Hydrogen Energy Supply Chain project viability remains uncertain in wake of Hydrogen Headstart scheme for green hydrogen

Key Findings

The Australian and Japanese governments plan to jointly develop the Victorian coalfields into a hydrogen industry with the Hydrogen Energy Supply Chain (HESC) project. Japan has committed to spend A$2.4 billion to partially fund the project.

The HESC project intends to capture some of the carbon dioxide created in the coal-to-hydrogen process to produce ‘clean’ blue hydrogen. Risks remain if the carbon capture and storage (CCS) process underperforms and fails to meet the ‘clean’ requirements set by its Japanese buyers.

As soon as it reaches commercial scale, the project risks being uncompetitive against renewable green hydrogen which will see significant cost reductions. Due to the high shipping costs involved, the delivery cost is likely to threaten its commercial viability.

With the federal government refusing to support it through its A$2 billion Hydrogen Headstart scheme the HESC project needs significant funds to reach commercial scale and support CCS.

When Japan embarked on its National Hydrogen Strategy in 2017, it had ambitious plans for widespread use of hydrogen to transform and decarbonise its economy. Since then a review of the US$3.4 billion spent in 2021 revealed that “70% of the funds spent on the Hydrogen Society Vision was spent on bad ideas”.

One such failure is the strategy to rely entirely on fossil hydrogen until at least 2030 – such as the gasification of Australia’s brown coal resources into hydrogen for shipping to Japan –the HESC project.

Japan released its updated Basic Hydrogen Strategy in June 2023. In the revised strategy, the Japanese government will seek to increase investment to more than US$100 billion through private and public funds – and ramp up supply such as through its alliance with Australia’s hydrogen supply chain.

The HESC pilot project was completed over five years to 2022 after the Australian and Victorian governments jointly invested $100 million. In March 2023, Japan committed to spend A$2.4 billion through its Green Innovation Fund to partially fund scaling up the project. Initially at 30,000 to 40,000 tonnes a year and at full scale, by 2030, it aims to produce 225,000 tonnes a year of liquified hydrogen for export.

However, with only a portion of that funding expected to be spent on Australian facilities, this leaves a very large unfunded investment to bring the project to commercial scale. The Japanese funding will contribute to the development of a hydrogen liquefaction facility in Victoria as well as a ship, ship loading and unloading facilities. In particular, it is not planning to fund the CCS component of the project. This component alone is likely to require billions in investment, based on the Gorgon project experience. The Gorgon project has cost A$3.2 billion to date, and has injected just 6.5 million tonnes over the first six years of operation. CarbonNet is designed to store 4million tonnes per year (mtpa) of CO2.

Of all the various forms of hydrogen production, using coal to produce hydrogen is the most emissions-intensive, creating 18 to 20 times more CO2 than the amount of hydrogen produced. The project’s “clean” blue hydrogen label relies on plans to capture 90% of emissions. However, its success largely hinges on the ability of sub-seabed offshore geological storage to sequester the target amount of CO2 emissions. This is no easy task, given that Gorgon has achieved a 32% capture rate in its first six years of operation. Globally, CCS projects have a poor track record.

This will remain Australia’s problem. Any failure could jeopardise Australia and the Victorian government reaching its recently affirmed emissions reductions targets. The cost of the CCS will be reportedly factored into the hydrogen pricing. There are no incentives to ensure any carbon dioxide is actually captured – as the project’s ‘clean’ rating has already been given and it’s not clear how CCS performance will be monitored. It has been reported that the Japanese government will outline rules on how this will be managed.

Further, offshore geological storage sites, are a “scarce” resource. The Climate Change Authority reports that to be efficient, “access to sequestration for counterbalancing emissions should be prioritised for emissions with no near-term decarbonisation options”. Some sites are not suitable for the storage of anything. A June 2023 IEEFA report highlighted that two Norwegian CCS projects – cast doubt on whether the technical prowess and regulatory oversight exists to ensure captured carbon actually stays sequestered permanently.

