IEEFA: Lessons from the Texas energy crisis for emerging LNG importers in Asia

The Texas energy crisis has become world news.

During last week’s extreme winter weather, surging electricity demand collided with falling generation, forcing the state’s grid operator to implement rolling blackouts. In many cases, blackouts lasted for over 24 hours, causing fuel and electricity supply shortages and disruptions throughout the gas supply chain. At least 4.5 million Texans were at one point without electricity and more than 30 deaths have been attributed to power losses, though the final toll could be much larger.

News of the Texas power crisis has spread throughout Asia, where energy growth markets such as Vietnam, the Philippines, and Bangladesh are considering U.S. liquified natural gas (LNG) imports as an alternative to coal-fired electricity generation. But the events in Texas have highlighted the risks inherent in LNG imports for both the energy transition and climate change adaptation.

Below are five lessons from the crisis for emerging markets in Asia.

Lesson 1. Gas/LNG volatility is here to stay.

It has been a tumultuous year in global LNG markets. The COVID-19 outbreak sent global LNG demand plummeting and Asian prices hit an all-time low of $1.85/MMBtu last May. U.S. LNG export facilities remained idle for much of the summer, oil and gas drilling fell by 40% internationally, and bankruptcies in the North American oil and gas sector soared to their highest level since 2016. Starting in the fall, a combination of production shut-ins, shipping delays, and cold weather caused Asian LNG prices to spike to a record high of $32.50/MMBtu.

