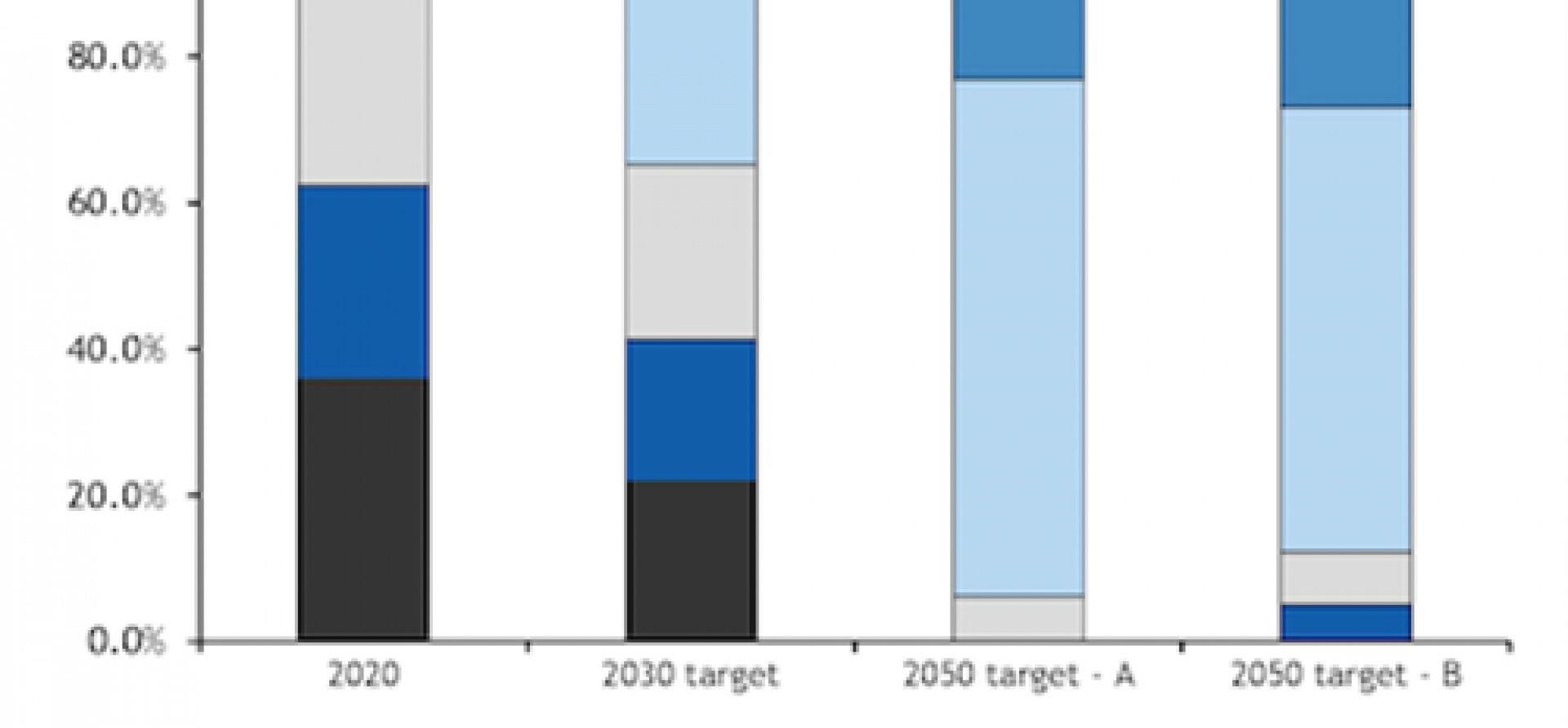

South Korean 2020 Power Generation v Targets (%)

Source: Argus Media

This new 2030 target means that coal’s share in the South Korean power generation mix will almost halve by 2030 to 22%, down from 42% in 2018. The share of renewables in the power mix will increase dramatically to reach 30% by 2030, up from 6% in 2018.

In December 2021, South Korea unveiled the first detailed plan for how it will reach its coal phase out target. The nation will shut down 24 coal-fired power plants – almost half the South Korean fleet – by 2034 and the operation of the remaining plants will be restricted.

KEPCO’s most recent investor presentation reflects this national policy to shift away from reliance on coal.

In support of the national targets, KEPCO’s presentation outlines its own coal power reduction plans – the company’s coal power capacity is to reduce from 33.2GW in 2020 to 19.8GW by 2034 with no further coal capacity to be built and all generation from coal to cease by 2050.

South Korean thermal coal demand has shifted dramatically. Energy policy has left the project behind

KEPCO also highlights a highly ambitious shift into renewable energy. It states that it will move from 1.7GW of renewable capacity in 2020 to 42.6GW by 2030.

Offshore wind will play a major role in the nation’s shift to renewables. South Korea plans to build the world’s largest offshore wind plant by 2030. At 8.2GW, the plant will be almost seven times larger than the UK’s Hornsea project, currently the world’s largest. KEPCO is among the major South Korean companies involved.

There are also plans for a 6GW floating offshore wind plant, also to be the largest of its type. In November 2021, Equinor and Korea East-West Power signed a Memorandum of Understanding for a 3GW offshore farm in South Korea using Equinor’s new floating wind technology.

The type of energy transition planned by South Korea is increasingly mirrored around Asia – the region that represented the mining industry’s last hope of coal demand growth.

The accelerating pace of the energy technology transition has significant implications for the Australian coal industry and questions the sense of adding coal supply into a market set for long-term decline. In such a market, extra mining capacity only steals market share from existing operations, putting jobs at risk.

Following the Bylong Coal Project’s failure, there is little sense in attempting new Australian thermal coal projects.

Simon Nicholas is an energy analyst at the Institute of Energy, Economics and Financial Analysis.

This first appeared in Renew Economy.

Related articles:

IEEFA Australia: Captive insurers threaten an orderly coal exit

IEEFA: Risks are rising for ‘new generation’ of Australian coking coal projects

IEEFA update: One of NSW’s major coal customers is going through transition pains