IEEFA India: Andhra Pradesh’s forceful contract renegotiations could derail US$40bn of potential investment flows into renewables

Andhra Pradesh (AP) is one of the top renewable energy states in India in terms of installed capacity as well as potential.

In early 2019, AP introduced new solar, wind and wind-solar hybrid power policies aligned with its near-term target of installing 18 gigawatts (GW) of renewable energy by FY2021/22. As of June 2019, AP had 7.9GW of grid-connected renewables capacity of which 4.1GW was wind, 3.3GW was solar and 0.5GW was biomass energy, while also boasting the fully operational 1GW Kurnool Solar Park, one of the largest in the world.

Recent chaos however in AP’s renewable sector may jeopardise both the state’s ambitious targets and US$40bn of potential incoming investments over the coming decade.

Recent chaos in AP’s renewable sector may jeopardise the state’s ambitious renewable energy targets

In reviewing the state’s position, the newly elected Chief Minister Jaganmohan Reddy (May 2019) has called for retrospective renegotiation and even cancellation of renewable energy projects contracted during the previous government, suggesting corruption in the awarding of contracts, and further blaming contracts for the financial losses of AP’s state-owned power distribution companies (discoms).

The Chief Minister also called for a slew of measures including recovery notices for solar and wind projects contracted at high tariffs, a revision of high tariffs to match the level of recent low tariffs, and cancellation of a few big projects including 21 wind power projects, the landmark 600 megawatt (MW) Siemens Gamesa hybrid project, the Axis Energy hybrid project, a number of energy storage projects and about 600MW of schedulable power.

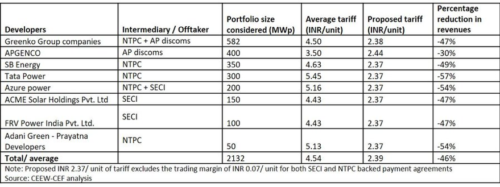

Figure 1: List of Some of the Contracts Under Contention

The renewable power tariffs under contention range from Rs3.50/kWh to Rs5.45/kWh and were signed during the previous feed-in-tariff regime.

India’s wind energy procurement had moved to the far more successful reverse bidding auctions since 2017, and contracts have been awarded at the lowest bid price rather than at pre-determined fixed feed-in-tariffs set by the procuring party. The auctions have brought transparency and competition in renewable energy procurement, locking in massive, long term deflation to electricity consumers of India.

THE CORE OF THE ISSUE HOWEVER IS THE LOSS-MAKING STATE-OWNED DISCOMS. AP’s two discoms, Andhra Pradesh Southern Power Distribution Company (APSPDL) and Andhra Pradesh Eastern Power Distribution Company (APEPDCL), have both made entirely unsustainable losses of Rs934 crore (US$130m) and Rs628 crore (US$90m) respectively in FY2018/19. The gap between average cost of supply (ACS) and average revenue realised (ARR) per unit of electricity supplied was prohibitively high at Rs0.23/kWh and Rs0.71/kWh for APSPDL and APEPDCL respectively.

Expensive legacy thermal power PPAs, tariff cross-subsidies, high aggregate transmission, and commercial (AT&C) losses are some of the key reasons for state-owned discoms’ bad financial health across the country.

The Central Electricity Authority (CEA) of India reported tariffs from Andhra Pradesh Power Generation Corporation’s (APGENCO) four coal-fired power plants at Rs4.65/kWh in FY2016/17. In FY2018/19, AP’s average cost for purchase of thermal power was Rs4.13/kWh. The two-part tariff split includes Rs1.29/kWh of average fixed cost charges and Rs2.84/kWh of average variable cost charges. Thermal power purchase agreements (PPAs) in India mandate payment of fixed cost charges whether or not the power is drawn by discoms. This has caused discoms a huge degree of distress.

Under the government’s directive, contract and tariff renegotiations have begun in AP

Under the government’s directive, contract and tariff renegotiations have begun in AP, however the process is not without problems.

In one particular case, APSPDCL asked Greenko Energy-backed wind power projects contracted at Rs4.50/kWh to slash tariffs to Rs2.44/kWh —just one paisa above the lowest renewable power tariffs that has ever resulted in India’s reverse bidding auctions. It appears APSPDCL wants to walk away from its legally binding contract and unfairly burden renewable energy sources to bring their average cost of supply down.

