A gas pipeline in disguise? Known unknowns about H2Med

Key Findings

Whether it be a gas or hydrogen pipeline, H2MED risks not having a market by 2030, when the pipeline is expected to be ready.

IRENA notes there is little demand for low-carbon hydrogen.

Repurposing gas infrastructure for hydrogen is complicated and costly; blending gas and hydrogen does not make sense economically for consumers, or for decarbonisation.

H2MED is an expensive project that could cost around €3 billion to build.

H2MED, formerly known as “BarMar,” is a proposed undersea pipeline between Barcelona and Marseille to replace the shelved MidCat project that would have connected the Iberian Peninsula with France and, effectively, with the wider European Union. H2MED was announced as the centrepiece of France, Spain, and Portugal’s so-called “Green Energy Corridor,” the latest in a string of efforts to help Europe wean itself off Russian gas.

H2MED is expected to start operation by 2030, although countries involved have not confirmed a project delivery timeline. But timing is not the only concern. Significant uncertainties have emerged about the project’s purpose, demand, technology, costs, financing, and overall need.

Although its name suggests this is a hydrogen project, H2MED is expected to begin operations transporting natural gas to Germany and Central Europe via France as “a temporary and transient energy source.” The pipeline will also help share liquefied natural gas (LNG) capacities between European nations. In the long term, France, Spain, and Portugal intend to retrofit H2MED to transport green hydrogen.

In a bid to secure support for the project, H2MED’s proponents are describing it as a “Mediterranean hydrogen corridor“ that might also include Italy and other neighbouring countries. In recent months, Spain and Italy have explored the feasibility of an offshore pipeline that would run 700 kilometres between Barcelona’s regasification terminal and the northern Italian port of Livorno at a price of roughly €3 billion to build. A “virtual” gas pipeline was also discussed.

To make the H2MED project appealing to investors and communities across the regions affected, the project is advertised as “the underwater branch of Via Augusta,” a reference to the longest road in ancient Hispania that extended for 1,500 kilometres from the Pyrenees to Cadiz, in the south of Spain.

Who is behind H2MED project?

H2MED will connect two main European gas transmission system operators (TSOs), Enagas and GRTGaz, by transiting near two large LNG terminals—the Barcelona regasification terminal in Spain, and the Fos Cavaou regasification terminal near Marseille in France.

GRTgaz owns and operates the largest French gas transmission network and is currently owned 61 % by Engie and 39% by Société d'Infrastructures Gazières SIG. Elengy, a subsidiary of GRTgaz within the Engie Group, owns a 100% stake in Fosmax LNG, the operator of the Fos Cavaou LNG Terminal. Meanwhile, Enagas owns and operates the Barcelona LNG Terminal, the largest regasification terminal in Spain.

Redes Energéticas Nacionais (REN) operates the main transport infrastructure and manages the National Electric System and the National Natural Gas System in Portugal.

France’s TSO Terega and Italy’s TSO Snam might also be involved in this project. Terega, the French gas TSO for Occitania and operator of the cross-border virtual interconnection point (VIP Pirineos) together with Spain, is fully held by Terega SAS. The company is owned by a consortium comprising Italian gas transport and storage operator SNAM S.p.A. (40.5%), Singaporean sovereign fund GIC (31.5%), EDF Invest (18%) and Credit Agricole Assurances (10%). Snam operates a transmission network of around 41,000 kilometers between Italy, Austria, France, Greece, and the UK. It holds 3.5% of the world’s storage capacity.

The role of TSOs in H2MED has not yet been clarified. If this ends up being a project entitled to regulated remuneration, as it has been the case for gas infrastructure projects in Spain in recent years, European gas TSOs will have a guaranteed return on investment at the expense of consumers.

A recent IEEFA study found Spain’s rate-of-return regulation has encouraged the Spanish gas TSO Enagás to over-invest in gas infrastructure, boosting costs for the country’s gas consumers.

H2MED as a gas corridor to Germany: is it needed?

Germany has been a vocal proponent of H2MED, seeing it as a solution to improve its own energy security. But will this pipeline help ease pressure on Germany’s gas market?

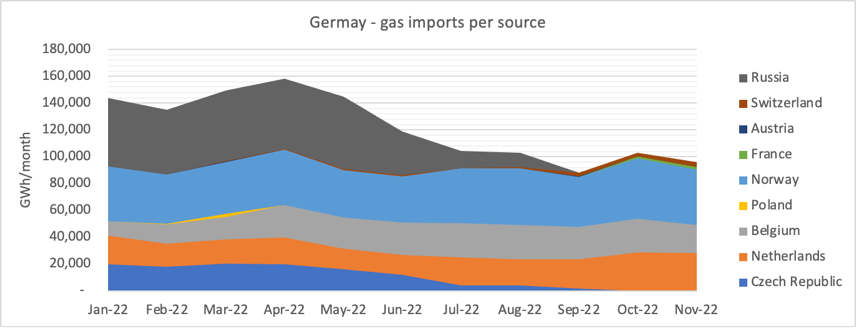

In recent months, Germany has been affected by a reduction in gas supplies and high energy prices. The country has consumed less gas than in previous years, thanks to gas demand destruction, unusually mild weather, voluntary reduction and/or replacement of gas consumption, as well as electrification in some sectors such as heat pumps being installed in residential areas. Consequently, Germany’s gas imports have fallen dramatically. At the beginning of 2022, imports were high, reaching a peak in April with average values of 158,173 gigawatt-hours (GWh)/month and 5,272 GWh/day. But after May, gas imports started to decline and had fallen by September to an average of 88,159 GWh/month and 2,939 GWh/day, equivalent to 56% of the imported gas volume in April.

