IEEFA India: Restrictive banking provisions hampering renewable sector growth

In the last few years, India’s renewable energy installations have increased substantially from 63 gigawatts (GW) in December 2017 to reach 104GW as of November 30, 2021. Falling technology costs and a strong regulatory push from the Central government have helped to drive this growth, along with state governments giving various waivers and incentives to developers and installers.

However, restrictions to one such provision from the states – the banking of power – risk slowing the growth of the rooftop solar and open-access solar market.

Banking restrictions will impact the growth of the rooftop solar and open-access solar market

Banking allows a generating plant to supply excess power to the grid, with the option of drawing back the same amount of power within a certain time period and against the banking charges specified by State Electricity Regulatory Commissions (SERCs).

Banking provisions are particularly important for open access solar and wind projects, which sell electricity direct to commercial and industrial (C&I) consumers and have high potential to generate excess energy during peak summer or windy seasons.

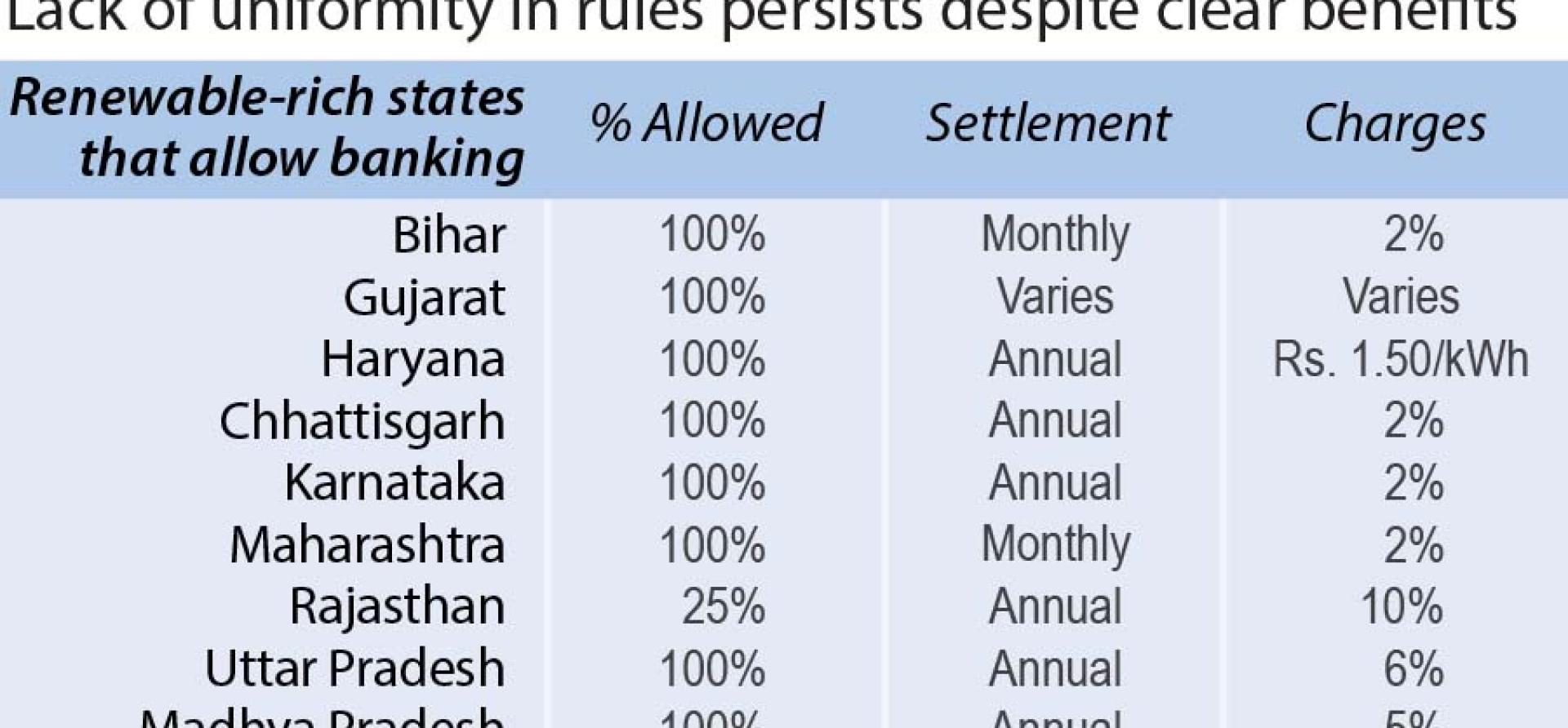

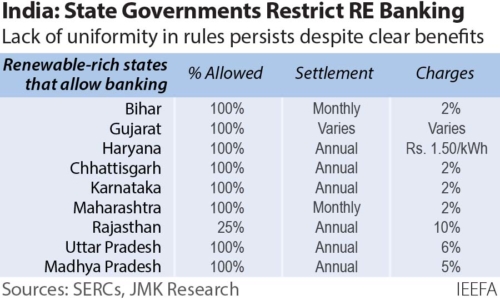

Generally, banking in India is provisioned at the point of consumption by the electricity distribution companies (discoms) and is only permissible for intrastate transactions.

Until recently, most states offered an annual banking provision. But many of the renewable energy-rich states have now moved to a monthly banking period, and in some cases have withdrawn banking facilities completely for renewable energy projects. Gujarat and Maharashtra, for example, have introduced daily and monthly banking periods respectively now for solar, while Andhra Pradesh has completely withdrawn its banking facility.

Gujarat and Maharashtra have introduced daily and monthly banking periods respectively for solar

State discoms say banking facilities were introduced to promote the adoption of renewable energy and that these restrictions are now justified in most renewable energy-rich states because they are close to achieving targets set by the Ministry of New and Renewable Energy (MNRE).

But while discoms say they face an additional cost burden, which leads to higher per unit electricity costs for consumers, the underlying reason for banking restrictions is to discourage high-paying C&I consumers from switching from conventional to alternative power procurement through the rooftop and open-access renewable power procurement model.

Following various state regulators’ restrictions, the Ministry of Power (MoP) in August 2021 issued draft electricity (Promoting Renewable Energy through Green Energy Open Access) rules that allow banking on a monthly rather than on an annual basis for open-access consumers.

With banking facilities withdrawn or restricted to monthly periods, excess generation from intermittent sources like solar and wind will be lost and the business model for solar projects selling power via the open-access model will become unviable.

In a new briefing note, we suggest alternatives to banking restrictions including the option of discoms paying for banked energy at their lowest cost of procurement discovered in any competitive bids in that state, instead of returning power back to the developer/end consumer.

As of March 31, 2021, the C&I segment’s renewable energy share was just 2% to 14% of the total (thermal+renewable) installed capacity across most key renewable energy-rich states. This is less than 1% of the overall electricity generation portfolio across these states.

Imposing restrictions at such an early phase of renewable sector growth will have little effect on discoms’ finances, but will slow progress towards India’s renewable energy target of 450GW by 2030.

Jyoti Gulia is Founder of JMK Research & Analytics

Vibhuti Garg is an Energy Economist and Lead India at IEEFA

This article first appeared in Solar Quarter

Related items:

IEEFA/JMK India: New restrictions on banking of power risk curbing renewable energy growth

IEEFA/JMK Research: Round-the-clock tenders can help meet demand for firm renewable power

IEEFA India: Financing options must be scaled up to boost adoption of rooftop solar