IN IEEFA’S VIEW SUCH SHORT-TERMISM IS LIKELY TO COME AT A MASSIVE LONG-TERM COST by degrading the state’s investment risk profile. This sovereign risk will materially undermine global capital flows into AP, raising the cost of capital and hence the required renewable energy tariffs, while undermining confidence and diminishing overall investment.

Throughout India, renewable tariffs contracted a few years ago were consistently higher than the lows of sub-Rs3/kWh attained since 2017. The solar module and wind turbine costs, the cost of finance, and the engineering and construction costs have all come down drastically in the last three years, driven by technology advances and economies of scale. According to Mercom India, the lowest solar bids in India’s reverse auctions in FY2015/16 ranged from Rs4.63-5.05/kWh, close to double the Rs2.40-3.00/kWh seen since 2017.

Another important point to note is that renewable energy contracts in India also have zero indexation for inflation for 25 years, meaning the real price of renewable energy is deflationary. In contrast, thermal power has inflationary variable costs of fuel and transportation.

The real price of renewable energy in India is deflationary

In 2018, 1.5GW of auctioned capacity out of AP’s move to build the world record creating 2GW Ananthapuram Solar Park resulted in tariffs between Rs2.70/kWh to 2.73/kWh from leading renewable energy developers SoftBank, Ayana Renewables and SPRNG Energy.

Given the intensity of AP’s solar irradiation and its high-quality wind power sites, the state has huge potential for attracting further renewable energy investments at tariffs well below the current prevailing wholesale rate, and in turn driving sustained system deflation over the coming decade while bringing power purchase costs (the ACS) down over the long run.

THE LOCKING IN OF HIGH PRICED, FIXED COST CHARGES FOR THERMAL POWER HAS BEEN AN ISSUE FOR DISCOMS all across India. Near term, discoms have been caught out, unable to fully benefit from newly available, low cost renewable energy due to the legacy impact of expensive thermal and renewable tariffs set at a time of higher price norms. While a burden when there is financial distress, the problem in the longer term will naturally recede as power demand continues to grow strongly and investment in new low cost within-state renewable energy projects progressively dilutes these legacy contracts. This will progressively put more weightage on low-cost sources of new supply to reduce the average cost.

Retrospective cancellations, renegotiations and recoveries send a bad signal to the market, undermining contractual certainty and the rule of law. An increased sovereign risk will make domestic and international investors extremely wary of investing in AP as well as in India, at a time when the country is in great need of infrastructure growth.

Creating uncertainty could affect renewable energy investments like Greenko’s which is backed by two committed foreign sovereign wealth funds in India’s renewable energy sector — Abu Dhabi Investment Authority (ADIA) and GIC of Singapore. Other developers under the ambit of the government’s PPA renegotiations could also be affected, such as SoftBank, Adani, Tata, Azure, and ACME — essentially the who’s who of India’s renewable energy sector.

IN IEEFA’S OPINION, AP IS RISKING A LONG-TERM, LOW-COST AND DEFLATIONARY PIPELINE OF 35-40 GW OF NEW RENEWABLE ENERGY INVESTMENT for about 2GW of relatively expensive capacity. This is ‘pennywise but pound foolish’ when considering the size of the deflationary opportunities available to AP over the coming decade.

While the Ministry of New and Renewable Energy (MNRE) and the Appellate Tribunal for Electricity (APTEL) have rightly intervened and put a legal stay on AP’s orders in the APSPDCL Greenko case, uncertainty remains.

In the broader context, the sanctity of contracts is important. If there has been corruption in expensive legacy contracts, as alleged by the AP government, they should be investigated in full. If proven, contract cancellations are entirely justifiable, and enforcement of a free and fair market will enhance India’s standing. For the benefit of India, the rule of law must apply in either case.

At the same time, certainty must be sought as a matter of priority. AP’s renewable energy sector depends on it.

Kashish Shah is a research analyst with IEEFA.

This article first appeared in ET Energy World on 7 August 2019.

Related articles:

IEEFA India: Developing an energy sector vision in Andhra Pradesh

IEEFA India: Post-election, India must formalise energy reforms already long deliberated