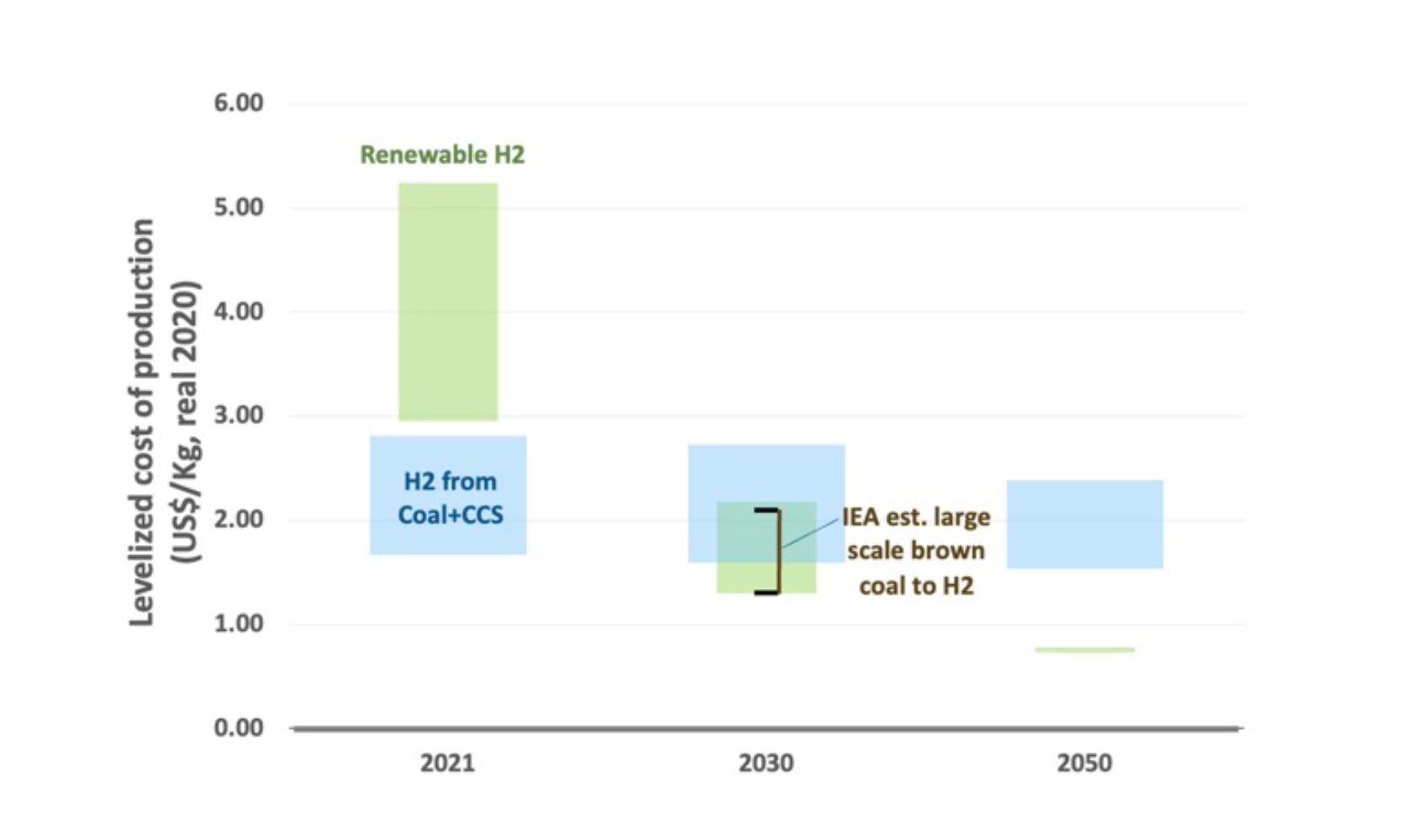

Coal-based hydrogen is currently less expensive to produce than renewable hydrogen – by up to half as much. By 2030, that is set to change. As renewable energy scales up, its costs are expected to fall, as are the costs of electrolysers used to produce the renewable hydrogen; so much so that by 2030, just when the HESC reaches full-scale production, it will be based on a more expensive technology. BloombergNEF forecasts that green hydrogen made with renewable energy will be cheaper than coal-based hydrogen everywhere by 2030.

The International Energy Agency has projected the cost of a large-scale brown coal to hydrogen project to be on par with renewable energy-based hydrogen by 2030. From then, the cost of renewable-based hydrogen will continue to fall. Australia’s Clean Energy Finance Corporation agrees that green hydrogen will be cheaper than blue hydrogen by this date. Meanwhile, coal-mining costs could continue to rise. HESC will struggle to prove commercially viable in the medium term as it competes with other suppliers of hydrogen beyond the initial short-term off-take agreement with Japan.

Figure 1: Coal-based Hydrogen Production Cost in Australia will be at a Crossroads in 2030

Source: BloombergNEF, IEA

The complexities have only just begun.

The conversion process required for shipping is energy intensive. HESC is proposing liquefaction, produced by cooling to -253 degrees, and the process energy, is equivalent to a loss of more than 30% of the energy content of the hydrogen according to US Department of Energy.

Shipping from Victoria to Japan over a 9,000km, 21-day journey is challenging for hydrogen. Beyond the significant capital expenditure required for a large new-generation fleet, there are significant hydrogen losses en route. The hydrogen lost for boil-off and fuel use for propulsion for the 9,000km journey could be up to 40% of the cargo and boil-off could be as high as 9 times that of the equivalent loss experienced in LNG shipping.

Finally, the delivery and regasification at the receiving port is expected to consume another 5% of the energy content of the cargo. Whilst there are other forms of transporting hydrogen over long distances, each with their own issues, these will remain the technological barriers to effective long-distance shipping of hydrogen.