Germany receives gas from its neighbouring countries and also takes gas out of storage. As of Dec. 1, the total storage levels in Germany were near capacity at 98.24%.

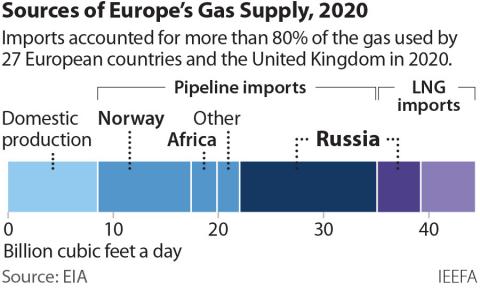

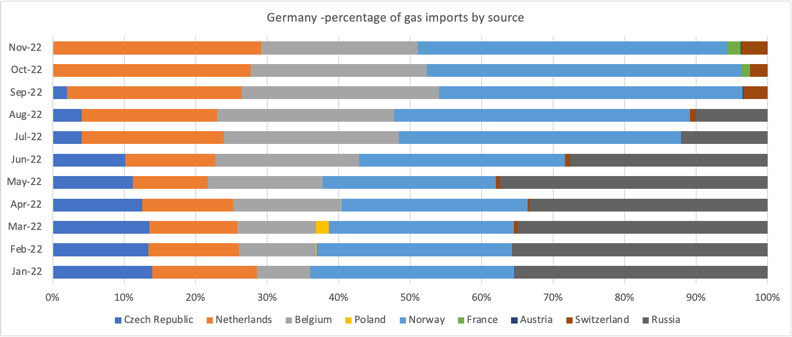

Throughout 2022, the import mix has changed. At the beginning of 2022, Germany imported gas mainly from Russia (35%), Norway (27%), Netherlands (13%), the Czech Republic (13%) and Belgium (11%), with remaining volumes coming from Austria, Poland, and Switzerland. By November, Germany shifted to importing gas from Norway (43%), Netherlands (29%), Belgium (22%), Switzerland (3.6%), France (1.9%) and remaining volumes from the Czech Republic and Austria.

It is important to note that Germany currently has spare capacity across its existing infrastructure. ACER’s recent release shows that even though the Belgium-Germany’s gas pipeline being fully utilised, there is 45% spare capacity in the pipeline between the Netherlands and Germany, and 20% spare capacity in the connection between Norway and Germany. The two pipelines are the arteries transporting the highest volumes of gas to Germany.

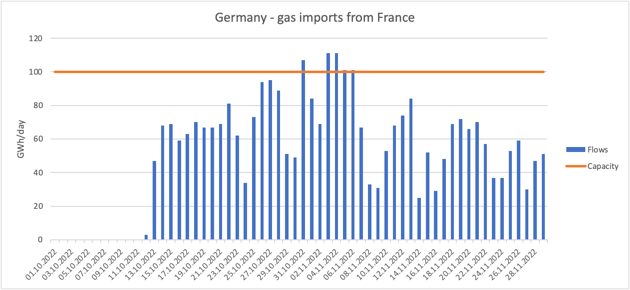

From Oct. 12, 2022, gas has been flowing from France to Germany at the cross-border interconnection point in Medelsheim. The maximum import capacity is 100 GWh/day. Flows have passed the maximum capacity during some days in October and November, but since Nov. 7, the average daily imports have been just 50.5 GWh/day, a 50.5% utilisation rate.

An expensive stranded asset?

Both Spain and France expect it will take at least seven to eight years to build H2MED. Under this timeframe, H2MED will not constitute a solution to the current energy crisis. If gas consumption in Germany and other European countries continues falling, the gas flows transiting via H2MED pipeline will not be needed and the project is likely to become an expensive stranded asset.

The forecasted EU gas demand by 2030 is expected to fall by at least 30% compared to 2019 levels if all Fit-for-55 measures and REPowerEU proposals are implemented. If this is the case, the German gas demand should not be a real consideration for building the H2MED pipeline. Taking into account that EU gas demand was 24% less than the five-year average in November, the reduction in demand by 2030 could be as much as 50%. Last month, gas demand fell 23% in Germany, 21% in Italy, 20% in France and Spain 20% and 33% in Netherlands.