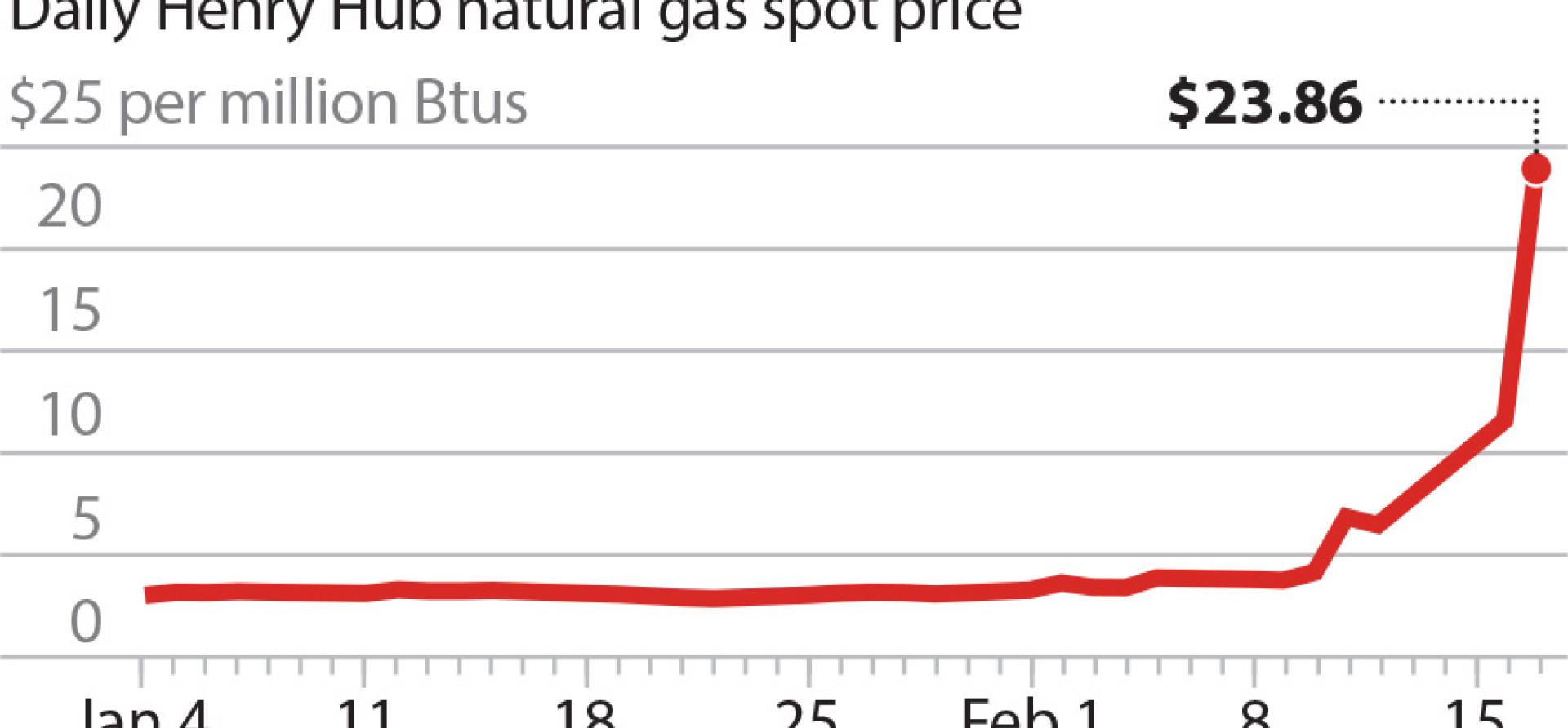

The Texas energy crisis is another sign that volatility in global gas markets is likely to continue. High electricity demand combined with supply chain disruptions sent wholesale natural gas prices skyrocketing. At Texas’s Waha Hub, for example, prices jumped from $2.77 to $219, while spot prices in Oklahoma’s Oneok hub jumped to over $1,000/MMBtu. For gas producers able to keep wells operating, the Texas freeze was “like hitting the jackpot,” but for LNG exporters, power outages disrupted liquefaction trains and feedgas pipelines. Several LNG export terminals scaled back production, while Corpus Christi LNG and Cameron LNG went offline completely. Overall, 10 cargoes amounting to 1 billion cubic meters of gas were likely delayed from the already-volatile global LNG market.

Volatility in global gas markets is likely to continue

Lesson 2. Volatile prices can cause LNG-fired power plants in Asia and associated infrastructure to go under-utilised.

Volatile LNG prices create an increasingly challenging environment for price-sensitive emerging markets. High prices and difficulties sourcing gas can cause gas-fired power plants in importing countries to go underutilized. In turn, all the associated infrastructure – ports, regasification facilities, pipelines – are also at risk of being stranded. IEEFA recently estimated that volatile LNG prices put over $50 billion of natural gas projects at risk of cancellation in Vietnam, Bangladesh, and Pakistan.

Since the value of associated infrastructure is dominated by fixed costs, per unit natural gas prices depend largely on total gas demand. This means that to realize any economic benefits from imported gas, costs must be spread over a wider consumer base than currently exists in many south and southeast Asian countries. The decision to import LNG is therefore not an incremental one. Rather, it will lead to new sources of financial vulnerability resulting from long-term, large-scale fossil gas lock-in. Without major storage capacity, volatile LNG prices will be a constant threat to the affordability of gas and gas-powered electricity in import markets.

Lesson 3. LNG imports come at the cost of domestic energy security.

By importing greater volumes of LNG, Asian countries become more vulnerable to supply disruptions in global gas markets and geopolitical dynamics beyond their control. With increasingly severe and frequent weather events caused by climate change, Asian importers are not just assuming the risks of climate-related disruptions in their own country, they are also assuming risks of climate-related weather events in exporting countries. In Texas, generators were not required to invest in cold weather safeguards, leaving them vulnerable to unpredictable weather events.

LNG import infrastructure in Asia is highly vulnerable to extreme weather

LNG import infrastructure in Asia is also highly vulnerable to extreme weather. While numerous countries rely on floating storage and regasification units (FSRUs) as cheaper alternatives to land-based import terminals, FSRUs are difficult to operate in poor weather conditions. In 2018, Bangladesh announced it would cancel plans to build additional FSRUs because they were unreliable during the monsoon season. In Malta, the inoperability of FSRUs during storms has caused the complete shut-down of the country’s gas-fired power plants.

Lesson 4. Grid expansion and modernization must take centre stage.

Some commentators have suggested the solution to climate-related blackouts is to build more generation capacity, but all power sources are susceptible to outages when weather events occur. In Texas, 30,000MW of thermal capacity was forced offline – including 40% of natural gas capacity and a nuclear reactor – as well as 17,000MW of wind capacity. As a result, wholesale electricity prices skyrocketed to the state’s $9,000 per MWh cap, up from their average of $30.

Along with generation capacity, grid reliability depends largely on transmission infrastructure and interconnections to other areas. The Texas grid is highly isolated from surrounding power systems, limiting power imports from nearby markets. In small portions of the state connected to other grids, cities experienced brief blackouts compared to the rest of the state.

A greater emphasis on system-level planning in emerging Asian markets, rather than a myopic focus on generation, could improve the efficiency of existing generators, enable the installation of greater capacities of domestic renewable energy, and lower wholesale electricity prices during times of short supply.

Lesson 5. The energy transition is a humanitarian issue.

The COVID-19 pandemic and the Texas energy crisis have exacerbated the risks inherent in LNG imports and revealed the flaws of centralized generation capacity buildouts. In Texas, blackouts disproportionately affected low-income communities, while electricity bills for some households that maintained power spiked into the tens of thousands of dollars. The total cost of electricity sold in Texas from February 15-19 was $50.6 billion, up from $4.2 billion in the prior week. For Asian countries already grappling with high electricity prices, the risks of LNG imports and associated infrastructure lock-in are simply too high. Instead, reliability and resilience are key to keeping costs down and the lights on.

Read the Vietnamese translation here.

Related articles:

LNG volatility causes tender cancellations in Bangladesh, Pakistan

Growing risks for US$50 billion of Mozambique LNG projects

Risks rise for ExxonMobil, Total LNG projects in Mozambique