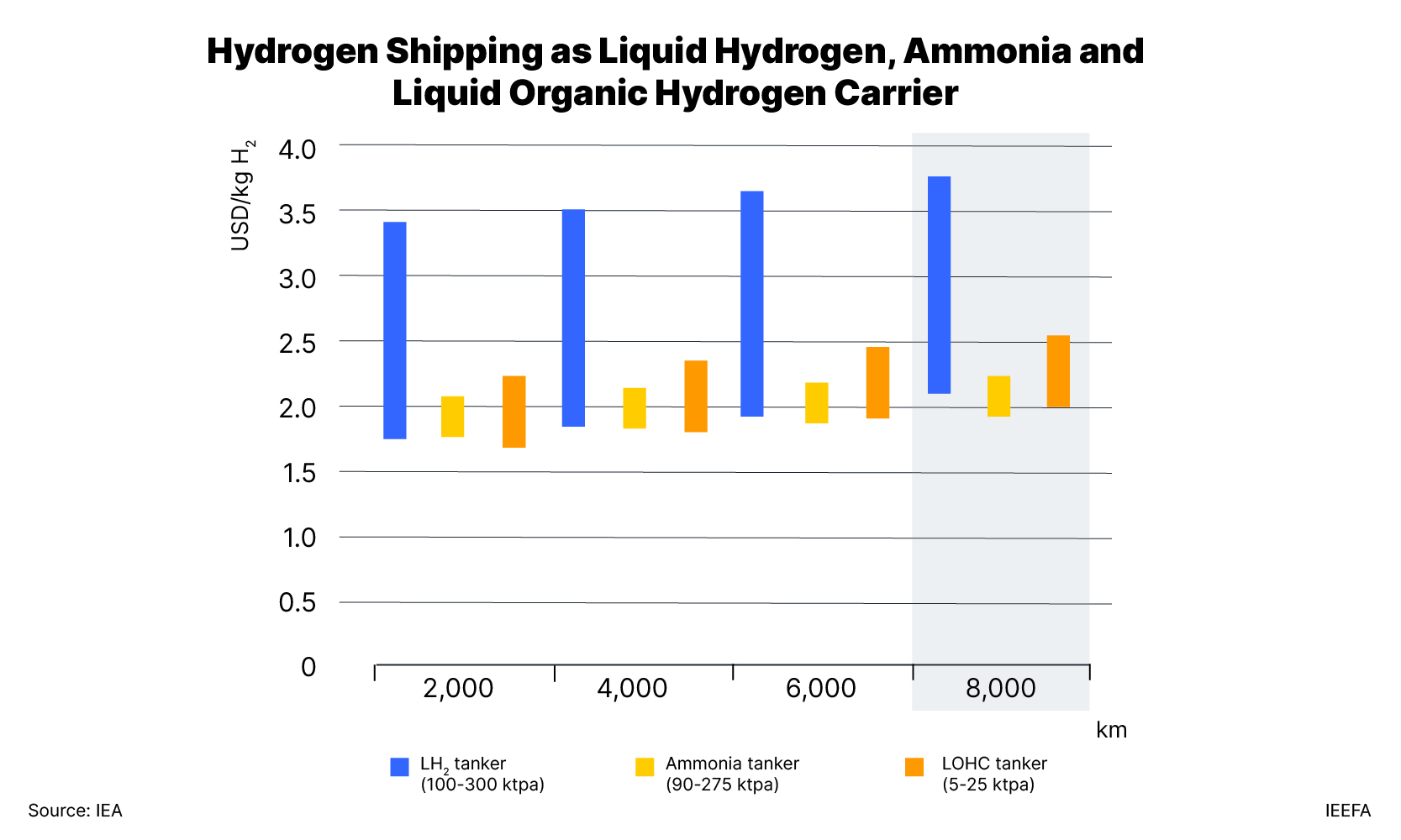

The IEA’s Energy Technology Perspectives 2023 report examined transportation of hydrogen using various forms of shipping such as liquid hydrogen (LH2), ammonia and liquid organic hydrogen carrier (LOHC) and over varying distances. It found that transport costs of delivering liquid hydrogen in 2030 was USD 2.0-3.7/kg H2 for an 8 000-km trip in the NZE Scenario (Figure 2). The cost was lower for other forms, but they also contain other complexities and energy conversion costs. Importantly, the expected cost of transportation alone for Japan’s 9,000 km shipping journey would likely exceed the target price for delivered cost of hydrogen of USD 3/kg into Japan – even if the production of hydrogen itself was free.

Figure 2 - Indicative levelised cost of delivering hydrogen, by shipping option and distance in the Net Zero Emissions Scenario, 2030

Source: IEA

Given the scale of the shipping issue, commercial successes will prioritise the location of the hydrogen production – close to end use, over the supply of low-cost hydrogen delivered over long distances, such as with HESC.

Japan has reaffirmed it is ramping up hydrogen supply chains and hydrogen-conversion to its fossil fuels power generation. Japan is trialling retrofitting existing power generation assets to use hydrogen and ammonia fuel. Technical challenges pose risks that could stall the energy transition – meanwhile proven renewables technologies off the shelf are being overlooked. Studies show that Japan can meet its energy needs with 90% clean power from renewables by 2035, overcoming energy security concerns of importing costly fuels whilst reducing pollution and emissions.

Even if the carbon sequestration issues could be resolved, hydrogen produced by coal risks being outpriced by renewables-based hydrogen by the time commercial scale is reached. Further, shipping from Victoria is too far away from its end use in Japan.