IEEFA update: The American wind-energy horse is out of the barn

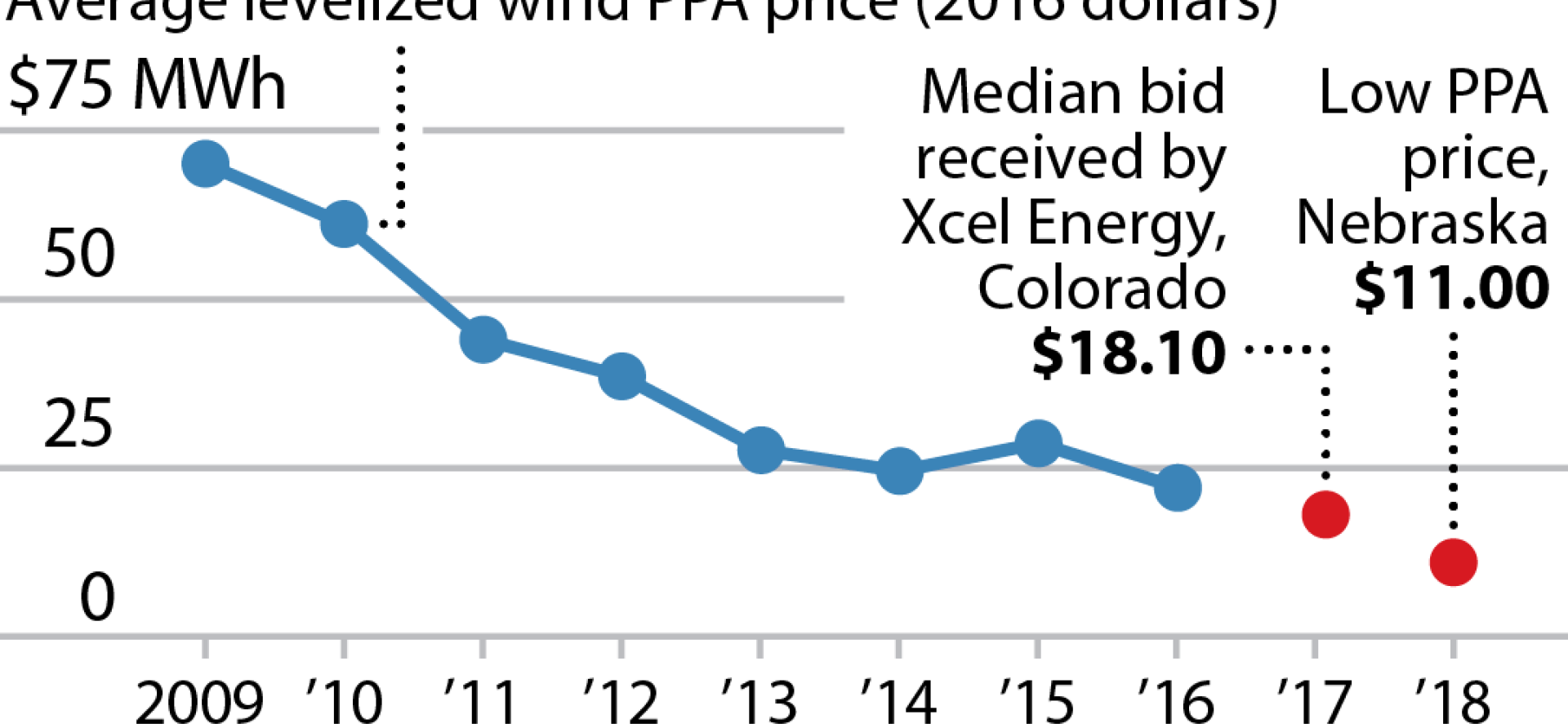

Almost a decade has gone by now since U.S. wind-turbine power purchase agreements were priced at $70 per megawatt-hour. Technology advances and efficiency gains have since driven a seemingly relentless drop in such prices.

Average wind power purchase agreements had fallen to $20 per megawatt-hour (MWh) by 2016, and in December 2017, Xcel Energy—the Minnesota company that provides power to millions of customers across eight states—reported that a power-generation solicitation in Colorado drew bids for renewable power that were “incredible.” The median bid for wind projects received at that time by Xcel Energy was $18.10 per MWh: for wind-plus-storage projects—that is, wind farms coupled to battery-storage complexes—the median bid was $21 per MWh. “Median” of course signifies the midpoint in a data set, which means that half of those Xcel bids were below those prices.

And indeed wind PPA prices recently went as low as $11 MWh in Nebraska.

These price declines have occurred—and are continuing to occur—in part because of lower installation costs and rapid improvements in wind-generation technology (large-diameter turbines and higher hub heights). The latter have led to better operating performance and an increase in market share for turbines designed for lower-wind sites.

Renewable-generation momentum is likely to continue as solar comes up fast on wind’s heels.

Granted, PPA prices are unlikely to continue to decline at recent rates, especially given the tariff-driven increases in the cost of steel for turbines and the stepping-down of the federal wind production tax credit in coming years.

But the horse is out of the barn, so to speak, and has been for a while, as can be seen in this captivating national map of “wind country,” which it turns out stretches coast to coast. The map, courtesy of Christopher Ingraham at the Washington Post, pinpoints county-by-county locations for the almost 58,000 wind turbines in the U.S. It is built from a national wind-turbine database compiled by the U.S. Geological Survey, the Department of Energy, Lawrence Berkeley National Laboratory and the American Wind Energy Association.

American wind farms are big business, and investment in new wind power capacity in 2017 alone amounted to $11 billion. An article this past January by Platts broke the trend down some state by state, noting that Texas led in 2017 capacity installations “with 1,179 MW installed, followed by Oklahoma with 851 MW, Iowa with 334 MW, Illinois 306 MW, and Missouri 300 MW.”

“AWEA noted that wind developers have reported 13,332 MW of wind capacity currently under construction and 15,336 MW in advanced development, a 34% year-on-year increase,” Platts noted.

In 2017 alone, total investment in the U.S. wind energy industry totaled $11 billion, and gigantic companies like Xcel, Berkshire Hathaway Energy and Alliant Energy are driving further growth.

Momentum is likely to continue as wind replaces traditional power generation, and as solar comes up fast on wind’s heels, as detailed in an IEEFA report last month by my colleagues Tim Buckley and Kashish Shah.

Change is happening fast—regionally, nationally, and globally—and more is on the way.

David Schlissel is IEEFA’s director of resource planning analysis.

RELATED ITEMS:

IEEFA update: Ignoring Washington, heartland utilities continue to move away from coal

IEEFA Report: Advances in Solar Energy Accelerate Global Shift in Electricity Generation

IEEFA Update: Modernization Is the Ticket to National Energy Security