Retrofitting H2MED to transport green hydrogen to France in the long term is based on the assumption that Spain and Portugal will be able to produce enough renewable hydrogen to meet domestic demand and have a surplus for export. Both countries have increased their renewable power generation, but this might not be enough. During the first 10 months of the year, 34,695 GWh of electricity were generated in continental Portugal, with 54.4% coming from renewable sources and 40.84% from fossil fuels. And 232,494 GWh were generated in mainland Spain, with 41.5% coming from renewable sources and 58.5% from non-renewable sources.

If H2MED is a green hydrogen pipeline, it should be built for purpose

H2MED will need to be technically adapted from transporting gas to transporting green hydrogen, which could be costly and very specific since it needs to be done on a case-by-case basis. If the intention is to blend green hydrogen with natural gas, research suggests only 20% of hydrogen could be safely blended. In this case, the emissions would be reduced by 6% to 7%. If H2MED is intended as a green hydrogen pipeline, then it should be built for purpose.

Green hydrogen is made by using electricity from renewable energy technologies to electrolyse water (H2O) and separate its hydrogen atoms from the oxygen with no CO2 emissions. Studies have found that hydrogen-based fuels should primarily be used in sectors such as aviation or industrial processes that cannot be electrified. Using hydrogen-based fuels instead of direct electrification alternatives requires two to 14 times the amount of electricity generation, depending on the application and the respective technologies.

Experts also suggest that transporting hydrogen over long distances is potentially worse for the climate than burning natural gas; it is better to produce hydrogen close to the location of demand. Producing hydrogen locally will help reduce energy dependency and improve security of supply where it is needed the most.

Potential for transporting LNG from the Iberian Peninsula to Central Europe

H2MED could open up a new transit route for gas and LNG imported by Portugal and Spain to be sent to Germany via France. Understanding the sources of gas that would transit via H2MED is crucial, since green hydrogen transportation is meant to occur only in the second phase of this project.

LNG imported at the Barcelona terminal could be regasified locally and sent via H2MED to Marseille, before injection in the French gas network. With this operation, Spain might want to justify the unnecessary gas infrastructure that has been built throughout the years. Spain’s LNG terminals currently have 50% spare capacity, Portugal 19%, and France has none.

Spain imports piped gas from Algeria and from its six operational LNG terminals with a total capacity of 44 million metric tons per annum (MMtpa, or 60 bcm) at a 50% utilisation rate. Spain and France are interconnected via the VIP Pirineos gas pipeline with bidirectional flows depending on the fluctuations in demand in both countries; the pipeline is interconnected with Portugal via the VIP Iberico.

Algeria used to account for half of Spain’s total gas supplies, but since November 2021 Algerian gas flows to Spain via the 12 bcm/yr Maghreb-Europe pipeline transiting Morocco have stopped due to diplomatic issues between the two North African countries. Gas imports from Algeria continued via the direct 8 bcm/yr Medgaz pipeline across the Mediterranean Sea. Spain's gas deficit has been filled with LNG imports from various countries, including Russia, which is usually more expensive than piped gas.

Portugal imports gas from Algeria via Spain and from its only operational LNG terminal, which has a total capacity of 5.8 MMtpa (7.9 bcm) and an 81% utilisation rate.

France imports piped gas from Norway, the Netherlands and the four onshore LNG terminals in operation with a total capacity of 25 MMtpa (34 bcm) and an average utilisation rate of 103%. Additional capacity will be available when the proposed Le Havre (FSRU) LNG terminal with 3.3 MMTPa (4.5 bcm) capacity starts operations in 2023.

Why H2MED is being considered eligible for PCI funding?

The costs and financing of the project are not yet clearly defined. Building H2MED is costly and requires financial backing by buyers to reach a Financial Investment Decision (FID).

At an Oct. 4 BloombergNEF roundtable, Europe and Asia’s clean hydrogen industries noted the need to find willing long-term buyers for clean hydrogen, cumbersome renewable energy licensing rules and waiting to capture all available funding as the three main factors delaying their FIDs.

Unlike MidCat, which was not eligible for EU funding since it did not make it onto the Projects of Common Interest (PCI) list, H2MED is planned as a PCI project because of its future hydrogen component. The European Commission is ready to support the H2MED undersea gas pipeline project as a PCI, provided that it complies with the criteria set out in the Trans-European Energy Networks (TEN-E) Regulation. Being part of the PCI list makes the projects eligible to obtain part of the cost of the project through financing with public money, in addition to public guarantees and administrative facilities.

New undersea hydrogen transmission lines are estimated to cost about €7 million per kilometer. The length of H2MED pipeline could vary between 300-400 kilometers, so the pipeline could cost approximately €3 billion.

If this €3 billion hydrogen pipeline is being built, it will be an unnecessary expense paid with public funds that won’t alleviate the current gas crisis and, on the contrary, will further aggravate costs for energy consumers. The leaders of France, Spain, Portugal and other countries involved must prevent H2MED from becoming another failed project turned into a stranded asset like MidCat and paid for by consumers.

Ana Maria Jaller-Makarewicz ([email protected]) is an IEEFA energy analyst