A Google Earth, of Sorts, Tracks the Rise (and Fall) of Coal-Fired Power Plants

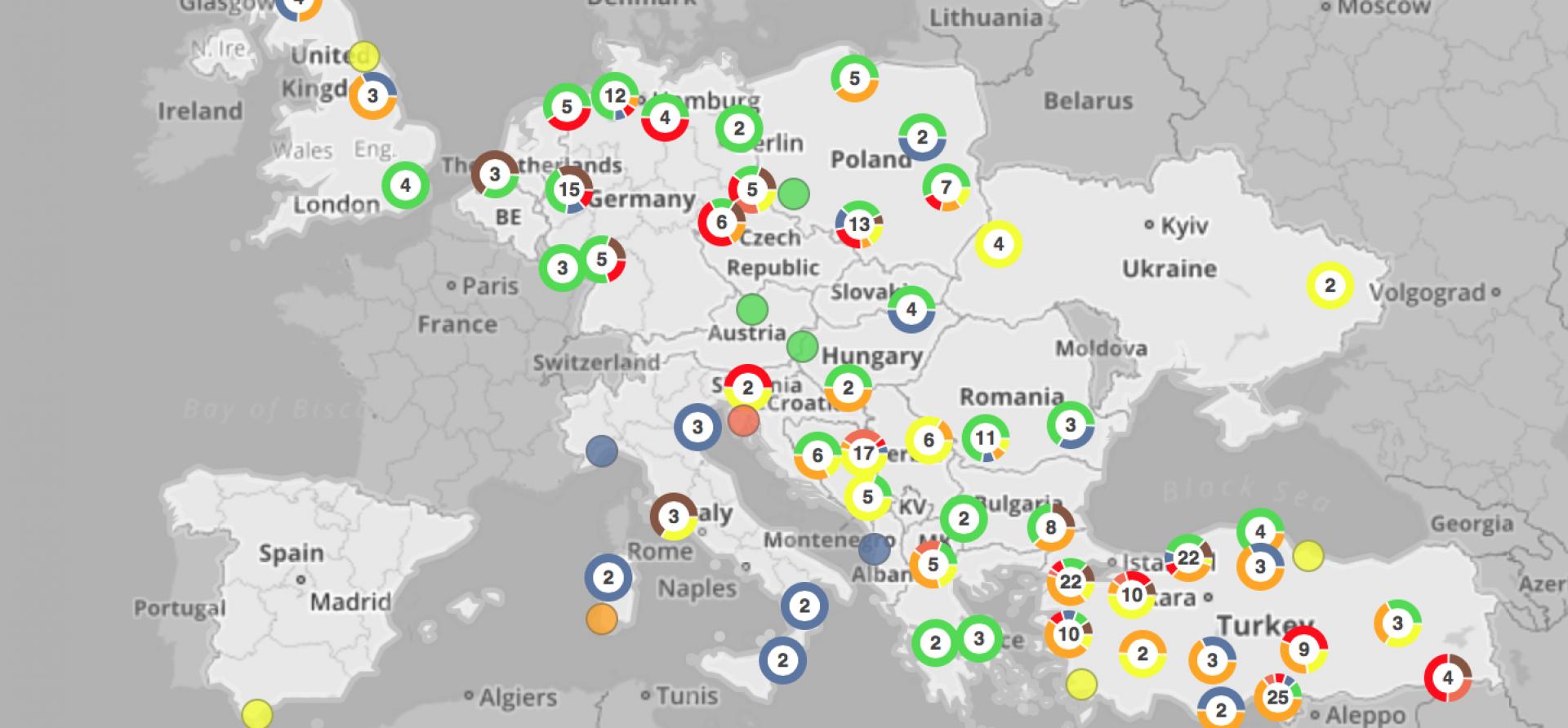

Meet the new Google Earth of the coal industry: the “Global Proposed Coal Plant Tracker,” an online tool launched last month by a group called Coalswarm that offers interactive regional maps showing either where new coal plants are being planned, built, in various stages of approvals or quite often cancelled (or “shelved”).

The tracker doesn’t explain the why behind what’s happening in any particular province or nation, but sometimes a picture is worth a thousand words — and its maps say a lot. In India, for instance, a remarkable number of coal-fired power cancellations are apparent. In China, construction is nowhere near what might be expected in the most populous country in the world. In the U.S., the specks marking abandoned coal-plant plans far outnumber those that either made it into operation or are still on the drawing board.

The tracker is built on research contained in a Coalswarm/Sierra Club report — “Boom and Bust: Tracking the Global Coal Plant Pipeline” — published in March, that presents a comprehensive overview of the state of coal power plants around the world. Collectively, East Asia, South Asia and Southeast Asia accounted for more than 80 percent of new coal plant construction in 2014 and the region is projected to continue to dominate the market for the next several years.

The takeaway, though, is that the coal industry has not had a great track record in pushing to build new power plants over the past several years. “Since 2010, two plants have been shelved or cancelled worldwide for every plant completed,” the report concludes (the tracker maps illustrate this point in striking detail). This coal-plant bust followed a period of rapid expansion in the 2000s, and the report notes that, globally, “The pace of net coal capacity additions (new capacity minus retired capacity) worldwide remained around 20 GW to 25 GW per year for over two decades, then abruptly tripled during the period 2005 to 2012 before receding in 2013.”

The picture is particularly telling for China and India, the two countries that are the ones most mentioned when coal enthusiasts talk up the future of coal. In fact, coal consumption in China actually decreased in 2013—driven by greater energy efficiency and the rise of renewables, coupled with an economic shift away from the most energy-intensive industries. Average coal plant utilization in China is down from 60 percent in 2011 to 54 percent in 2014. a 35-year low. Meantime, an additional 117,000 megawatts of coal-fired capacity are under construction, even though this build-out carries a serious risk that some of these new plants will become stranded assets.

“In India, projects shelved or cancelled since 2012 outnumber project completions by six to one, and new construction initiations are at a near-standstill,” the report finds. It sees national coal-supply reliability as a major hurdle for the construction of new coal-fired power plants, causing investors to be wary of investing in new coal projects in India.

Coal India, the state-owned enterprise, provides 80 percent of domestic coal and has failed to meet even its own production targets in recent years, leading to shortages for existing power plants—and shortages of electricity (a Reuters article this past October noted that power blackouts due to coal shortages are a common occurrence in many Indian states). As a result, proposed new plants are banking on imported coal, which has turned out to be more expensive than projected, a potentially crippling blow to India’s electricity distribution companies, which are already facing severe losses because regulated power rates are not high enough to recoup costs.

The report also notes the important role grassroots opposition has played in blocking new coal projects in India, even going so far as to put a number on it: 55 percent of organized efforts to stop proposed new coal power plants have been successful.

There’s bad news, too. While two proposed coal plants have been cancelled for every project completed globally, the authors say this trend on its own isn’t weighty enough to ward off the looming threat of climate change. If just one third of all proposed coal plants go on line, the report warns that they would collectively “use up nearly all of the available carbon budget for avoiding the internationally recognized 2°C warming threshold.”

Local, regional and national battles around new coal-fired plants are certain to persist, and Coalswarm’s deeply researched tracker is a singular roadmap to what’s happening.

Cathy Kunkel is an IEEFA fellow.